INDmoney: Good Personal Finance to Cryptocurrency Rewards

- 14 May 2021 | 8431 Views | By Abhinav Mishra

As an individual you continuously need investment and tax saving advice, you may be looking for loans or the best credit card. What if you can manage everything in one place? In this article, we are going to talk about one such platform which lets you see all your investment-related information in one place- INDmoney.

What is INDmoney?

INDmoney is a brand/service of Finzoom Investment Advisors Private Limited. Other than INDmoney, Finzoom has another platform related to investment management known as INDwealth. Finzoom is a SEBI registered investment advisor which aims to put more money in your hands and to make advisory services highly transparent and unbiased with a focus on lowering expenses and helping you achieve your financial goals.

No matter what type of investment you want to make, INDmoney has a suggestion for you. They have over 14K mutual funds, 8K stocks, 10K bonds, 100+ PMS, and 10K foreign stocks. They are coming with two more services:

IND Dynamo – which lets you get 2.5% extra every year above your regular SIP return?

IND Baskets – This will let you use both superstar fund managers and already existing algorithms to manage your portfolio.

They work with different types of loans. If you are looking for a new home loan, they will suggest you best home loans available based on the input you provide. They also give proposals with a low-interest rate for loans against property, loans against investment, loans for commercial property and personal loans. All you need to is submit the loan application form.

Other than the above services they also have INDwealth as one its prime service.

What is INDwealth?

INDwealth is a private wealth management service that delivers premium services such as private family office, tax services, analysts, succession planning, and trust services. INDwealth provides feature-rich Robo-advisory service, and it uses machine learning extensively to suggest investment tailored for you. It lets you manage your family member’s accounts from one place.

If you are looking for a platform that can manage the portfolio of your complete family then you should consider going with INDwealth Platinum+ plan. Under this plan, you will get a Wealth Manager, Research Analyst, and team of a tax advisor.

Features of this subscription are:

- You get your personal family office

- Unlimited on-demand consultation

- You get customized investment proposals

- Quarterly & yearly tax computations

- Risk Monitoring of your portfolio

- Track your financial life

- Monthly performance audit

How much it costs to take INDwealth subscription?

The cost of the subscription depends on the AUM you want them to manage.

- For AUM below 50 lakhs, the charges are Rs 399 per month plus GST

- For AUM above 50 lakhs, the charges are Rs 999 per month plus GST

- For AUM above 3 crores, the charges are Rs 2999 per month plus GST

If you want to add other family members to the platform you can do that but in that case, the charges are different. You can add up to 4 PAN cards. The charges are:

- Rs 3999 per month for AUM below 10 crore

- Rs 5999 per month for AUM above 10 crore

You can also upgrade to IND GOLD for 360-degree Financial Planning and Advisory, Portfolio Review, and Wealth Management.

Why you should choose INDwealth?

INDwealth is designed to give you the best advisory using advanced research methodologies and cutting edge technology. They have a dedicated team of wealth managers, compliance officers, Chartered Accountants who help you to manage and grow your wealth.

Unbiased and transparent – Since the recommendations are made by Machine Learning algorithms, there is no biasing on a recommendation based on the plan or any other factor.

Post Tax Return Analysis – The software provides you post-tax returns and also suggest you smart strategies to save overall tax.

Complete financial planning – Unlike other platforms, they just don’t recommend where to invest but also takes into consideration your liabilities, income, expenses, and taxes so that you get the best future planning for your family.

Minimal Expenses – Since the cherry-picked investment products are algorithm-based and require no human efforts, the expenses and commissions charged are very less.

Data safety – The platform uses encryption to protect your data and also commits not to share your data with anyone.

Investment and Loan analysis – You may have loans in your portfolio and you may be paying a higher amount in interest, the INDwealth does critical analysis and recommends to prepay or switch your existing loans.

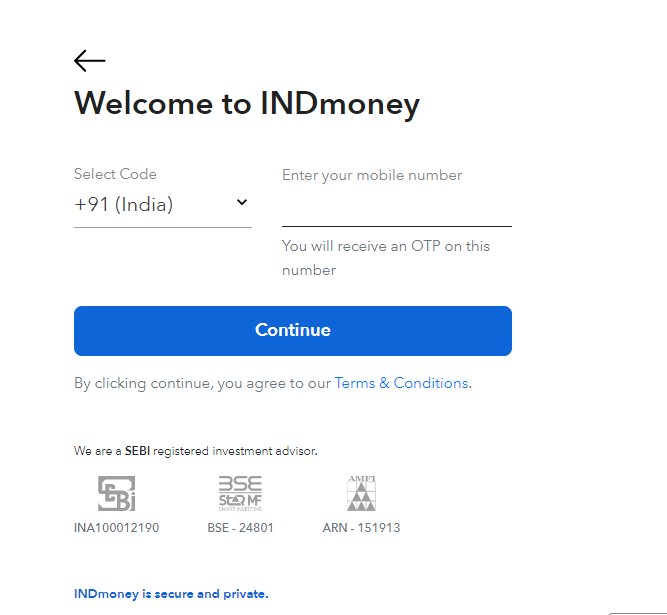

Starting with INDmoney

Whether you want service related to loans or investment, you will have to register using your phone number.

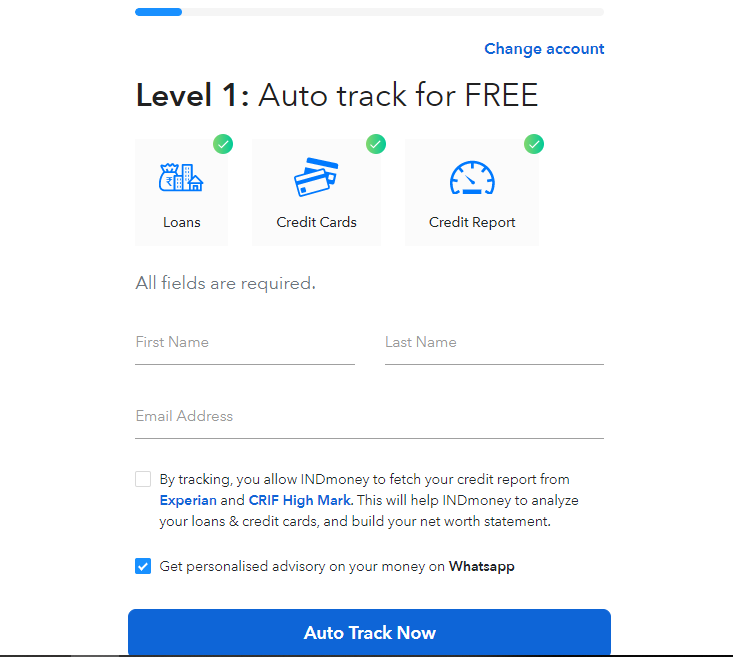

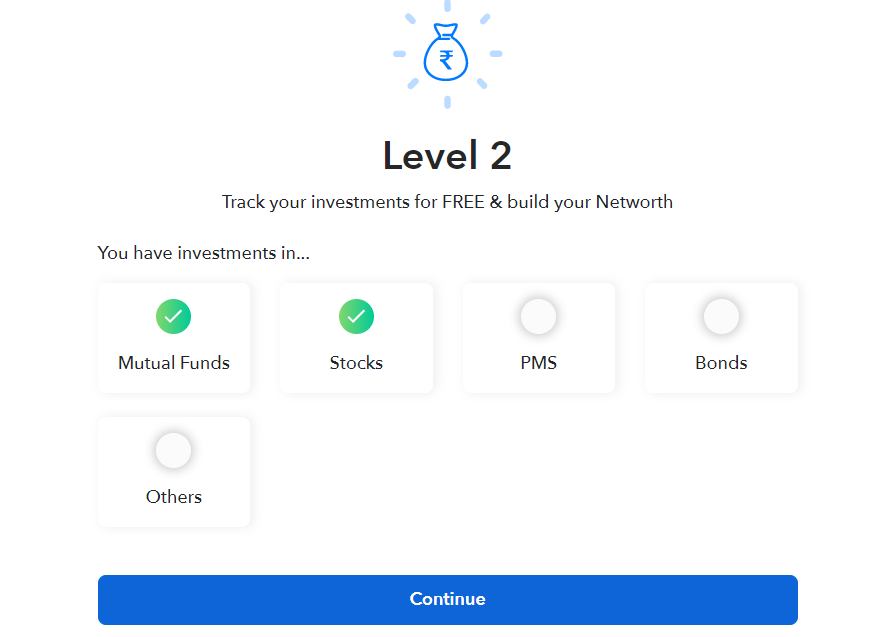

Once you verify your account, you can set up your profile. They will track your credit score and liabilities by going through your credit card statements. On the next step, you have to give details about your existing investments, if you have invested in mutual funds, stocks, bonds, etc.

They will fetch your PAN card and ask for confirmation to auto-track your investment.

Once you verify your Email address you can login to your Dashboard which will have sections like Investment, liabilities, tax, proposal and Wealth Office.

Understanding different sections

Mutual funds

Perhaps the best thing about the INDmoney platform is that the platform is technology-driven. The platform does not make general recommendations like other ML-driven platform but it first understands your attitude towards risk which helps identify an appropriate mix of investments that you are comfortable with.

To know that, you will have to answer the below questions:

- Select the investments you currently own?

- Your DOB

- What is your yearly income

- You have Rs.10 lakh to invest at the start of the year. Below are the three hypothetical investment portfolio returns scenarios with likely best and worst-case annual returns. Which scenario would you prefer?

Based on your answers, your risk level will be decided, and based on that different types of investment options will be suggested to you.

Stocks

You can also invest in stocks using the platform. You can link your existing stocks to INDmoney by uploading your NDSL statement or connecting your broker’s profile with INDmoney. The two brokers that INDmoney supports are Zerodha and Upstox.

You can also invest in US stocks by creating a free brokerage account with DriveWealth. This is a distinguishing feature of INDmoney, very few platforms let you invest in US stocks.

EPF

You can also link your EPF account with INDmoney.

Bonds and Fixed Deposits

You can add existing bonds and fixed deposits details in your INDmoney account.

Explore

This section allows you to view all stocks, indices, different types of mutual funds, different types of FDs you can open depending on your need, different types of bonds available, and PMS options. To available PMS options, you will need to have a minimum investment of 50 lacs.

How can you invest using INDmoney?

You can invest using INDmoney but you need to complete your profile. Further, you will have to give all your personal details including your address. As mandatory, you will have to upload your PAN, address proof document, your signature, and finally your banking details.

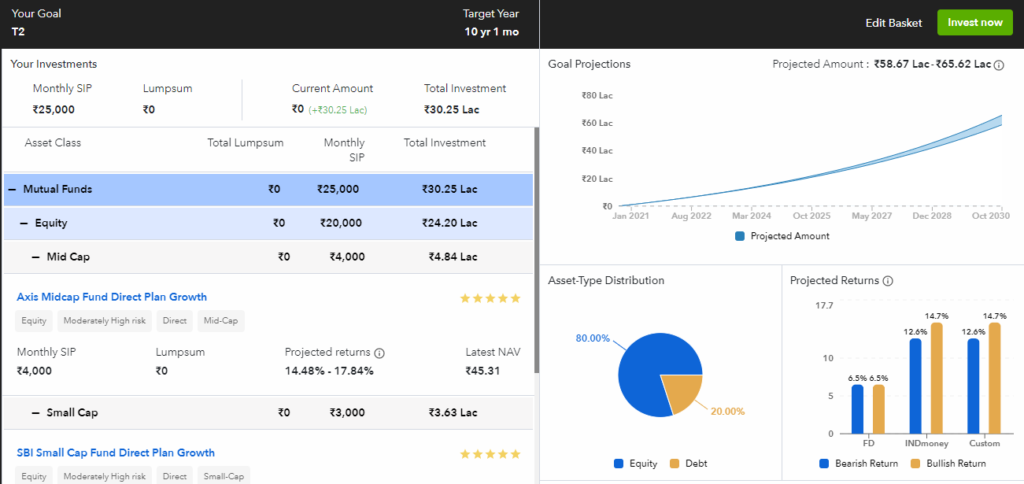

Goal Setting Feature

The platform lets you create goals and gives a roadmap of how you can achieve it. If you know your limitation i.e how much per month you can invest, you can choose the ‘I want to invest’ option. If you have a target in mind then you can choose ‘I have a target’.

Under ‘I want to Invest’ you will have to give the amount you can invest in monthly SIP, any Lumpsum amount you can invest, and your goal end date. Based on your inputs, it will project your final amount and areas where you should be investing to achieve that goal.

Under ‘I have a goal’, all you need to give is your goal amount and by when you want to achieve it. The software will let you know how much you will have to achieve to reach that target.

The user experience

As a first time user, with so many things on offer, the platform becomes a bit confusing. Once you register, you are not aware of pending actions from your end. Since it lets you access the Dashboard without completing the profile, only when you try the ‘investment option’, you will come to know there are other missing information. A more user-friendly experience would have been, once a user registers, the basic information is taken and even though Dashboard is created, users are prompted/notified that they need to complete the profile to start using the platform. Or a step by step process to complete all information on the website would have provided a better user experience.

A lot of users have also complained about the customer service. Though the company is still new, it has to work harder in keeping its customer happy.

We have seen other investment management platforms earlier, when you compare them with INDmoney, this looks a lot of complete – meaning you will have everything on the platform which you need for investment be it stocks, MFs, or bonds. If you like to manage your funds on your own, you will find INDmoney very attractive with features like goal-based investing, regular to direct plan switching. They have every single detail available on their platform. The only thing which you will find missing is insurance. Perhaps this add-on will make this a user’s delight.

Indmoney Dives into Crypto

Since its launch, INDMoney has not only gained a dedicated fan following but has also updated itself with almost all features.

An IndMoney app user can now compare his investments and debts in terms of net worth. Adding to that, one can also add his health and life insurance policies to track and manage.

With the world of finance already bubbling with new investors, new methods of investing, cryptocurrencies cannot be left behind or ignored. Now, IndMoney has started to take care of the same as well.

Interestingly, it has not allowed the users to directly make an investment but is carrying out the same via a Reward or a loyalty program named “INDCoin”.

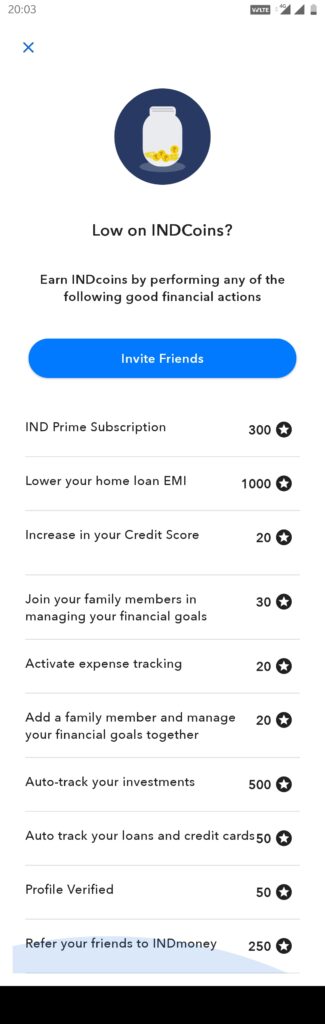

How do you earn INDCoin

INDCoin rewards you when:

(a) There are improvements in your Credit Score: INDmoney uses Experian to track your Credit Report.

(b) You subscribe to INDmoney Prime.

(c) You refer INDmoney to friends, or you verify your profile.

(d) Use IndMoney advisory such as lowering your Home Loan EMI, or let more and more its services.

This is probably one of the rarest bonus/reward programs introduced by ANY app.

What Crypto Currencies are available in INDMoney?

As of now, the following cryptocurrencies are available on this platform:

(a) Bitcoin

(b) Ethereum

(c) Ripple

(d) DogeCoin

(e) Ripple

(f) Uniswap

(g) Cardano

(h) Binance

(i) Neo

(j) Litcoin

(k) Tron

(l) Chainlink

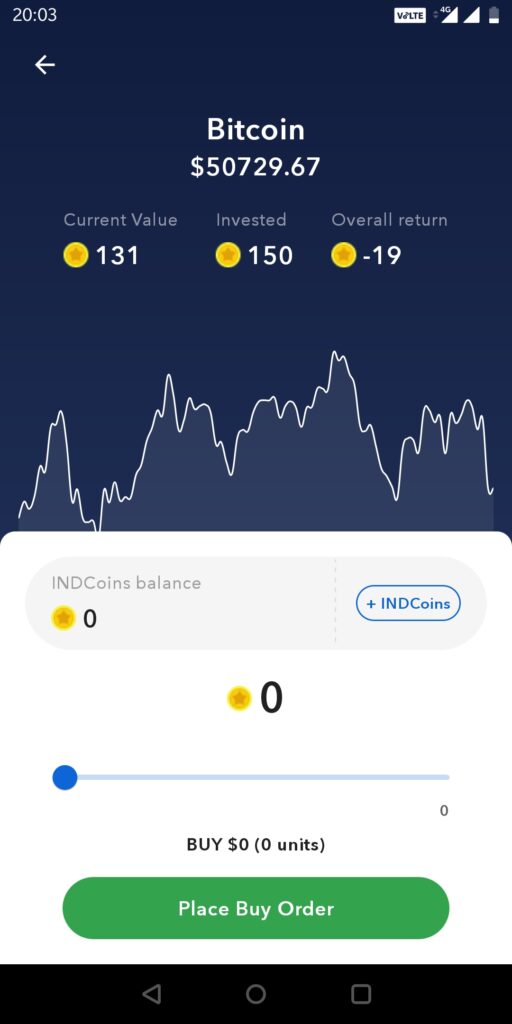

How to Trade in Crypto via INDmoney

Provided that you have INDCoins balance, it is a simple tap-and-go process to trade crypto via INDMoney.

You can use any of the above methods to accumulate INDCoins.

Once coins are accumulated, you can browse and search for the currency you want to trade or invest in.

Then, just place an order, and voila. You now own crypto.

The whole process can be summarized in this video:

For first-time crypto traders or just experimenting investors, this is indeed a very interesting opportunity, as one doesn’t need to spend an actual amount of money. Just completing some tasks would fetch you a chance to invest and observe the Crypto trend.

It is fair to understand the volatility and risk associated with cryptocurrencies, and it’s not being everyone’s cup of tea due to lack of compliance and standards. Trying and observing and learning is altogether a different story.

Given the company is backed by institutional investors comprising Tiger Global, Dragoneer & Tona Investments, and Steadview Capital who have invested a total of $58Mn in the company, the company has a great future.

Read about: 11 Best Robo Advisory Investment Companies in World