Grip Invest : Best Investment Opportunity in India for New Gen ?

- 19 May 2021 | 12529 Views | By Abhinav Mishra

The book – ‘Rich Dad, Poor Dad‘ talked about a lot of things about investing. The most important point in the book was – how to make money work for you? Most of you must have been impressed by the idea and tried implementing it in your life. In real life, high returns on investments come with higher risk. You might have thought of putting the money in Fixed Deposits but the returns are too less. What do you do? How to many money work for you?

In this article, we are going to talk about a company that claims that when you invest through them, your money will work for you and the returns will be much higher compared to any traditional investment options.

Why Leasing is an Attractive Alternative Investment Opportunity?

GripInvest is a crowdfunding-based leasing investment platform. It is one of a kind and primarily focuses on small or retail investors, who are actively looking for portfolio diversification.

Having discussed various features, let us explore how leasing can be an attractive alternative investment:

1. Less Flickery than Equity Investments

Equity markets are an imperfect reflection of a country’s economy. While there are several genius investors, the world of equity is still unpredictable. This volatility has ruined and created wealth for multiple investors, over and over again. As an alternative to these, most of all investors would think of debt funds and mutual funds. Interestingly, leasing can be one less volatile option too.

This out-of-the-box, investment mode is not dependant on buying and selling, but for the investor, a piece of concrete evidence in terms of asset creation and use is there.

2.Consistency of Returns:

Often backed by a contract, these lease-based investments retrieve their core benefit from the consistency of returns. From anywhere between 15% to 25% or even more, returns on lease-based investments reap healthy returns. These returns are not high as some of the best equities but are multifold times better than a fixed deposit or debt fund-based investment.

3. Tax Benefits:

Since there is n asset creation, there is a benefit of depreciation, which makes one claim its benefit, and thus reduce the burden of the tax. When compared head to head with options such as an ELSS, this one is certainly less risky.

4. Suited for Short Term Financial Planning:

With platforms like Grip, lease-based investment can be a short to medium-term goal, unlike conventional decade-long ones. This seems to come in handy for those small investors who seek immediate returns with their investments and tend to close the investment made in a span of 2-3 years.

5. Asset-Backed Finance

Wherever there is lease-based finance, there is asset creation. When we compare this finance with equity (since its return is comparable), asset creation works in the favor of lease-based financing. Why is this so? Simple. In equity-based investment, there is a provision of being the owner of the Company, but the same can vanish when lenders (banks and bondholders) take their share.

In lease-based finance, the finance is essentially on an asset. So, in the case of default, the asset can be sold and returns can be garnered.

What is Grip?

Grip is a platform that offers investment opportunities selected by experts. The investment goes in physical assets like vehicles, furniture, and equipment. Why will someone invest in such assets and how returns will come? These physical assets are leased to corporate to earn high returns. Grip has a robust and secure technology that aims to let you choose investments with an attractive risk-return profile. If you are not sure which asset to chose, Grip has a team of experienced advisors and a management team that consists of diligence professionals, credit underwriters, data scientists, bankers, and leasing experts who will suggest an investment for you based on your budget, risk profile, and convenience.

Where does Grip invest your money?

As mentioned above, your investment will buy a physical asset that will then be leased out. Leasing is a simple contractual arrangement where the owner (lessor) receives regular payment from the user (lessee) over the agreed period of time. The assets can be vehicles, buildings, and equipment.

Let us understand this with an example. You are planning to buy a commercial shop in a complex and rent it out to get fixed returns per month. The problem here is the high initial investment. You and your five friends get together and buy the shop that will then be leased to a company that is looking for office space. You and your friends will receive a monthly return. Grip helps you in every step of this process.

Benefits of leasing

Leasing is a very common concept. Many businesses like airlines, manufacturing giants, and heavy equipment companies lease their assets rather than own them. Below is how it will help you:

- More stability – It is less volatile compared to the stock market and delivers predictable cash flows in the form of monthly rentals.

- Strong Collateral – Strong collateral enables better recovery, re-lease, and sale to lower overall risk.

- Tax Efficient – Lower effective tax rate to the lesser (you) by way of depreciation and other tax set-offs.

How does Grip work?

Now you know where the capital is going, so the next question you must be having is – How it works? Grip manages the end to end journey for your investments, leasing, and returns.

- Grip takes in small investments from a number of investors.

- It then invests the capital in a vetted list of physical assets.

- The assets are leased out only to trusted leasing partners.

- Investors start receiving assured monthly rentals.

Why should you invest through Grip?

Detailed Analysis – Grip does not suggest any asset to you to invest. All the investment opportunities are curated through rigorous due diligence.

High-Quality Leasing Partners – All the leasing partners are established and credible organizations that ensure minimum risk.

Complete transparency – You will have disclosure of all aspects of each investment, terms of the lease, and potential risks.

Established co-investors – This is the best feature of Grip. Many retail investors may think that the company is taking a small amount from retail investors who don’t completely understand the business and hence there is a risk involved. You will be glad to know that for each asset, reputed investors invest at least 30% of the total investment amount.

Repayment Security – Every asset gets backed by a security deposit or post-dated cheque with an ability to reclaim the asset for selling or re-leasing.

Secure & Hassle Free Transactions – You as an investor don’t have to go into any hassle in the investment process, expert advisors from Grip will identify the asset for you, execute your transaction and also manage it.

How to invest through Grip?

You can register on the Grip, using your Email and phone number which will be verified by OTP. If you register by Email, you will still have to verify your phone number.

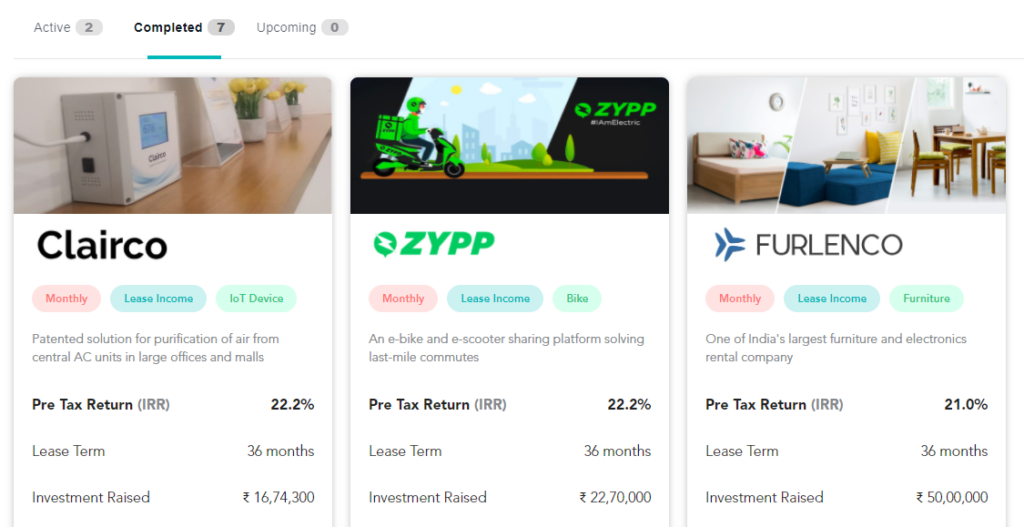

On your Dashboard, under the Asset section, you will see 3 options – Active, Completed and Upcoming. The active assets are those where Grip is still taking in investment from investors. The completed are those in which investments are complete and investors have started receiving the payout and upcoming are ones in which investment will start shortly.

Grip has completed investments in 7 projects as of now and has raised capital between Rs 10,00,000 and Rs 50,00,000 for them. The average pre-tax return is 21%.

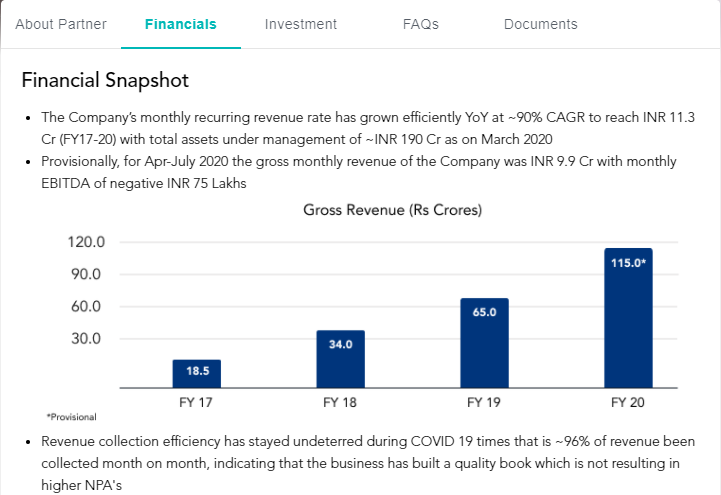

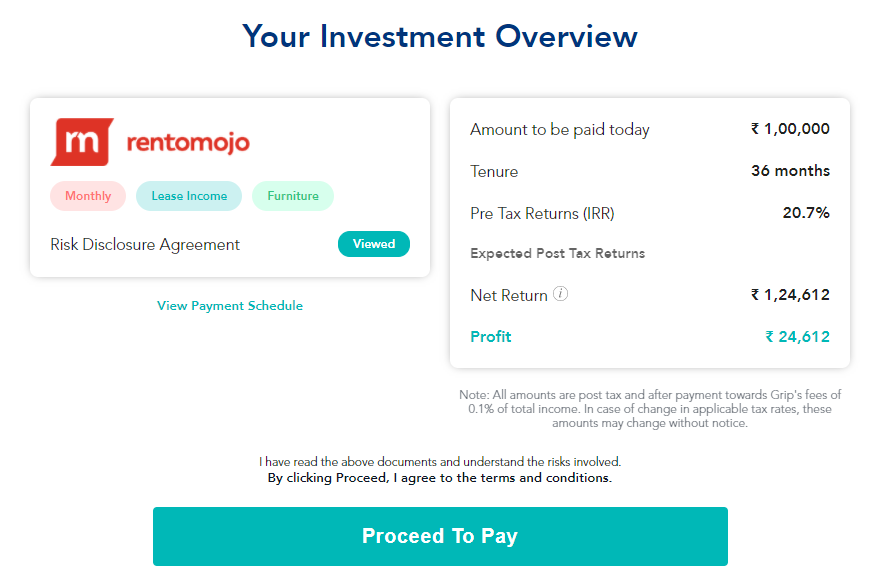

If you are planning to invest through Grip, you need to check partners in the Active tab. In the above image, you see two active assets (may change with time) – Bounce and Rentomojo. Before you invest in any company, you try to know the business of the company and its growth, right? To make investors understand the business of its partners, Grip provides a section ‘About partner’ where you can get an overview of the company and its business model. There is another section which shows the growth of the company – ‘Financials’. The last section is ‘Investment’, it talks about the Key Lease Terms and Risk factors in this investment.

Though Grip is leasing assets to trusted companies, in today’s time, a lot can happen in span or 1-3 years. You should go through the risk factors and understand all the risks. Grip does not claim that the investments are completely risk-free. For example, one of the points in Risk Factors for Rentomojo states, ‘Such investment does not guarantee that an investor will make money, avoid losing capital or indicate that the investment is risk-free.’

What is Grip’s Investment calculator?

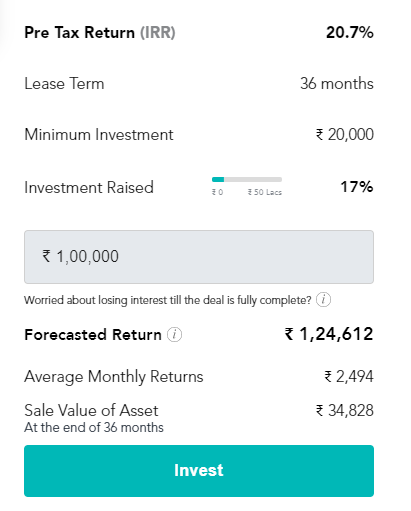

The minimum amount you can invest in Rentomojo is Rs 20,000. Different investment options will have a different minimum amount. Let’s assume, you decide to invest Rs 1,00,000 for Rentomojo lease. You can see in the below image that the lease term with this asset is 36 months. The forecasted Return is Rs 1,24,612 and the average monthly return is Rs 2,494. Also, the sale value of the asset at the end of 36 months is calculated as Rs 34,828.

Breaking down the numbers

If you look at the numbers, the forecasted return is the sum of the monthly returns and sale value of the asset. If you invest 1 lac today, you will receive Rs 2494 for the next 36 months and after 3 years you will receive Rs 34,828 as the depreciated value of your asset. Investors have to pay tax only on the returns they receive as per their tax bracket.

What if there is a delay in raising funds?

You can make out from the details shared by Grip that the lease agreement will start once the company is able to raise the complete investment amount. What happens to your investment in case the company is not able to raise funds for a particular partner? If Grip takes more than 7 days (after your investment) to raise funds for a partner, you will receive an additional interest on your investment from the 8th day onward till the time fund is raised. The interest rate for this will be equivalent to the rate offered by HDFC bank under the 30-day Fixed Deposit scheme. This interest will come along with your first monthly returns.

Should you invest?

In addition to the interest rate point discussed above, you must note other fine points before investing. There is a 0.1% Grip fee which will be deducted from your investment amount (kind of processing fees). Also, if you are thinking the monthly returns will start coming immediately (even if the funds are raised immediately) then that is not the case. Monthly payments will start after 45-60 days from the date of completion of funding for the deal. Before you proceed to make a payment, read the Risk Disclosure agreement, and check the Payment schedule. You can make the payments through UPI or Net Banking.

If you check the partners of Grip, you will notice most of them are Startups that are dependent on funding to continue their business. Though you are not investing in these startups directly, however, your monthly returns depend on the survival of these companies. The investment period is 3 years, in case the company fails during this period, it will default its payment to Grip and Grip will not be able to pay you. Yes, the lease agreement can be broken and assets will be recovered. Later, Grip can also sell the assets and give you the amount corresponding to your investment but if the situation arises, your returns will be significantly be impacted.

This is not a completely risk-free investment, understand the asset in which you are investing like its re-sale value, etc. Also, understand the company which is going to lease the asset – its future funding and capital raised so far. If you see no major issues, then only invest.

Read: ELSS Vs Equity Funds: Facts that will Make You Think Twice !!