Jarvis Invest: Artificial Intelligence for Equity Investing

- 10 September 2021 | 1978 Views | By Abhinav Mishra

Jarvis Invest is an India-bound artificial intelligence-based equity advisory interface. With embedded risk management and stock analysis function, it analyzes investor needs via a simple questionnaire and suggests a portfolio accordingly. In this article, we shall explore more about Jarvis Invest, and how one can access it.

If India has to become a developed economy, it needs to have a strong financial market. If you look at the financial habits of Indians, they are nowhere close to any developed nation. Before we get to numbers, it is essential to understand why people in India do not invest in the stock market.

The apparent reason is fear of the stock market. Most people in India do not understand the market, but everyone has heard of Harshad Mehta, Satyam computers, and Nirav Modi scams. Yes, SEBI is doing a phenomenal job in regulating the market, but the fear remains.

Unless the financial literacy increase, the clouds of fear will stay. Now coming to the numbers – In the USA, close to 56% of the population invest in the stock market while in India, only 4.5% invested in the stock market.

From the above discussion, you can conclude, Indian people need to become financially literate. Only then they may consider investing in the stock market.

So people should not invest in equity? What if they do not want to learn? If learning is slow, should you wait and keep money in a savings account? Till you learn, make use of machine learning to invest in equity. Buying Stocks vs Investing in Equity Mutual Fund

What is Jarvis Invest?

Jarvis Invest is India’s first Artificial Intelligence (AI) based equity advisory model with an embedded risk management system. Jarvis is designed in a way that eliminates the emotional aspect of investments. The platform creates a personalized equity portfolio for you using technology. With so many stocks listed on the stocks, new investors have no clue which one to pick. They depend on tips from friends and social media. For such people, Jarvis Invest is an option worth exploring.

How does Jarvis Invest work?

It is an app-only platform. The first thing you need to do is download the Jarvis Invest app from the Playstore.

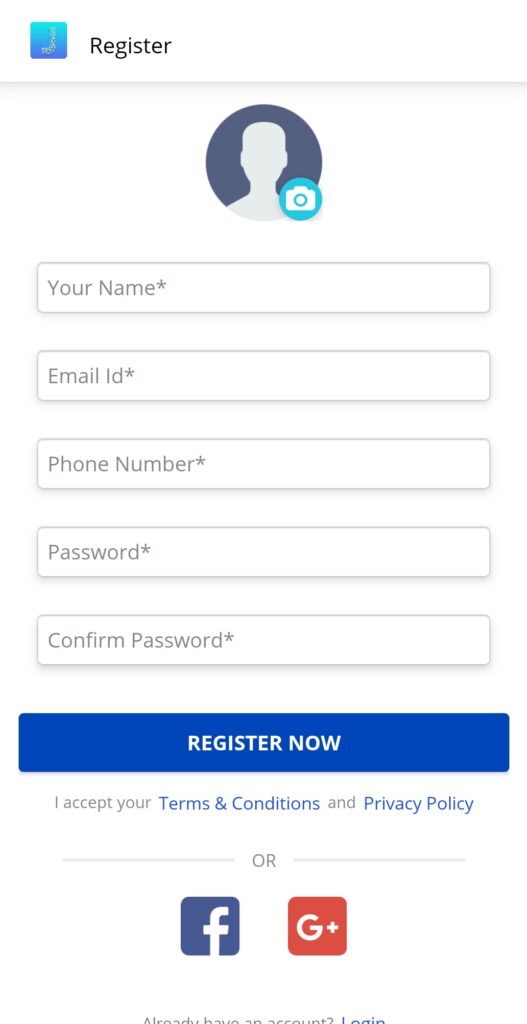

You can Signup by giving your name, email address, and phone number.

After Signup, you need to complete a questionnaire that will determine your risk profile – moderate, aggressive, conservative, etc.

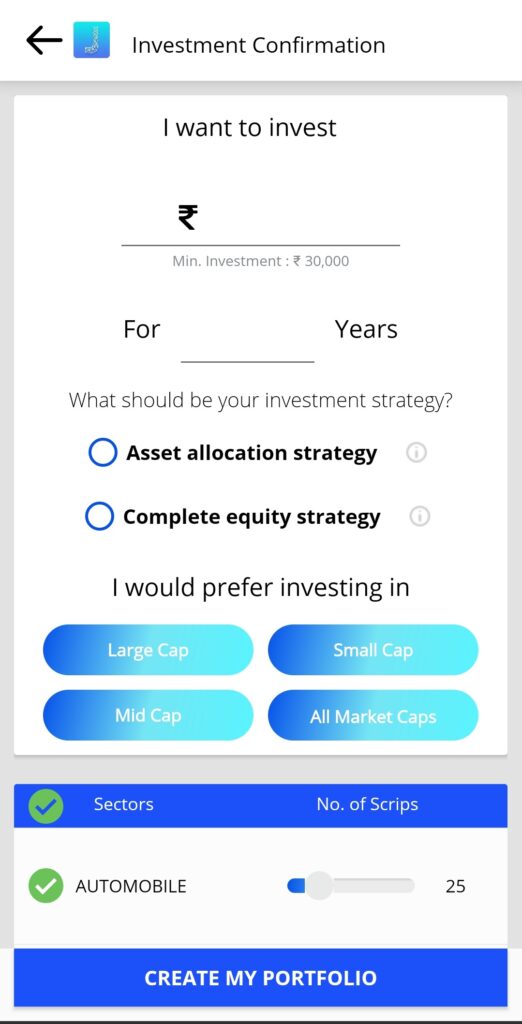

Next, you get to decide the amount you want to invest per month and for how many years. The minimum amount you need to invest is Rs 30,000, and the investment duration has to be between 1 and 5 years.

If you understand the market and can decide, you can choose which category of funds you want to invest in – large, mid or small-cap stocks. You also have to select your investment strategy :

- Asset Allocation Strategy – your investment goes to different financial instruments like gold, debt, and equity.

- Complete Equity Strategy – In this option, the app suggests you stock-based portfolio.

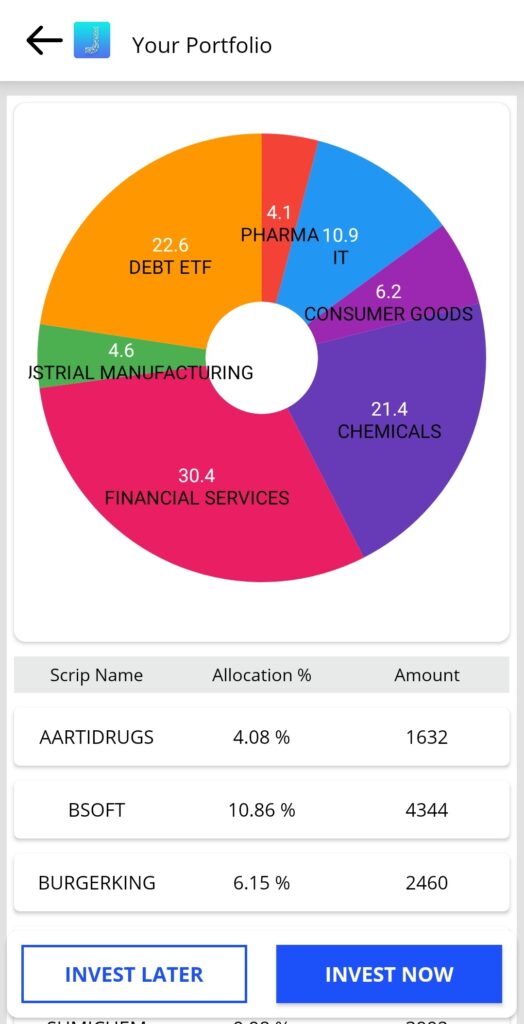

Your portfolio is created as below once you select all the options like below.

At the backend, for portfolio creation, the hyper-intelligent machine analyses about 12 million data points, including derives multiple quantitative strategies & also derives meaningful information from text data and investor sentiments.

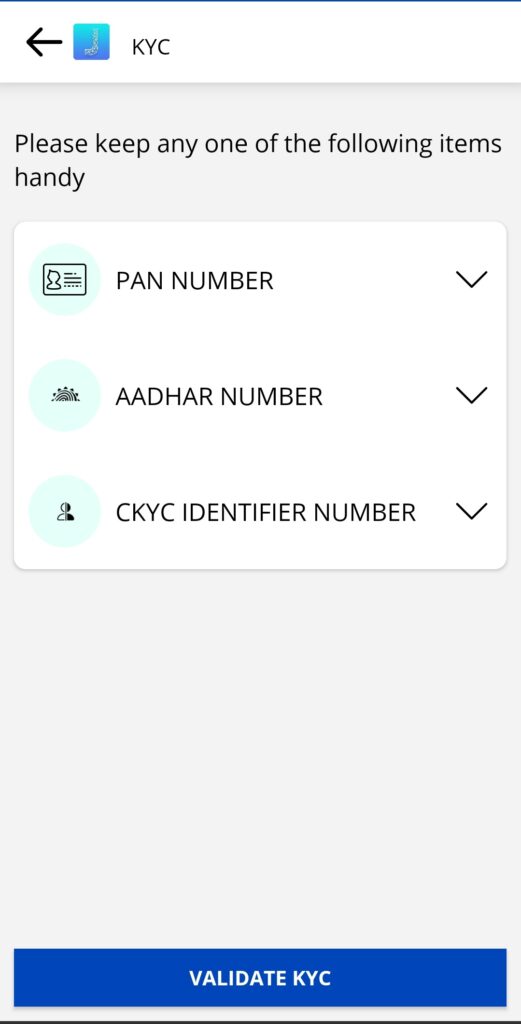

After your portfolio gets created you can start investing. Before that, you need to Validate KYC. You will have to update your PAN, Aadhar, and CKYC Identifier Number.

You can choose your broker to execute your trades. The company has partnered with Zerodha, Upstox, and Cube Wealth.

What is Risk Management under Jarvis Invest?

Once you have invested using Jarvis, it tracks the performance of your funds and conducts risk management of every portfolio independently. Based on individual portfolio analysis, it generates alerts. Below are different features of the risk management process –

- Timely Profit Booking – When and which stocks to pick is comparatively easier than knowing when to sell the stock. The app sends your alerts when to book profits on your stocks.

- When to exit – The app will send you alerts to exit stocks to minimize your risk.

- Managing allocation – The app helps you limit your exposure to certain stocks.

- Periodic Rebalancing – It will periodically review your portfolio and will recommend any changes to it if required.

How are returns with Jarvis?

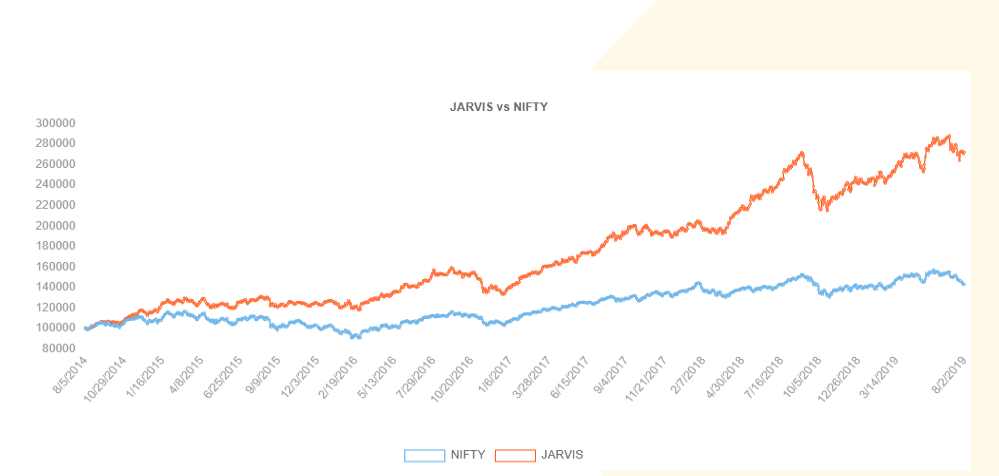

The company claims to have beaten Nifty from 2014 to 2019 (as per data available on site). If you look at the below graph, you can see, the gap between the Nifty Index and Jarvis investment has continuously increased with time.

Who can use Jarvis?

There are no or very limited products available in the market that guide retail investors on equity investment. You can use Jarvis if you are a novice or have a little understanding of the market, or you might know enough about equity investments, but prefer to refrain from the hassles of research or executions.

Is Jarvis free to use?

No, Jarvis is not a free service. You need to pay up to 3% of the AUM on a per annum basis from the start date of your service. One can explore the app and decide if the services are good enough for them.

One can also use Jarvis, via smallcase.