Why do Investors Lose Money In Mutual Funds?

- 4 March 2018 | 1586 Views | By Mint2Save

Mutual funds have orchestrated themselves as one of the high yielding investment avenues in the recent times. Thanks to the evolution in the global economic scenario, increasing understanding of savings and managing financials and advent of investment vehicles, we are witnessing an era of towering returns over savings and accelerated investments of money in mutual funds.

Whenever it has come to creating wealth via investments, the ground rule has always been the same: Stay Invested for long and be calm. Be it gold, be it real estate, or good ol’ stocks, a patient and calm investor has reaped way better results than an impatient money seeker. Mutual funds are no different at all. Though there are categories like liquid mutual funds which are specifically for short term investments, there is no real wealth creation in them.

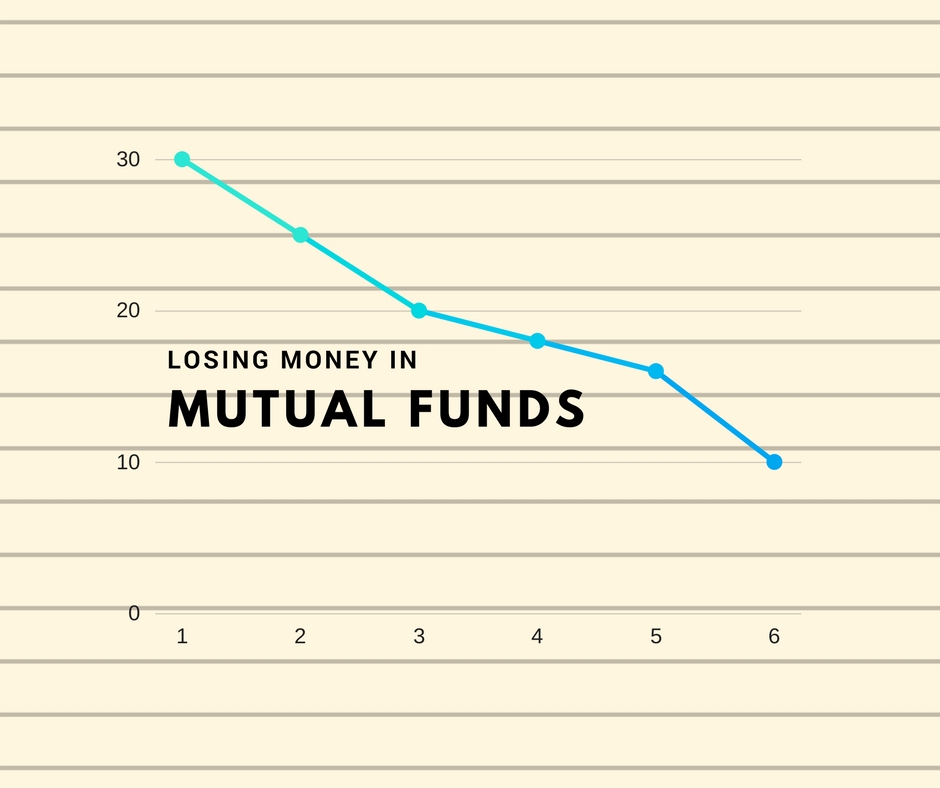

However, even though equipped with multiple types, investment models, and plethora of products, mutual funds have not always been a return generator. If you go researching, you might witness some investors, who indeed have lost money when they invested into mutual funds. In this article, we will explore the various reasons that have made people lose money in mutual funds.

Reason 1: Impatient when investing:

From Warren Buffet to Porinju, no investment guru has ever denied the utter requirement of patience when when investing. Still, many people fail to understand its relevance. Volatility in the markets is primarily caused by frequent trading and increased volatility is a result of investors being impatient. While debt oriented mutual funds do not affect the impatient investor (in terms of returns), it is the equity mutual funds, whose returns can go negative when the investor turns negative.

One of the reason for the investor to go impatient, apart from the need of money, is the fear of losing money when markets tumble down for a series of days. This concern is increased when the investor is new or is highly observant of the portfolio or the returns of his mutual fund. Equity oriented mutual funds are not recommended to anyone seeking less than 3 year tenure of investing, as only then the returns seem to be benchmark returns.

Investment Strategies to Calm Down the Impatient Investor

Being an investor centralized instrument, mutual funds to bring a lot of commendable strategies that reap the best returns, even for the impatient investor. These include:

- SIP: Investment a fixed pie of funds regularly to protect from volatile market conditions.

- SWP: Taking out a fixed sum of funds from the mutual fund to the bank account of the investor.

- STP: Transferring funds across one mutual fund to another.

Systematic investment plan or SIP has been a popular option among new age investors. While lum sum investing can fluctuate more when it comes to returns, SIP’s averaging technique shields from the frequent ups and downs of the market.

Reason 2: Lack of Research While Investing

Thanks to the massive media outreach, everyone can now be an expert at almost everything. Is it good? Sure!! Can it be tested while handling money matters? Not recommended. Lack of research and non understood popular opinions which are derived from social media or random news channels, can indeed, hamper your hard earned savings.

Mis-selling of a mutual fund is also a type of consequence of lack of research. A major role is played by commission oriented banks and agents, who tend to canvas those products which are not designed for the specific goals that the investor wants to meet.

There have been reports of multiple instances, where equity mutual funds have been sold to those customers who seek Fixed Deposits and Recurring Deposits. This has led to ruin of capital and also reduced the trust in bankers.

Reason 3: Going with Bubble Performers

This reason is slowly becoming the major reason that people are losing money in mutual funds. If you observe any market that has been embraced by the customers, who will find a surprise increase in the number of companies which offer that product.

When the world of smartphones went high on sales, a new company popped every other day which promised to offer a better smartphone than the one you currently one. Were all these companies targeting the same consumer: Us? Yes. Did all these companies made good phones? No.

Barring a handful, no other company has even survived the massive competition or have their phones passing the test of time. The initial friendly response they got from the market, was certainly wiped out by below par performances of the phones and non customer friendly after sales services.

This analogy exactly fits a lot of mutual fund companies too. Mutual funds investments have reached a multi billion mark and is increasing consistently. Looking at the great opportunity, it becomes obvious that new mutual fund companies have popped up eyeing a hefty share from the rich pie.

Bubble performers can be regarded as those who have performed phenomenally well in the past 6 months to 12 months, but have far inferior performance when a relatively tenure is put into picture. Now there can be three reasons that a bubble performer can be attributed to:

- Stock markets going on a high ride: In this situation, almost every mutual fund tends to get better half of its return. Hence, it is no different that the bubble performer is giving good returns too. But as it has always been, the high would not continue for long, the climb will slip downwards too. When a bubble performer falls, the returns crash down dramatically.

- The fund managers have been replaced: When the fund managers are replaced, it becomes imperative for the new managers to reap better returns than what the previous ones did. However, one should do research on the new fund managers and find out how successful they have been previously.

- Change in Strategy: It is not easy to track a change in strategy of a mutual fund, until there is a public release of the same. However, when the results become obvious, the change can be analysed and understood using the mutual fund investment instrument.

Mutual funds, especially equity oriented, command patience as a primary requirement. Guided by an able mutual fund adviser and good research, returns can blow the roof out. However, risk has to be accepted not as something to be afraid of, but as a measurable tool.