Mudrakwik: India’s First and Best Instant Loan App

- 14 August 2020 | 4426 Views | By Abhinav Mishra

The Government of India’s Digital India program was launched a few years back with a vision to transform India into a digitally empowered society. Since the launch of the program, a lot of companies like Mudrakwik and many more have come up to support the mission.

By 2023, the Indian digital lending industry is expected to grow dramatically and is estimated to have a market size of $100 billion. The fintech investments in the country have almost doubled to $3.7 billion in 2019, up from $1.9 billion the previous year.

We have already seen some startups offering instant loans, we are going to cover one more in this article – Mudrakwik.

What is Mudrakwik?

Mudrakwik is an instant loan app that provides you an instant loan – it can be a personal loan or Buy Now Pay Later option. It is developed by Mudrakwik Fintech Pvt Ltd based in Pune. The company was founded by Swapnil Madiyar. Later he was joined by Aayush Goel and Sahil Bansal. Aayush and Sahil are Ex Goldman Sachs employees while Swapnil inherits business acumen. It is one amongst very few startups worldwide which has reached break-even in just three months of operation.

The company wants to collaborate with Finance and Technology to go in line with the Digital India program. The company wants to make the digital lending process accessible and easy to every salaried individual and bridge the gaps in the financial sector by employing state-of-the-art technology to make credit lending a seamless and quick process.

They want to provide financial aid to the underserved population who mostly don’t have access to easy loans because of their lack of credibility.

How to get an instant loan through Mudrakwik?

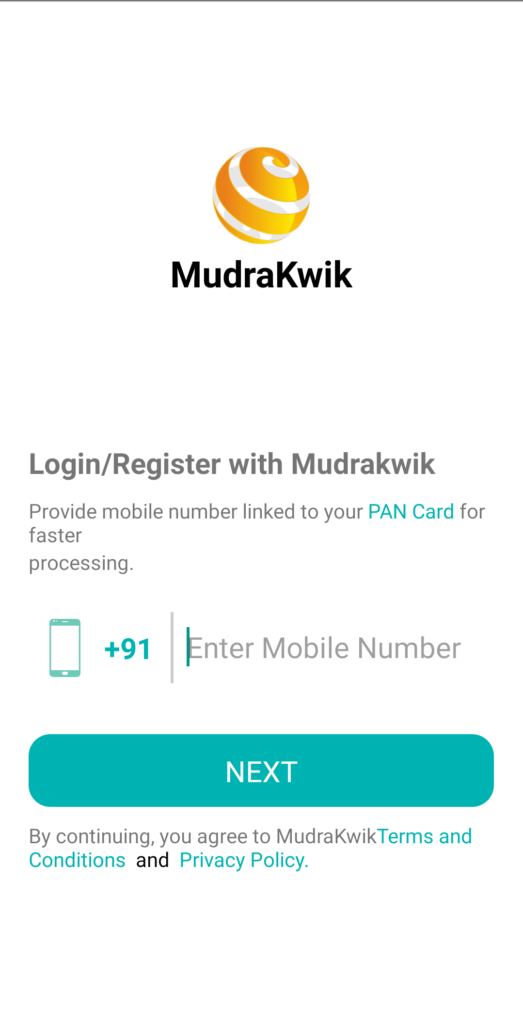

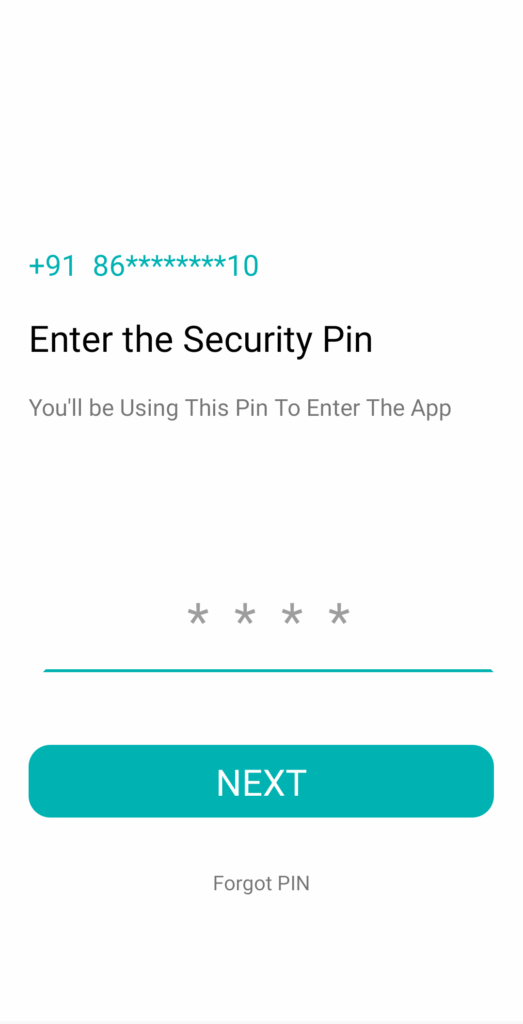

The loan facility is only available through the Mudrakwik app. You can download the app from Playstore or App Store. You can login/register to the app by providing your mobile number. Once the number is verified, you need to set up a PIN.

You can then choose your preferred language – Hindi or English.

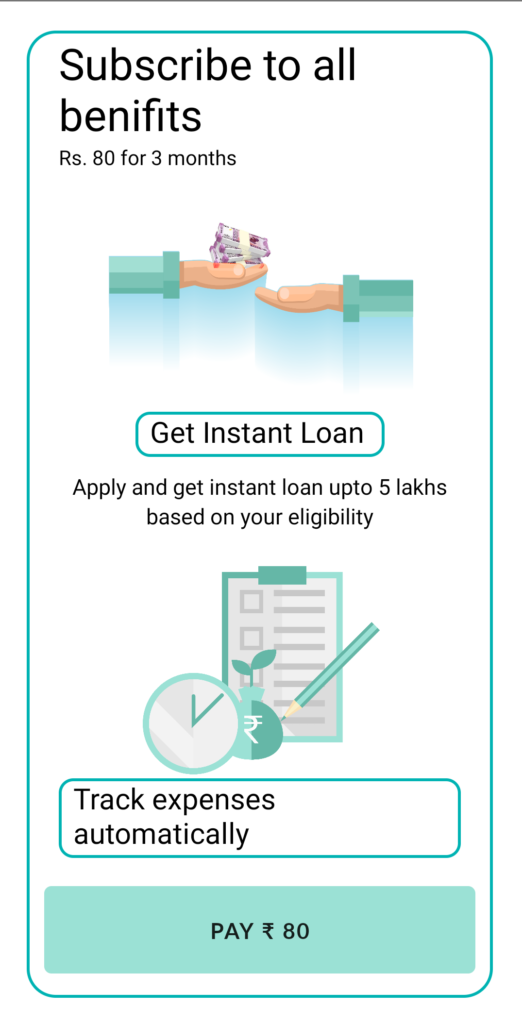

The app then prompts you to pay Rs 80 to ‘Subscribe to all benefits’ for a period of 3 months. With this subscription, you get instant loan up to Rs 5 lakhs, track your expenses and become a business associate for Mudrakwik.

Once you subscribe by making payment of Rs 80, you get on the user dashboard which lets you upload a few basic documents for your eligibility check. Once the document is uploaded, you can apply for a loan.

What are the documents required to apply for a loan through Mudrakwik?

You will need to upload below documents before you can apply for a loan:

- Aadhar Card

- PAN Card

- Company ID

- Latest Salary Slip

What are the features of Mudrakwik?

Automated approvals – The app provides quick and automated approvals with no human intervention.

No Paperwork – To get credit in your account against the loan, you don’t need to do any paperwork.

24*7 Disbursal – App uses Artificial Intelligence and Machine Learning technologies which have fully automated the process and help disburse loans at any hour of the day and even on holidays.

Improve your credit score – Once you apply for a loan on Mudrakwik, your credit score will improve.

BNPL feature – Other than getting the cash loan you can also avail BNPL facility – Buy Now, Pay Later.

Instant credit – Once you apply for a loan and it is approved, you get the loan amount into your bank account within five minutes.

What are the different products offered by Mudrakwik Fintech Pvt Ltd?

LoanMart – is an aggregator app that lets users compare and choose from an array of options from different credit lending portals.

CreditKart – is India’s first Fin-Com that provide ‘Buy Now Pay Later’ facility to its customers. You will see a range of affordable products from Rs. 10 to Rs. 10000. It is created to provide access to quality products across the country, CreditKart gives the users seamless shopping experience.

Mudrakwik – is the instant loan app which offers loan at minimum interest rates with no collateral.

What is basic eligibility to get a loan on Mudrakwik?

If you satisfy the below criteria, you can get a loan from Mudrakwik:

- you should be an Indian resident

- your age should be above 18 and below 45 years

- you should have regular monthly income

- you should be a salaried person, business owners are not eligible

Processing your loan

Loan Amount: You can apply for a loan for as little as Rs 1,000 and up to 5,00,000.

Tenure: The minimum duration for which you can apply a loan is 90 days while the longest tenure is 500 days.

Interest rate: The interest rate varies from case to case and depends on the loan tenure and customer’s risk profile. The maximum interest rate the company charge is 34.6 % per annum. For example, if you apply for a loan amount of Rs 50,000, the interest rate will be 30% per annum with the tenure of 90 days. After deducting the processing fee, the interest payable is as follows: Interest = ₹ 50,000 * 30% / 365 * 90 = ₹ 3699.

Processing Fee: You will have to pay a processing fee with every loan request. It varies according to the loan amount and tenure. It varies from 2% to 4.3%. For example, for Rs 1000 loan processing fee is Rs.42.38 + GST.

What is the Equated Daily Installments (EDI) facility?

Mudrakwik offers the EDI facility where user’s credit score applies as they repay a part of their loan on a daily basis. For example, if you want to apply for a loan and you have an insufficient credit score, you can still apply for the minimum amount of Rs.1,000. You will receive Rs.900 from Mudrakwik after deducting the processing fee and other applicable charges. All you have to do is pay an amount of say Rs 50 for 20 days which will clear your loan. You will be eligible for the next maximum loan amount when the previous loan amount is cleared. You can continue availing the loan and paying back the amount in time. This will improve your credit score and also eventually make you eligible to apply for a maximum loan amount of Rs.5 lakh from Mudrakwik.

Why you should use Mudrakwik for loans?

- the app has a very innovative interface which is also very user friendly

- you get the loan instantly without paperwork

- you can get a small loan without a good CIBIL score.

Is Mudrakwik genuine?

Though the amount app charges as a subscription fee is minimal, they ask the money upfront without letting users check the platform. The app says, that once subscribed, the loan disbursal will be faster, a lot of customers have complained that even after paying and meeting all eligibility criteria, the loan was not disbursed and no reason was provided. A lot of customers have also complained that even though they have paid subscription fees, they are not able to access the complete app, the app again asks them for payment.

This is one side of the story, on the other side, they have a lot of happy customers. The app is still in its early days and hopefully, in the coming months, they will improve the app and remove all the bugs.