NIRA: Instant Personal loan without CIBIL & Documents

- 20 July 2020 | 5616 Views | By Abhinav Mishra

What will you do if you need extra money in a particular month? It could be for personal reasons like getting a new phone or a service or a business need. In such situations, the best way to get money is to apply for personal loan.

If you decide to take a loan because you need money, you will find hundreds of platforms offering loans. However, the most important thing to consider while applying for a loan is the ease of receiving credit since you need the money urgently.

One platform you can consider for personal loans is NIRA. NIRA is a personal loan lending app created by professionals with years of experience in the financial domain. The distinguishing feature of NIRA is that it provides loans to its users without seeing the credit score. The platform provides personal loans in the form of a credit limit which can be extended up to Rs 1 lakh. The basic criterion to qualify for a loan is you have to be a salaried person.

What is the NIRA team?

NIRA was founded by Rohit Sen who is the CEO and Nupur Gupta. Rohit has 12 years of experience in finance as a trader and has worked at Bank of America, Merrill Lynch, and Goldman Sachs. He holds degrees from Oxford University and the London School of Economics.

Nupur has 5.5 years of experience in finance as a quantitative analyst and structurer. She has worked at Goldman Sachs and Citigroup. She holds a degree from IIT Delhi and the University Of Waterloo, Canada.

NIRA team is committed to

- Transparency

- Simplicity

- Flexibility

- Service

How can I get a loan instantly in India?

Most people are looking for a loan instantly to meet their urgent needs. NIRA dreams of a world where everyone has access to frictionless, fast finance at a rate that is fair. Below are some advantages of taking a loan from NIRA:

Instant decision after a 3-minute application – The platform ensures, the user gets the loan instantly and with 0% paperwork.

Low-Interest Rates – Compared to traditional banks and financial institutions, NIRA charges you between 1.50% and 2.25% per month. The higher your credit score, the lower your interest rate. The rate also depends on the type of loan you are taking. The added advantage is that if you repay your loan on time, you can experience a decreased interest rate.

Support – Just like the loan application, the loan disbursal is very fast. To check your eligibility for a loan, all it takes is 3 seconds.

Repayment plan – You can choose loan tenure between 3 to 12 months, which means you can easily switch to different repayment plans with a few taps on your phone.

No collaterals – Unlike banks, you don’t have to provide collaterals to get the loan which is both time saving and easy.

How can I get a small loan with bad credit?

Even if you don’t have a CIBIL score you are still eligible for Cash Loans. NIRA also provides loans to people who are new to credit. If you have a CIBIL score, your request can be processed with a score of 681 or above.

What is NIRA finance?

NIRA finance gives you a personal loan through their partnership with Federal Bank, a leading bank in India. Federal bank is fully regulated by the Reserve Bank of India.

What is the easiest loan to get?

NIRA offers 4 different types of loans to its users:

Instant Cash Loans – You are planning for a surprise vacation with your loved ones or expensive jewelry for them but you don’t have enough money in your account? For such scenarios, Instant Cash Loan is your dealmaker. Banks usually don’t provide loans in 24-48 hours and in most cases take up to a week to process the request. Secondly, the interest rate is as high as 3-4% per month and you may need to provide collateral in the form of gold jewelry which most of you won’t like to do. NIRA finance gets you a cash loan of Rs 5000 to 1 lakh in only 3 minutes.

The tenure of instant small cash loan is 3 months to 12 months, unlike other providers that offer tenure period of only 90 days at maximum for a small loan amount.

Personal Loan – You need a personal loan for your personal use like buying a new mobile phone, or home improvements or for some courses or some medical emergencies. A personal loan gives you the flexibility to make a big purchase and pay it off in the coming months as per your comfort.

Can I get a loan of 1 lakh?

NIRA offers a personal loan starting from Rs. 10,000 up to Rs. 1 Lakh.

Eligibility Criteria – A citizen of India between 21 to 65 years of age having college degrees and working for a minimum of 6 months earning Rs 20000 or above are eligible for NIRA Personal Loan.

There are three fees that NIRA charges to its customers:

Processing fees – A flat amount of Rs 500 is charged for the first loan, the subsequent loan will come at reduced processing fees.

Prepayment fee – NIRA charges 2.5% if prepayment is before 90 days and 0% after 90 days.

Late payment fees – It is as below:

Late by up to 30 Days : 3% pm of EMI

Late by 30-59 Days : 3% pm of EMI + 2% of Outstanding Balance

Late by 60-89 Days : 3% pm of EMI + 4% of Outstanding Balance

Late by more than 90 Days : 3% pm of EMI + 5% of Outstanding Balance

Mobile Loan – You need to upgrade your phone every second year and the one you want could be over your budget. Who wants to save for months for a smartphone? The best thing to do is available NIRA Mobile loan. The phone amount gets credited in your savings account which you can pay in small EMIs. You can also get the advantage of cashback and discounts from their online vendor partners like Paytm and Amazon. The eligibility criteria are the same as Personal loan.

Small Personal loans – If you looking for money to invest in a hobby or planning to take up new vocational training, NIRA’s small loan is something you need to check. It helps you manage small chunks of expenses without paying high interest on a large principal sum over multiple years. The eligibility criteria are the same as Personal loan.

Which app gives loan immediately?

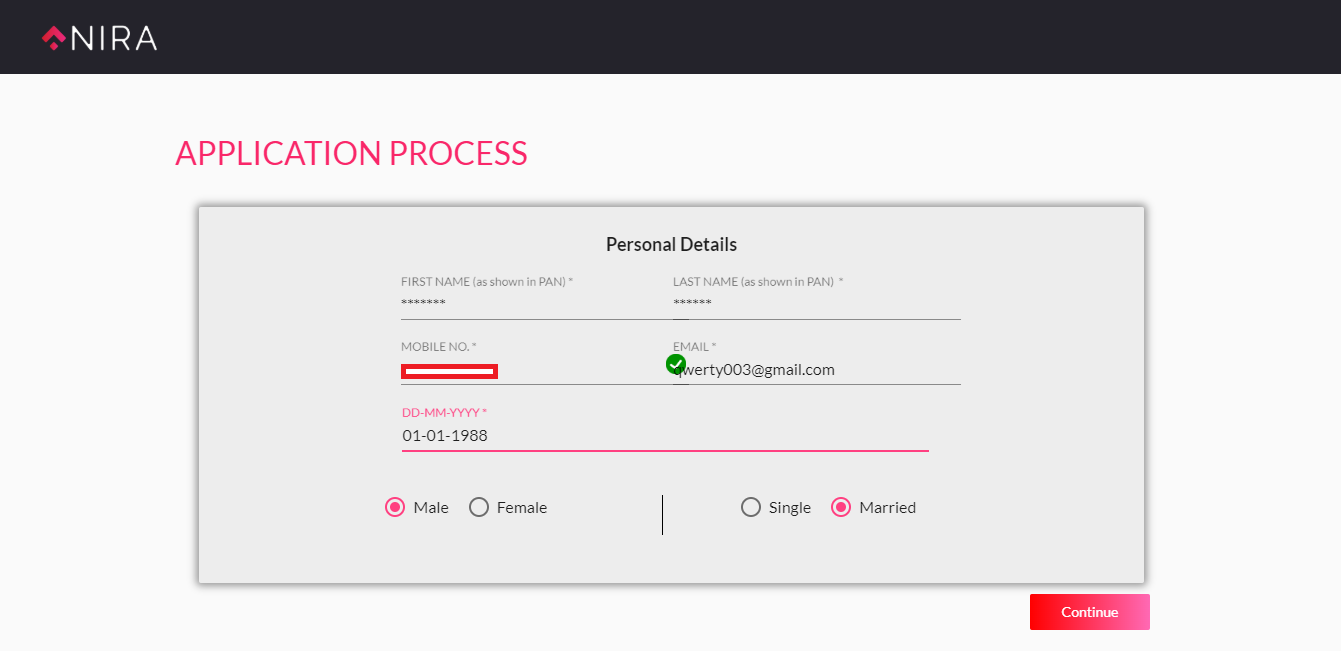

NIRA provides you loan immediately, below are the steps to apply for the loan:

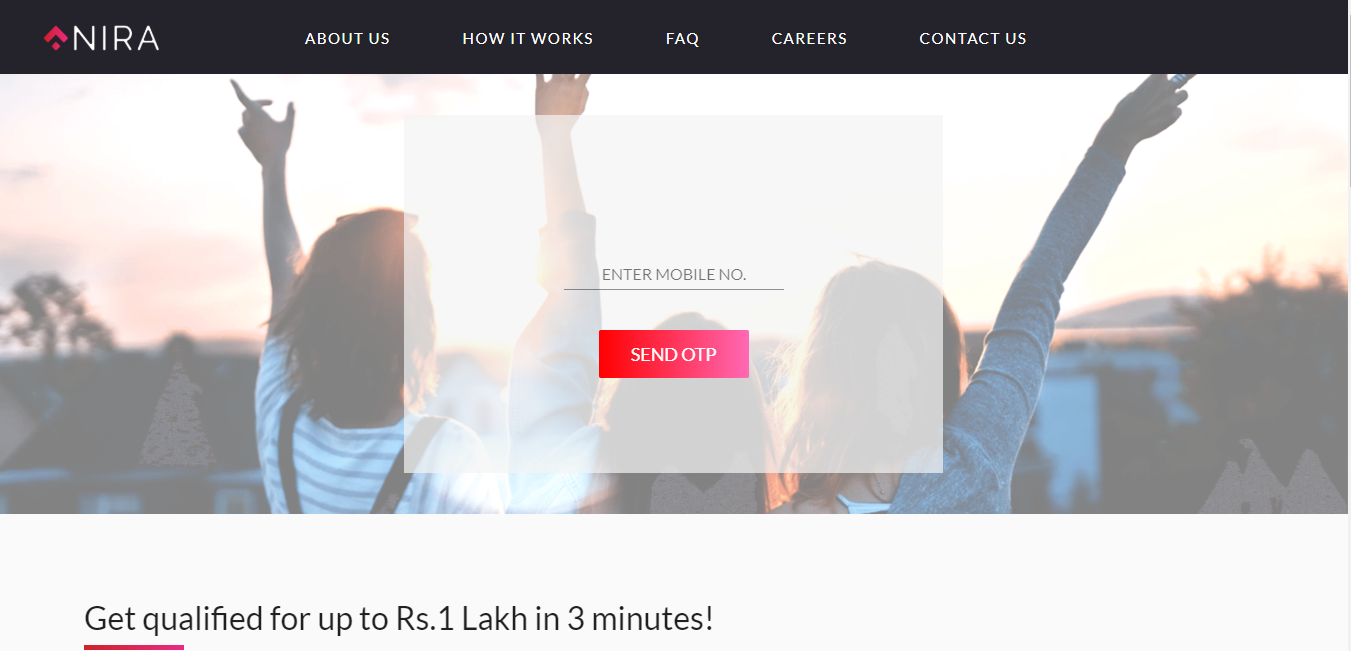

Download the app from the Playstore or apply online.

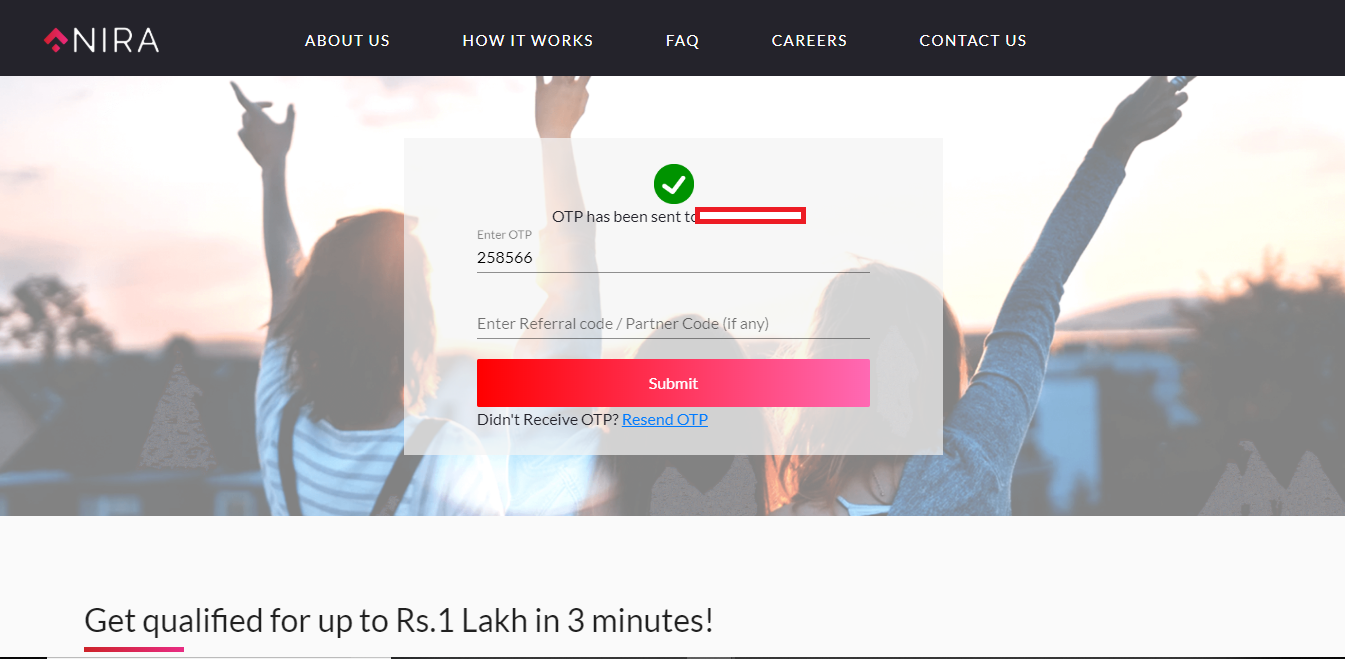

Verify your mobile number using OTP.

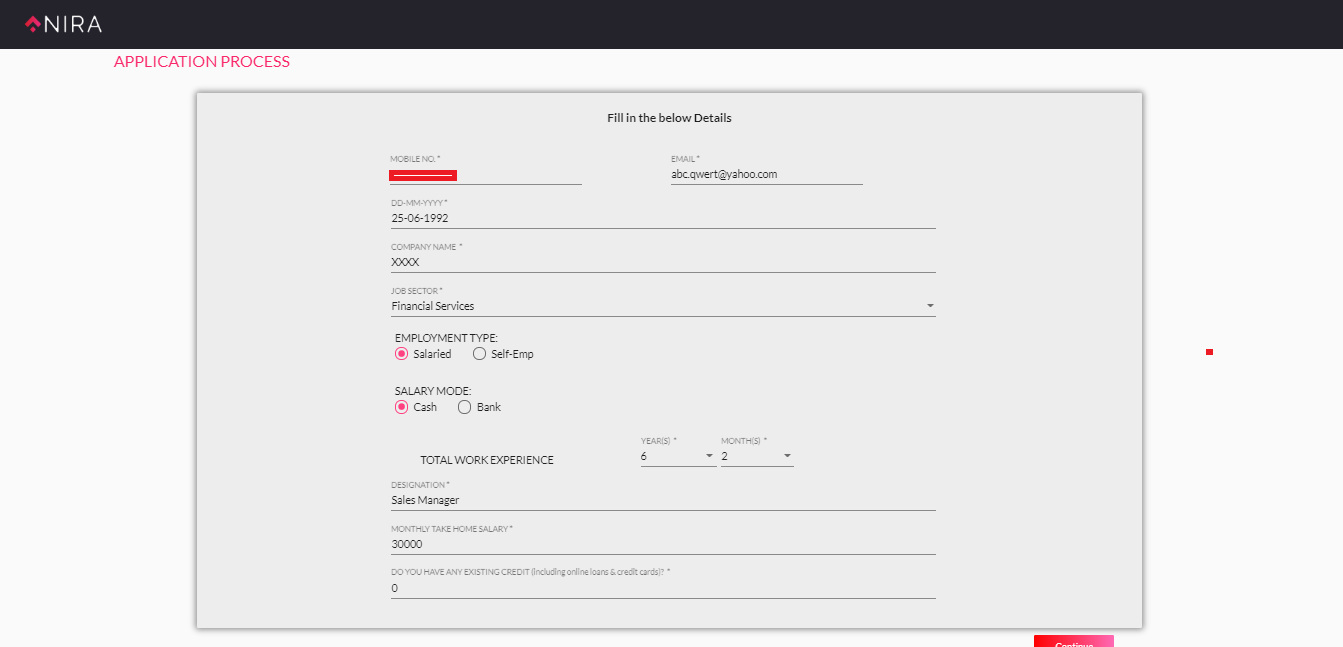

Provide your personal and financial details like email, company name, salary, years of experience, etc.

If you are not eligible, the possible reasons for rejection are provided.

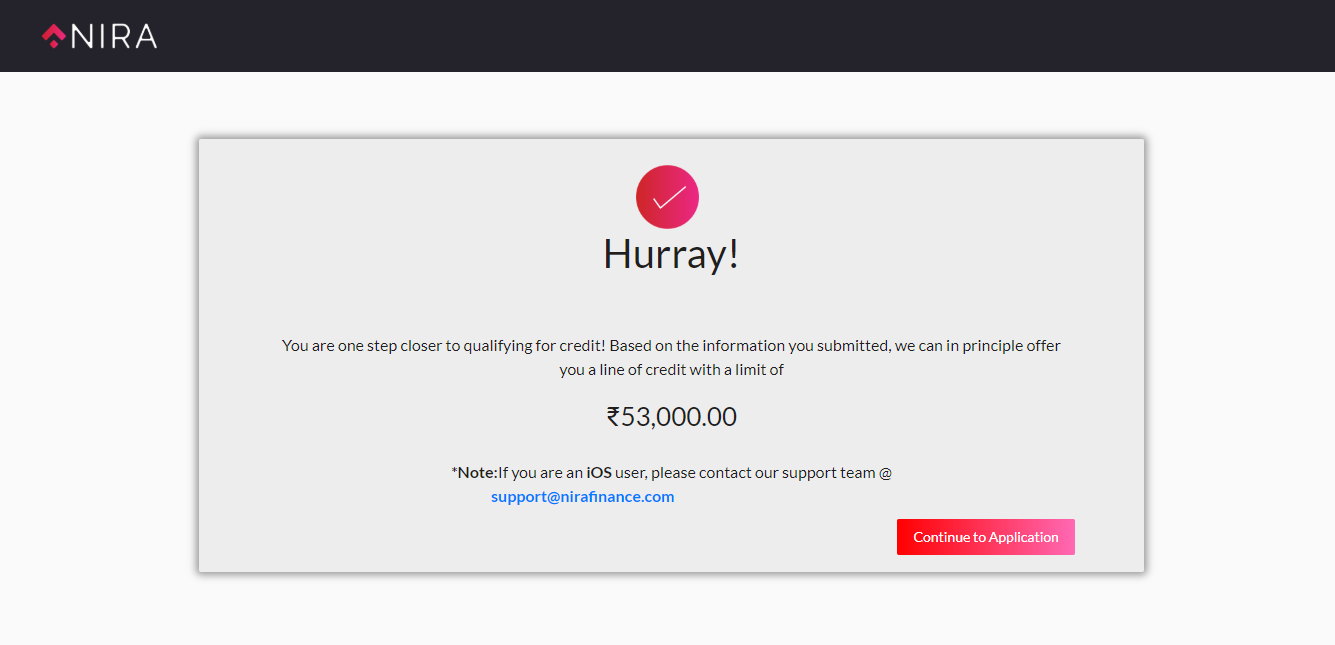

In case, you are eligible, based on the information provided, a credit limit is provided to you along with the interest rate per month.

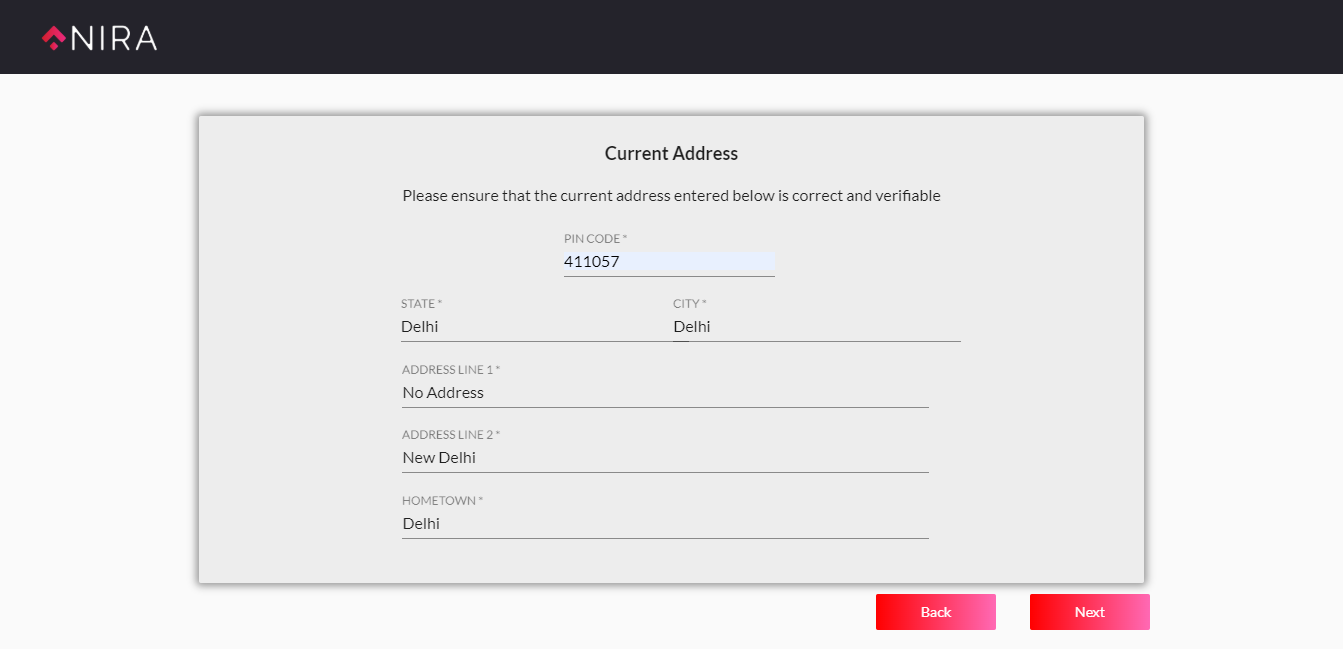

If you are good with the credit limit and the interest rate you need to complete your application form by providing your address, working status, and send for review.

Below are the documents required for NIRA personal loan:

- Aadhaar Card

- Identity and address proof

- PAN Card

- Recent salary slips of 6 months

- 6 months bank statement of the bank account

Once the documents are verified, you will have the approval to access the line of credit.

You need to set up an auto-debit mandate by signing the mandate digitally.

The loan will be disbursed into your bank in no time.

Some of the cons of applying for a loan from NIRA are:

- The processing fee is on the higher side, they charge you between Rs 250 to Rs 500 as a flat processing fee. If you are looking for a small loan of Rs 10000 then you will end up paying 2.5% as processing fee even with minimum fees on offer.

- You not eligible for a loan if you don’t receive a salary in your bank account. Even if you are earning more than Rs 20000 per month, the salary has to be in the bank and not in cash.

- The repayment percentage before 3 months is on the higher side. It could have been a little better.

- Auto debit bounce is on the higher side. Rs 500 will be charged for an auto-debit bounce from your bank apart from Rs 100 being the partner charges.