Working of a Mutual Fund

- 20 April 2017 | 1392 Views | By Mint2Save

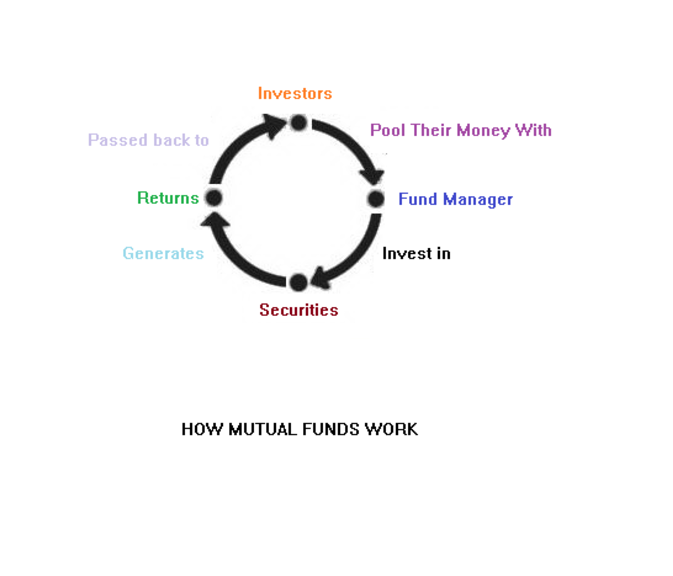

A mutual fund is that which pools investors’ money to make several types of investments, known as the portfolio, which comprises Stocks, equities bonds, and money market funds that may make up a mutual fund, with a nominal fee. You become a shareholder of the mutual fund company as a mutual fund investor. When there company earns profits you will earn dividends and when there are losses then your shares will decrease in value. The investments made in a mutual fund are managed by a portfolio manager who manages the funds on a daily basis and has an authority to buy and sell investments as per investment objective related to that fund which in turn decided the manager’s compensation on the basis of how he performed. In India various mutual funds are like, HDFC Mutual Fund, ICICI Mutual Fund, Birla Sun Life Mutual Fund, and many more

How the Mutual Fund Process actually Works

Suppose for example you have $20,000 you want to invest in ABC Fund. You need to download a new account application from the mutual fund’s website and fill it out, and mail it with a check. After some days, your account is open.

Explanation:

- Firstly, the check you have mailed will be sent to the transfer agent. It was then deposited into a bank then you are issued shares of the mutual fund on the basis on the value of the fund when your check was deposited.

- After that, the cash will be visible to the portfolio manager in your account. They will receive a report telling them how much money is available to invest in further stocks, bonds, or other securities based on the net money coming in or out of the fund.

- When the portfolio manager is prepared to buy shares of a stock such as Coca-Cola, They will work with investment banks, stock brokers, clearing networks, and other sources of liquidity to find the stock and fills that order at the lowest possible price.

- On the date of settlement, the mutual fund will have the money taken out of its bank account and paid to the person or institution that sold those shares of Coke to them in exchange for the Coke stock certificates and making them the new owner of it.

- Afterwards, when Coca-Cola pays a dividend, it will send the money to the person, who will make sure it is credited to the mutual fund’s account.

- The mutual fund will expected to hold the money in cash so it can pay them out to you as a dividend at the end of the year.

How to Earn Money from Mutual Funds?

When investors invest in a mutual fund then money comes in hand from three sources That is the Divided payments, when a mutual fund receives dividends or interest on the securities invested in the portfolio then such proportional amount of that income or profit is distributed to its investors. Another is Capital gain, by selling your fund, what you make or if you sell a mutual fund for more than you paid for it, is a capital gain and when you sell it for less than you paid is a capital loss. Investors always receive a part of net capital gain annually from most of the funds. Last is Net Asset Value (NAV), when the net value of a fund increases, it increases the value of your shares, similar to when the price of a stock increases. When you don’t get immediate sharing, but your investment’s value is larger, and you will have made money should you decide to sell it.

Why to invest in Mutual Funds?

When you purchase a mutual fund, you pool your money with many other investors. This will allow you to invest in a variety of investments for a relatively low cost. It also carries the lower risk. Another Benefit is that a professional manager makes the decisions about your investments. Also, mutual funds are widely available through trust departments of banks, financial firms, brokerage firms, credit unions, other investment firms. Mutual Funds are easy to buy or sell at any time.

But apart from some advantages it does also consists of disadvantages Like all investments, mutual funds also have risk you could lose money on your investment. The value of most mutual funds will change if the value of their investments goes up and down. You should never invest in two mutual funds at the same time as it can lead to overlap resulting in less diverse portfolio than you can imagine. Also, the fund is managed; fees will be charged with no matter how the fund performs. Investors must have to pay annual fees, sales fees, Some of these fees are paid by you, and others are paid by the fund with no guarantee of outcome.

“A mutual fund can do for you what you would do for yourself if you had enough time, training and money to diversify plus the temperament to stand back from your money and make sensible decisions”.