Master the Markets with Marketsmojo

- 22 September 2021 | 1505 Views | By Abhinav Mishra

Today, investors and traders are looking for financial websites to help them make the right investment decisions. There are many such websites available for investors. One such platform is Marketsmojo.

What is Marketsmojo?

Marketsmojo is a SEBI registered Independent Research and Advisory house founded by ex-founders of Moneycontrol. The firm has the mission to maximize the returns for retail investors by providing them truthful and unbiased investment pointers. The company claims to serve over 30% of equity investors in India and has led with a combined investing experience of 150 years.

Jarvis Invest: Artificial Intelligence for Equity Investing

The company runs Big Data analysis multiple times in a day on more than 500 pointers on all 4000 companies and rates each stock over four key parameters:

- Quality

- Valuation

- Financial Trend

- Technicals

What does Marketsmojo offer?

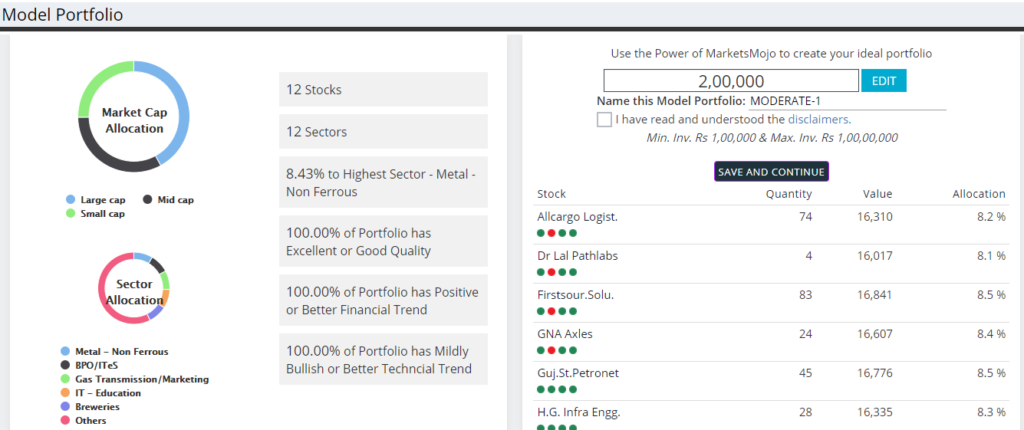

Model Portfolio – The platform has a list of top companies selected as per its evaluation parameters. You can invest in 10 to 12 stocks to create your portfolio. If you are already invested, you can upload your existing portfolio and get real-time advice on different stocks.

You can know the stocks you need to invest under a model portfolio for free by choosing your risk profile – conservative, moderate or aggressive. For the model portfolio, Marketsmojo claims to have delivered returns of 200% to conservative investors, 421% to moderate investors, and 520% to aggressive investors (last five years) with a portfolio of 10 stocks.

You can register to Marketsmojo for free and use the free services.

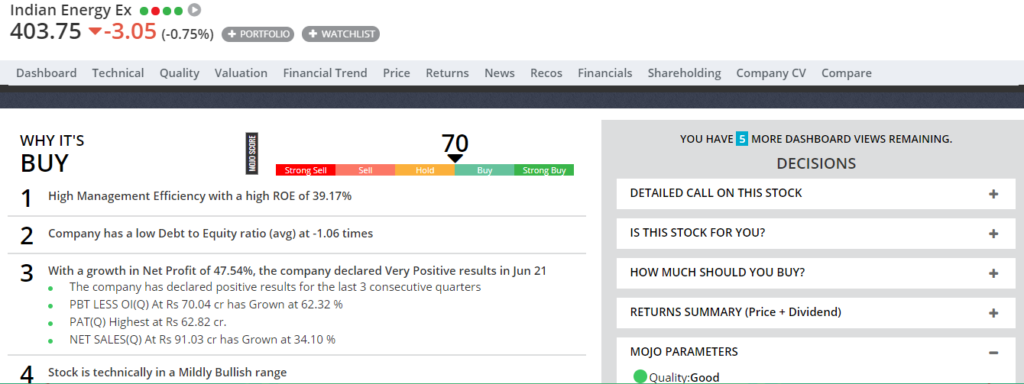

Research any stock – Under this, you get to see all the details related to a particular stock. The website creates a dashboard of the company you have entered and gives the score.

You also get detailed analysis which you can download. The platform will also suggest to you how much you should invest in the stock (percent). In short, you will get to know whether to buy, hold or sell the stock.

Under the free plan, you can only view five stocks with all details.

SwitchER – If you are unsure about your existing holding, you can use the Switcher service and switch to the better stock. All you need to do is put your current holding and the quantity (optional). The platform will give you the best option to switch to, along with a detailed report. Additionally, you get two more options you can use, in case, you already have the best option in your portfolio.

Stock of the month – Most investors are looking for one or two good stocks to invest in a market. Under this service, Marketsmojo gives you that. It will suggest to you the strongest stock for the month out of all the available stock. The stock is selected after passing it through layers of algorithms. It also goes for Investment Committee approval before sending it to investors. You get the stock name with a detailed report on the 10th of the month. You will get a total of 12 stocks a year, one every month, and the platform will also tell you when to sell them and what to buy next.

Create your own Screeners – Every investor likes to use different parameters to evaluate the stocks. There are hundreds of parameters based on which you can research a stock. Under this option, you can choose the parameters to create your screener for your stock selection modeling.

Portfolio Optimization – Under this option, the platform will identify issues in your existing portfolio and suggest changes to help you build a more robust portfolio. Your portfolio is created based on your return expectations and how much risk you are ready to take. You will get a diversified portfolio with the right number of stocks in different sectors and across market caps.

You can only optimize your stock portfolio as mutual funds investments are not covered by Marketsmojo.

Top picks – If you are unsure of stock to invest from the thousands available, this option may help you. Under this option, the platform suggests the best stocks to buy at any time across the market cap. The company has a success rate of over 80% in picking stocks that have beaten the index and given superior returns to the investors.

Pricing to Subscribe to a Professional Plan

To use most of the above services offered by Marketsmojo, you will have to switch to the professional plan. The cost of which is around Rs 42,000 for a year. However, there are offers most of the time, and you can get the professional plan at a much lower price. With paid service, you get the below features –

- Stock score

- Model Portfolio

- Portfolio optimization

- Top picks

- Screeners

- Stock of the month

- Switcher

Should you subscribe to Marketsmojo?

Most of the features available in the free plan are available on other sites as well. Hence, if you want to use the above features you need to go with a paid plan. Unless you have a large-size portfolio, it won’t be a good idea to subscribe to paid service since the fees are on the higher side. Though you can create a portfolio starting with Rs 1,00,000 but with a small portfolio size, your ROI will be low.

Also, an important point to note, it is just for a stock investment, and you won’t get any help on your mutual fund investments.