What is Mutual Fund Riskometer?

- 17 March 2017 | 1883 Views | By Mint2Save

Like any other kind of investment, Mutual Funds have their own set of ‘Risks’. Most of the investors do not know these and either end up avoiding mutual funds or at times invest in funds that do not meet their risk taste.

The mutual fund offer documents provide all the information one requires, but not always presented in an easily readable form. AMFI and various Asset Management Companies continue to struggle to educate investors so that they can take the most well versed decisions.

THE FORMER SYSTEM

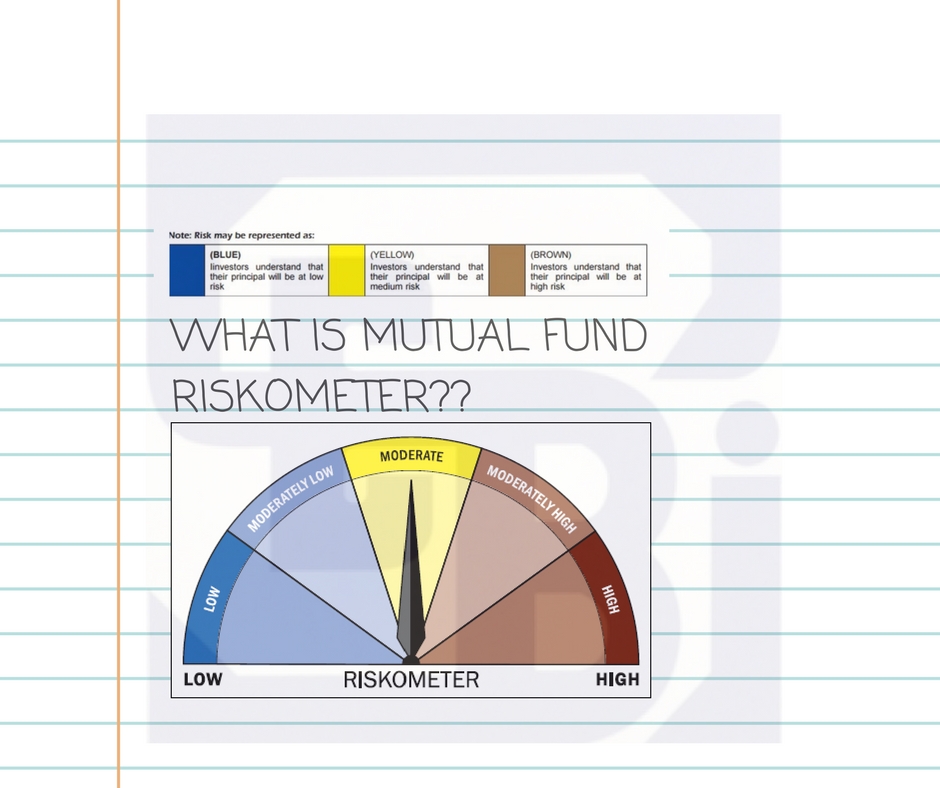

Two years back, in March 2013, the Securities and Exchange Board of India (SEBI), which is the capital market regulator, had demanded fund houses to use product labels. All schemes’ labels had to display a colour box, depending on the risk levels. The system was known as ‘Colour coding system’. Following is a depiction of the colour codes and the risk associated.

THE RISKOMETER

In effect from 1st July 2015, SEBI replaced the former ‘mandatory colour codes’ by a meter named as “RISKOMETER”, holding Five levels of risk from LOW to HIGH. The Riskometer will be revealed on the Front Page of the NFO (New Fund Offer) or wherever scheme information will be advertised / professed / disclosed / published. Funds will now use the new riskometer in place of the former colour codes. It would be the new product label.

The Change

While comparing the former colour coding system and new riskometer, there are two significant changes:

- The two additional risk levels are fused in former system.

- The colour coding risk level will shift to a 180 degree black & white graphic scale having arrow based risk representation.

The Following schematic diagram will explain the riskometer and its five risk levels :

It looks similar to a speedometer and has the following five different levels –

- Low Risk Level – Money is at low risk. Liquid assets and extreme-short term bond based debt funds are listed under this category.

Average maturity – less than 90 days

- Moderately Low –moderately low risk. Short to medium term funds having are listed under this category.

Average maturity – between 91 days and 3 years

- Moderate –moderate risk. Arbitrage funds and debt oriented hybrid funds having up to 20% revelation to equity components in the portfolio will fall under this risk group.

Average maturity – over 3 years

- Moderately High –moderately high risk. Spread equity funds, balanced funds, indexed ETF and gold ETF (Exchange Traded Funds) are listed under this category.

- High –high risk. Examples – Sectoral funds, international funds and sectoral ETF.

NEED OF CHANGE

The former system was not satisfactory to represent the entire range of risks that were present because it became tough for the individual to really fit some of the funds into a colour because this might not be precisely representative of the risk that might be existing. Another problem was that numerous different types of funds would fall under the same colour which would cover the difference that was present inside them.

In all we can say, the investors were not able to judge whether it would be helpful or not because of the narrower classification of the risks and there was vital of the broader classification. The Riskometer would provide more choices for the mutual funds to actually classify the risk and undertand the whole situation more clearly which would go on to benefit the investor to recognize the exact kind of risk that is existing.

WORKING

The Association of Mutual Funds of India has made a committee to put down basic standards and hygiene guidelines on how to use the riskometer to safeguard standardization. The committee is likely to come out with its report shortly.

BENEFITS OF RISKOMETER

- The mutual fund houses will be the major beneficiary as they will save a lot in marketing cost. They can now issue black & white advertisements.

- Try to examine Risk-Return relationship at portfolio level rather than at distinct fund level.

- Extra risk levels so more efficient working.

The Riskometer, in spite of being having a brief description, requires an understanding and could be open to explanation. But, there are several other factors apart from the riskometer that an individual should look at and hence this should be just the initial point for the investor as they go for deciding which fund they consider investing into. The riskometer is just a part of the work that needs to be done while selecting a specific fund.