Mutual Funds,Total Expense Ratio and Investor Consumerism

- 30 April 2021 | 1388 Views | By Mint2Save

It has not been that long since we have seen mutual funds become a staple investment destination for the masses. With the advent of massive print and media advertisements, social media campaigns, mutual funds have caught pace with the common investor.

Customized with indigenous and global investments consisting of equity, bonds, gold, cash, etc., mutual funds are what someone gets suggested for almost all investment goals.

Mutual funds have also been the foundation for several startups such as Groww, Kuvera, ScripBox, Paytm Money, etc. Read about INDmoney: Helps you to Simplify your Investments, Finances and Wealth Management

Mutual funds were introduced to the Indian investor in 1964. Since then, it has seen a monopoly of UTI, the entrance of public sector banking companies in the late ’80s, and that of the private sector in the mid-’90s. As of now, the Indian mutual market comprises over 2500 mutual funds, managed by -44- fund houses.

Are Mutual Funds a Good Investment?

- With such a large market, expert fund manager’s and ever-evolving regulations, mutual funds are relatively safer, and with better returns, when compared with conventional debt or equity-based instruments.

- They are also deemed as a less risky investment tool that can beat inflation and create wealth. Further, investment options like SIP, STP, SWP, etc., have created various customized and systematic investment plans for small investors.

- The startups have made investing easier and, one can easily choose the best funds based on the investment goal and risk appetite. Websites and research journals such as Morningstar are also updating the active investor in choosing and staying in the fund that suits him the best.

With the technology at one’s dispense to sort, filter, choose and invest, investor consumerism has reached the optimized levels for mutual funds.

Caution to Keep While Investing in Mutual Funds

While selecting mutual funds, the exercise follows a typical pattern, for instance:

- Selecting a goal: Buying a house, purchasing a car, planning a holiday, child’s education, retirement, tax-saving, etc.

- Filtering the investment mode: SIP or lumpsum.

- Choosing the risk appetite, from anywhere between very high risk to very low risk. Read: What is Mutual Fund Riskometer?

The above three exercises can be carried out via any other mutual fund investment app such as Kuvera. Once these are carried out, the app will select and sort out the best funds, based on past returns.

However, the investor often skips one crucial point while investing in a mutual fund. It is the expenses that a mutual fund accounts for. Most investment applications do not reveal them at the first sight, and investors don’t seem to pay heed to it either. All the expenses that a mutual fund accounts for are summed up in a single term: Total Expense Ratio or TER.

How is TER Calculated?

Total Expense Ratio is a summation of the following major components:

- Fund Management Fee: Mutual funds are managed by a team of professionals, headed by a fund manager. This team comprises research personnel, data analysis experts, and finance experts. The team is compensated for the work done, and this compensation is considered as a fund management fee.

- Administrative Expenses: These expenses include various stamping, trading, fund marketing, advertising, registrar and transfer charges, etc. These minor expenses, when accumulated, tend to form a significant portion of the fund’s expenses.

- Fund Distribution Fee: Mutual funds are known to be distributed mainly via two different methods:

(a) Regular Option: In this option, the mutual fund is canvassed by a mutual fund distributor. Depending on the amount canvassed, the distributor is paid a certain commission.

(b) Direct Option: Under this option, the investor directly deals with the fund house. As a result, the commission paid to the distributor is saved. This is the model upon which various direct investment mutual fund applications, such as Kuvera, IndMoney, Groww, etc., tend to focus upon.

All the above combine to form expenses of a mutual fund. How these expenses are accounted for in a mutual fund? The answer is Total Expenses Ratio, i.e., TER.

How is TER Deducted?

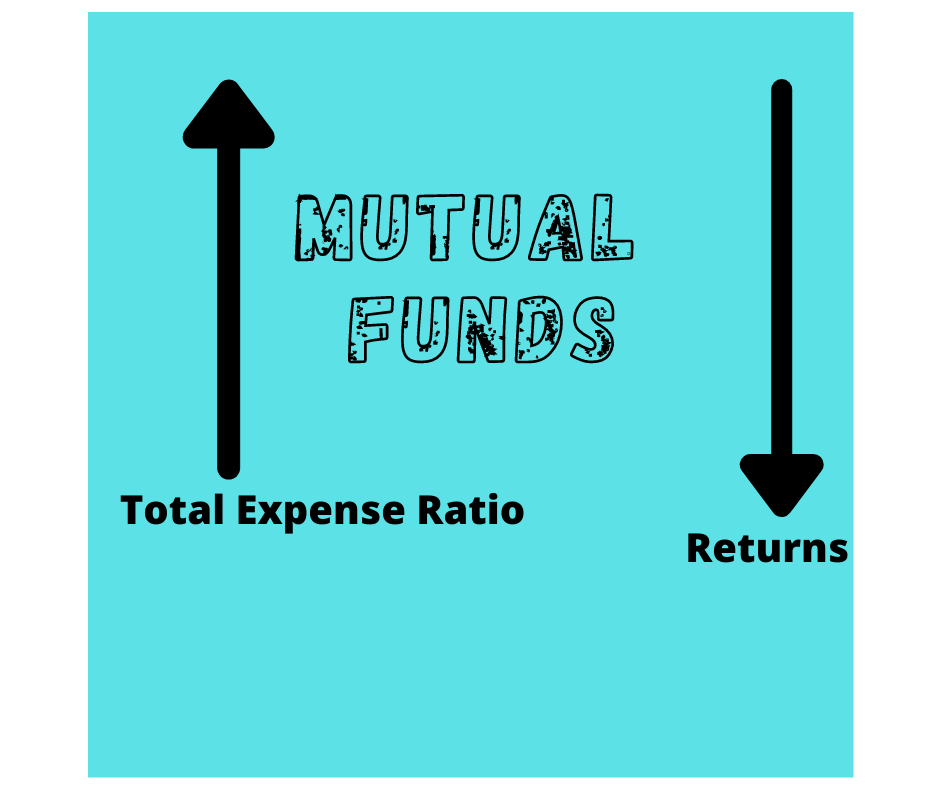

TER is stated as a percentage of the total assets under management of a mutual fund. The higher the TER, the lower is the actual return that a mutual fund delivers to its investors.

Direct mutual funds, though give more returns than the regular counterparts, cannot escape from the TER and the upper hand that the fund houses have on them.

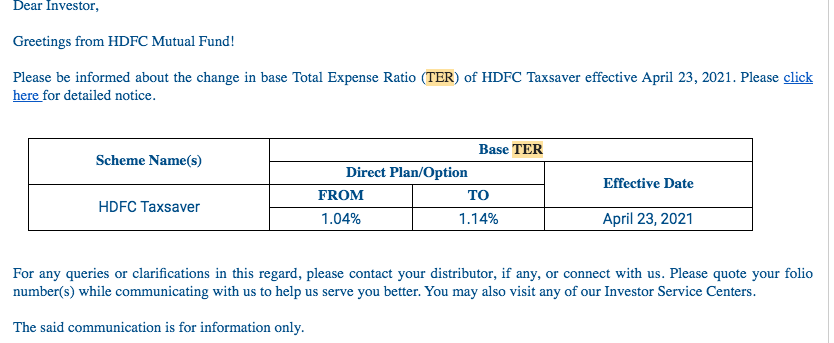

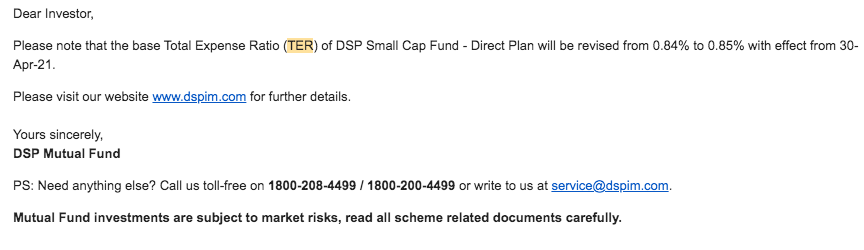

Favoring the investor, SEBI has often tried to bring many rules, regulations, and cappings. However, funds to keep changing the TER, at a short notice, which is often neglected by the investor. Here are a few examples of how fund houses notify about TER change:

In the image above, HDFC Index Fund doubled its TER. Any justification? No.

TER of a direct investment plan was increased by 10 decimal points. Being a tax saver mutual fund, it is also locked in for a period of -3- years.

TER of the direct plan for DSP Small Cap being increased by 1 decimal. This directly means that your returns are going to be less.

As of April 2020, the TER was high as 2.00%, as elaborated via the following table:

| Assets Under Management (AUM) |

Maximum TER as a percentage of daily net assets |

|

| TER for Equity funds | TER for Debt funds | |

| On the first Rs. 500 crores | 2.25% | 2.00% |

| On the next Rs. 250 crores | 2.00% | 1.75% |

| On the next Rs. 1,250 crores | 1.75% | 1.50% |

| On the next Rs. 3,000 crores | 1.60% | 1.35% |

| On the next Rs. 5,000 crores | 1.50% | 1.25% |

| On the next Rs. 40,000 crores | Total expense ratio reduction of 0.05% for every increase of Rs.5,000 crores of daily net assets or part thereof. |

Total expense ratio reduction of 0.05% for every increase of Rs.5,000 crores of daily net assets or part thereof. |

| Above Rs. 50,000 crores | 1.05% | 0.80% |

The TER has to be deducted from the total returns, and then the actual return made by the mutual fund is arrived upon.

How to Spend less on TER?

In terms of raw money, TER is an expense for which you didn’t buy the ticket. While one cannot actually make the TER zero, one can reduce it by following a few simple steps.

- Filtering funds by TER: While searching for a fund, one can explore those funds that have performed above average than the benchmark, and have less TER.

- Investing in Passive Funds instead of Active Funds: Various money and finance experts have routed for passive funds such as index funds, and low-cost ETFs. These funds are benchmarked to an index such as the S&P, Nifty, and have relatively lesser TER than that of active funds such as large-cap, mid-cap, small-cap, etc.

Small savings, when mixed with time, do count for a lot of large returns, and mutual funds are an easy way for small savings. Maximizing returns by choosing the best funds available with lesser costs will just require a few simpler steps.