Fund of Funds : Is it Worth to Invest in ?

- 2 April 2021 | 1112 Views | By Abhinav Mishra

Gaining a lot of popularity lately due to out-of-the-box and non-traditional investing techniques, Fund of Funds might be the next avenue for the masses. Tracking indices, gold, international equities, etc., this relatively new breed has gained a lot of attention lately.

A regular mutual fund collects money from investors and invests the collected money in stocks or debts based on the type of mutual fund it is. In this article, we are going to talk about a different type of fund which does not directly invest your money in stocks or debts but invests in other mutual funds.

What do you mean by a Fund of Funds?

Fund of Funds (FoF) also known as the multi-manager fund invests in other mutual funds or hedge funds and these funds can be within the same fund house or different fund house. When you invest in FoF, you are not directly investing in bonds, stocks, and other types of securities.

Why is the purpose of Fund of Funds?

You must be wondering, why a fund house invests in other mutual funds or in mutual funds of other houses. There is no rocket science to it – the answer is simple. When a fund manager is already aware of mutual fund schemes that have delivered good returns consistently, what is the point of putting efforts into creating a new fund that invests in similar stocks.

Secondly, you know diversification is important. So if you plan to invest in mutual funds or elsewhere, you will probably invest in large caps, mid and caps, government securities, gold, etc. By the time you realize, you would have already invested in 10 different places/funds. Managing all the funds is not an easy task since you will have to track them separately. To overcome this problem, you can invest your money in multi-management or FoF.

What is a fund of funds with an example?

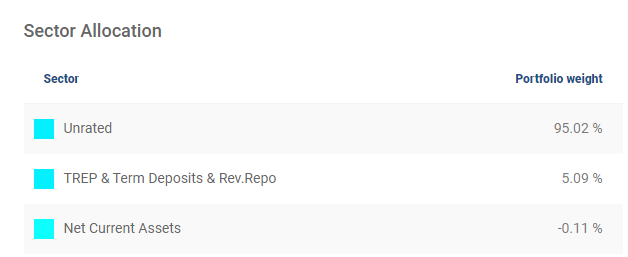

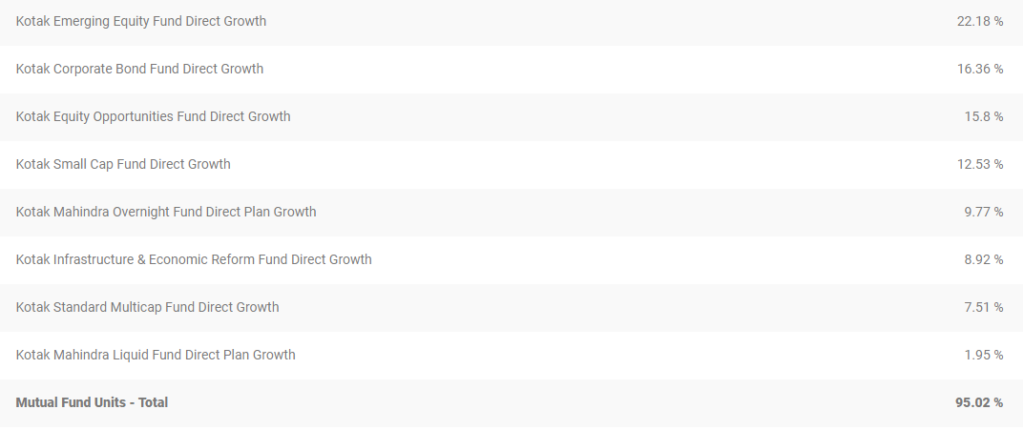

Now you know, what is FoF and its purpose, let us understand it better through an example. We will take the example of Kotak Asset Allocator Fund. If you see this fund, you will notice it has invested 95.02% in different mutual funds and 5.09% in TREP & Term Deposits & Rev. Repo.

If you check different mutual funds in which it has invested, you will notice all of them are from Kotak only. Also, you will notice the fund has covered different categories of investment reducing your risk – emerging funds, small caps, multi-cap, liquid funds, etc. So if you were planning to invest in all these categories a better option is to invest in this single Fund of Funds.

What are the different types of funds?

Different types of FoF are as below:

Asset allocation funds – These funds comprise a pool of assets – equity, metals, and a debt instrument, etc. This kind of fund comes with less risk and high returns.

Multi-manager fund of funds – The most common and popular type of FoF is multi-manager. This fund comprises various professionally managed Mutual Funds, all of which have a different portfolio concentration.

Gold funds – These invest in different mutual funds which are trading in gold securities and they also invest in gold trading companies.

International fund of funds – If you want to invest in mutual funds from a different country, then this option is great for you. Since this FoF invests in a number of international funds, the potential returns are higher and risk is reduced. These foreign funds hold foreign stocks so you as an Indian investor get exposure to foreign stocks such as Alphabet (Google), Microsoft, Apple, General Motors, etc.

ETF fund of funds – Exchange-traded funds are becoming popular with time. To invest in ETF directly, you need a Demat account but if you invest in ETF FoF there is no such requirement.

What are the Features of Fund of Funds?

Diversification – The primary reason why the fund of funds was started was to provide diversity to the investors. If you look closely, these funds offer two-layer of diversity. First, you get an allocation in different mutual fund schemes, and secondly, the different mutual funds in return invest in equity and debt securities. It is important for you to know, over-diversification sometimes reduces your potential gain.

Risk Exposure – Since the gain is reduced so does the risk. Allocation to different asset classes lowers down your risk from a specific asset class like market risk from equity investment or interest rate and credit risk from debt investment. If you are an investor with a moderate risk appetite, these funds are worth exploring.

Expense ratio – These funds have a higher expense ratio owing to investment in multiple mutual funds which have their individual expense ratio. Before you chose the fund of funds for investment, you should consider this parameter of the fund.

How is taxation done for fund of funds?

One reason why these funds have not become popular is because of their taxation mechanism. In equity-based mutual funds, the long-term capital gains are not taxed but in the case of FoF, even if the fund invests in equity mutual funds, it falls in the category of debt mutual funds. In this category, if you withdraw your investment before 3 years, Short Term Capital Gains are added to your taxable income and taxed as per your income tax slab. The Long Term Capital Gains are taxed at 20% with the benefits of indexation.

You should know that the dividend received on the investment is not taxable, as the burden is borne by the issuing fund house.

What are the funds of hedge funds?

A fund of hedge funds is an investment option in which the investor’s portfolio consists of shares in a number of hedge funds. Just like fund of funds invests in different mutual funds, funds of hedge funds follow the same strategy by constructing a portfolio of other hedge funds. A fund of hedge funds may invest only in hedge funds using a particular management strategy or it may invest in hedge funds using many different strategies in an attempt to gain exposure to all of them. Since you know to invest in most hedge funds there is a high initial minimum investment, through fund of hedge funds you can invest in all top hedge funds through the same investment amount.

What is a fund of funds for startups?

To boost the Indian startup ecosystem, the Government of India (GoI) created access to a large capital of funds for startups, through the scheme “Fund of Funds for Startups” so that more people create jobs in the country than seek a job. The scheme allows the startups to be registered with the Department of Promotion of Industry and Internal Trade (DPIIT) for tax benefits, IPR fast-tracking, easier compliance, and self-certification on labor laws.

What are the top 3 Fund of Funds in India?

If you are looking for the best fund of funds in India, here are the top three which have shown consistent performance:

DSP US Flexible Equity – Invest in international mutual funds

- 1-year returns – 17.15%

- 3-year returns – 13.82%

- 5-year returns – 12.40%

Quantum Equity FoF – invests in the equity market

- 1-year returns – 15.67%

- 3 year returns – 9.04%

- 5 year returns – 8.36%

Nippon India Gold Savings – invests in different gold mutual funds

- 1-year returns – 23.02%

- 3-year returns – 11.10%

- 5 year returns – 8.13%

Are fund of funds worth it?

If you want to have a diversified portfolio and you don’t want to do a lot of research for each category, the fund of funds is a good option for you. However, not all funds are good. You will have to put in some effort into choosing the best FoF which meets your financial goal. Some FoF schemes have outperformed the benchmark by a good mark in the last few years. Choose a scheme that has performed well over a period of time and that has a proven track record of selecting winning mutual funds.

Some fund of funds operates for the long term meaning they have locking for a considerable period. You should consider this point before choosing a fund of funds to ensure your liquidity needs are satisfied through other sources.