Republic: People Power to Startup Equity

- 15 September 2021 | 1156 Views | By Abhinav Mishra

Republic investing platform is an intermediary cum appraiser for various companies that seek seed or transitory funding to commence, continue or expand their operations. Often being marketed as a $10 platform, Republic brings investing to masses all over the world.

Startups are becoming a key investment strategy for many investors around the world. Startups are an ideal investment option for investors looking to add high-risk investment options to their portfolios. Until recently, investing in startups was a challenge. However, Republic has made investing in startups very convenient for both retail as well as institutional investors.

What is Republic?

Republic is a private investment platform for investors who are looking for high-growth investment options. Republic evaluates investment options from industries like gaming, startups, crypto, and real estate and lists them on the platform. The platform has over 200 companies registered with them who have raised millions of dollars from investors.

It is also an excellent platform for investors seeking funding from a wider base of diverse investors.

Why Invest through Republic?

Investing in startups till a few years back was done by the wealthiest 3% of the US population. The potential return is humongous. If any of the startups you invest in reaches a $1 billion valuation (unicorn), your returns will be multifold. No one knows which of the thousands of startups out there will become a unicorn. Republic gives you access to some of the companies which have the potential to become a unicorn in the coming years.

You get to invest in the early stages, so you get the large pie of the cake at a low price. You also can get involved with the startup and help them grow and be part of the exciting startup journey.

How much can I invest in the Republic?

Republic is an open platform, meaning anyone who is 18 years and above can invest on the Republic platform. Republic has set a minimum investment of $10. However, every startup gets to decide the minimum investment they want to keep for their fundraising campaign. Most companies keep the minimum investment between $25 and $100.

The SEC limits the maximum amount you can invest across all startups. It is based on your financial condition in a given year. Based on your net worth and income your limit is calculated. You can know your limit once you create your investor profile on the website.

The general limit is $2,200 per year. The limit may go up to $107,000 for non-accredited investors depending on their net-worth and income, and no limit for accredited investors.

How to invest through Republic?

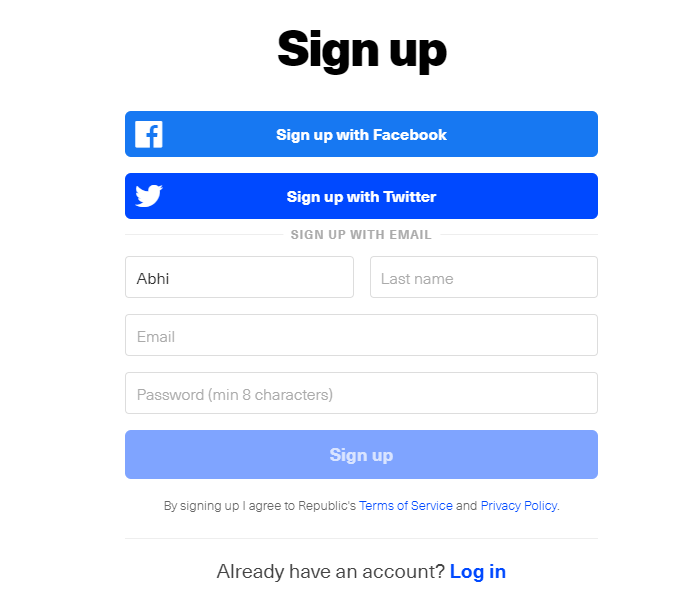

You can create an investor’s profile by registering on the platform through your email address. The registration link is – https://republic.co/register

Once you are registered, you have to go through the terms and conditions and acknowledge the terms and conditions of investment.

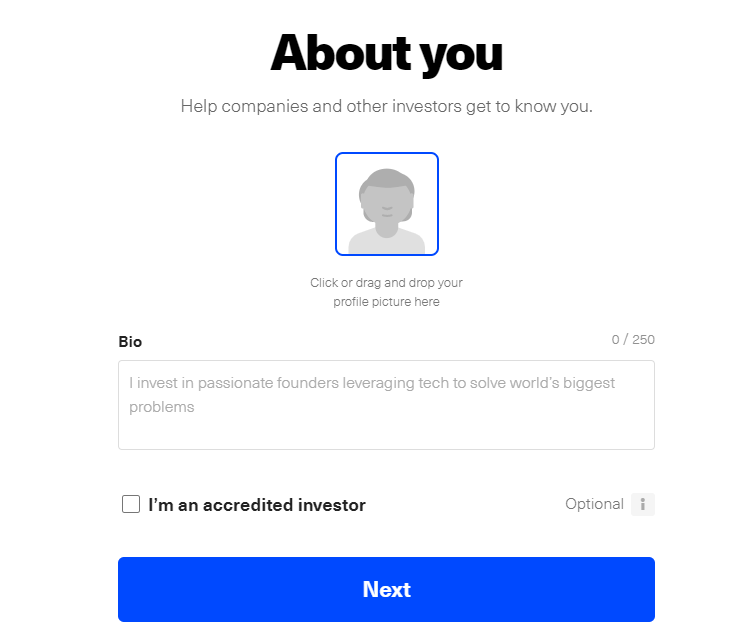

Next, you can create your profile by giving your bio.

Next, you can explore the different options available for investing. You can go through the deal terms, understand the risk associated with the investment and study the pitch material.

Once you have finalized the company to invest in, you can select the amount you want to invest in, the payment method, and complete the payment.

Once the campaign is complete and it reaches the minimum funding goal, you will receive your securities. If it was unsuccessful, you will receive a refund.

How does Republic work?

Once you invest in a company through the Republic platform, you receive an interest in the company, known as security. It is an agreement between the company and you.

Securities represent your financial interest in the company. Companies sold many types of securities, Crowd SAFE is the most common type of security. It entitles you to receive the return from the company if the company does well and certain conditions are met. For example, with Crowd SAFE security, you get returns if the startup goes through an IPO or gets acquired by the other company at a higher evaluation.

The other types of securities are Token DPA and TPA and debt securities.

Can I sell purchased securities?

As mentioned above, when you invest in a startup, you get security. Selling these securities is not easy, and hence your investment is not liquid. There is usually a one-year lock-in. In this one year, you can only transfer your securities back to the startup, or immediate family members, or an accredited investor. Strict rules govern the transfer or sale of securities. Hence you should read all the investment-related documents carefully.

Things to know before investing through Republic

If you plan to invest in startups through Republic, you need to invest for a long time. There is no way to know the definition of long. It could be five years or 15 years. Also, you should not invest just in one company. To diversify and reduce your risk, you should invest in multiple companies and different asset classes. Some other points you should consider before investing –

- Past performance of the founder does not guarantee future success.

- The startups can change their plans anytime without the need of your permission.

- Your stakes in the company may get diluted as the money raises more money.