International Investment Oriented Mutual Funds

- 1 July 2020 | 1228 Views | By Mint2Save

An intelligent investor is one who is constantly looking for diversification opportunities in their portfolio. A good way to minimize the investment risks is to spread funds across different asset classes, and to diversify each asset class. Many investors want to traverse geographical country boundaries and invest internationally. International mutual funds offer investors with such opportunities.

Can I invest in foreign mutual funds from India?

As the name suggests, these are the funds that invest in companies in foreign countries. These are also known as Foreign Funds or Overseas funds. Over the past few years, the awareness of investment opportunities has increased around the globe and investors want to explore different markets and tap their earning potential. As a result of the growing interest of investors in International funds, many fund houses have launched International funds with different portfolio structures and compositions.

The fund manager of an international mutual fund creates a scheme focused on certain risk classes, sectors, market types, market capitalizations, etc. Investors can choose to invest in equity or debt or both based on the investment objective of the scheme.

Should I invest in International Mutual Funds?

- The major advantage is diversification of a portfolio where an investor gets access to a range of financial instruments issued in the market worldwide. Investor’s portfolio is no longer driven only by the domestic market.

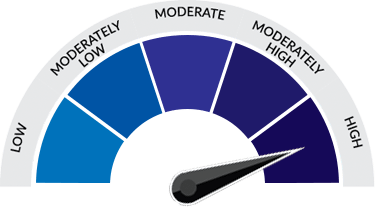

Riskometer for International Mutual Funds:

Riskometer for International Mutual Funds:

- International funds predominantly invest in economies from various countries and give the opportunity to capitalize on investment during different economic cycles. This effectively mitigates market risk and ensures minimal loss during critical market movements.

- You may want to invest in a few international stocks or in a certain economy. However, this is not advisable for an amateur investor. It is very difficult to judge the market sentiment of a foreign country due to a lack of credible sources and technical knowledge. International funds are managed by financial experts which increases the chance of good returns.

- When the Indian markets are in bad shape, at least some of investor’s investment is gaining value. Learn about Why do Investors Lose Money In Mutual Funds?

Types of International Funds

Global Funds – Many people think international funds and global funds are the same but they are not. Global funds invest in securities all around the world which may also include investor’s own country while International Funds invest in securities around the world except for the country in which the investor resides.

Regional Funds – These funds invest in companies from a specific geographical region anywhere in the world.

Country Funds – These invest in securities belonging only to one foreign country. This allows investors to benefit from a specific country’s economy.

Global Sector Funds – This type of funds focus on companies belonging to a specific sector in countries around the globe. The primary focus of these funds is to gain exposure in a particular sector.

What is the best International Mutual Fund?

OR

Which mutual funds give the highest return?

Franklin India Feeder – Franklin US Opportunities Fund

This fund was launched on 6 February 2012 and is a high-risk fund. The scheme operates as a fund-of-fund and has invested 99.60% of its assets in the Franklin US Opportunities Fund and the remaining 0.4% in cash and debt instruments. The Franklin US Opportunities Fund invests a majority of its assets in equity securities of US companies which demonstrates growth at higher levels than the overall US economy. This fund is suitable for investors who have a long term investment horizon and looking for overseas diversification of assets. The minimum investment in this fund is Rs 5000, the fund size is Rs 1514.88 crores and the Expense Ratio is 1.48%. The fund is managed by Pyari Menon.

Equity Sector Allocation

| Sector | Percentage Allocation |

| Sector Value Technology | 26.11% |

| Financial Services | 16.7% |

| Health Care | 15.42% |

| Consumer Cyclical | 11.35% |

| Communication Services | 7.4% |

| Real Estate | 7.31% |

| Industrials | 7.29% |

| Consumer Defensive | 3.09% |

| Basic Materials | 0.6%. |

Returns

- 1-year Returns – 23.40%

- 3 years Returns – 20.22%

- 5 years Returns – 13.65%

ICICI Prudential US Bluechip Equity Fund

This falls under Global fund category and the investment objective of ICICI Prudential US Bluechip Equity Fund is to provide long term capital appreciation to investors by primarily investing in equity and equity-related securities (including ADRs/GDRs issued by foreign and Indian companies) of companies listed on NASDAQ and/or New York Stock Exchange. The fund was launched on 6 July 2012. It is a high-risk fund. The fund allocated 96.13% in equity and 4.35% in cash. The fund has money allocated in companies like Amazon, Treps, ServiceNow Inc, Pfizer, etc. The minimum investment for this fund is Rs 5000, the fund size is Rs 587.22 crores and the Expense Ratio is 2.83%. The fund managers are Rohan Maru and Priyanka Khandelwal.

Equity Sector Allocation

| Sector | Percentage Allocation |

| Health Care | 18.23% |

| Industrials | 16.13% |

| Financial Services | 15.58% |

| Technology | 15.57% |

| Consumer Defensive | 11.32% |

| Consumer Cyclical | 10.19% |

| Communication Services | 5.16% |

| Basic Materials | 2.55% |

| Energy | 1.41%. |

Returns

- 1 Year – 15.1%

- 3 Year – 15.1%

- 5 Year – 11.2%.

DSP World Gold Fund

The main objective of this fund is to seek capital appreciation by investing in units of MLIID – WGF. The fund also invests a certain portion of its corpus in money market securities and units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. This fund was launched on 14 September 2007 and falls in the high-risk category. The fund allocates 95.76% in equity, 2.94% in cash, 0.02% in debt, and the remaining 1.28% in others. The majority of investments are in BGF World Gold I2. The fund manager is Jay Kothari.

Returns

- 1 Year 80.4%

- 3 Year 15.2%

- 5 Year 12.9%.

DSP World Mining Fund

The primary objective of this fund is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Mining Fund. The fund may also invest in the units of other similar overseas mutual funds which may constitute a significant part of its corpus. The fund invests 91.44% in equity, 6.53% in cash, 0.07% in Debt, and remaining elsewhere. The minimum investment in this fund is Rs 1000, the fund size is Rs 465 crores and the Expense Ratio is 1.67%. The fund was launched on 29 December 2009 and is managed by Jay Kothari.

Equity allocation is mainly in the basic materials sector, it constitutes 89.99%. While Financial Services is 2.02% of total equity investment and the industrial sector has 1.43% of total equity allocation.

Fund Returns

- 1 Year – 24.1%

- 3 Year – 20.5%

- 5 Year – 13.3%

Edelweiss Greater China Equity Off-shore Fund

The Scheme is created to provide long term capital appreciation by investing in JPMorgan Funds – JF Greater China Equity Fund, an equity fund that invests primarily in a diversified portfolio of companies incorporated in the Greater China region. It also invests in companies that have their registered office located in, or derive the predominant part of their economic activity from, a country in the Greater China region. The minimum investment in this fund is Rs 1000, the fund size is Rs 193 crores and the Expense Ratio is 1.39%. The fund was started on 1 January 2013 and is managed by Hardik Verma. The fund mainly invests in the financial sector (97.21%).

Fund Returns

- 1 Year – 40.1%

- 3 Year – 9.93%

- 5 Year – 18.1%

Nippon India US Equity Opportunities Fund

The primary objective of this fund is to provide long term capital appreciation to investors by investing in equity and equity-related securities listed in recognized stock exchanges in the US. Also, the fund focuses to generate consistent returns by investing in money and debt market securities in India. The minimum investment required in this fund is Rs 1000, the fund size is Rs 121 crores and the Expense Ratio is 2.65%. The fund was launched on 23 July 2015 and is managed by Anju Chhajer and Kinjal Desai. The fund has invested in some big names like in Microsoft Corp, Amazon.com, Facebook Inc, Mastercard Inc, etc.

Sectorwise allocation is as below:

| Sector | Percentage Allocation |

| Consumer Cyclical | 23.74% |

| Health Care | 23.63% |

| Communication Services | 17.52% |

| Financial Services | 13.99% |

| Technology | 11.95% |

| Energy | 4.45%. |

Fund returns

- 1 Year 15.5%

- 3 Year 16.7%

Factors investor should consider before investing in International Mutual Funds

Risks – These are high-risk funds, one major risk is currency risk. If you invest in a US-centric fund and the value of rupee falls against the dollar then the NAV increases, the reason being you have to give more rupees for each dollar.

Macroeconomic factors – The political situation of a country or its social or economic aspects can have a huge impact on the performance of the fund. Investors must understand these factors and keep a close eye on the market.

Tax – International mutual funds invest majorly in equity and equity-related instruments of international companies. For tax purposes, these funds are treated as debt funds. Therefore, the rules for STCG and LTCG for debt funds apply to these funds too.

Why should I invest in International Funds?

Investing in these funds adds diversification to the investment portfolio and helps generate smoother returns. Investors seeking an international flavor in their investment portfolio, having a moderately-high risk tolerance, and a long investment horizon should consider investing in foreign mutual funds. SIP can be a good mode of investment in these international mutual funds. Learn about its main benefit of averaging: What is Rupee Cost Averaging?