Wint Wealth: Debt Investment for the Masses

- 6 July 2021 | 2053 Views | By Abhinav Mishra

The problem for most investors is to find an instrument that gives them good returns over time. Most investment options follow the rule – high-risk, high-return, or low-risk, low-return. When you talk of high risk, high return, it is mostly equity and mutual funds. Most investors are not comfortable getting into it. When it comes to low risk, low returns, the most preferred option are fixed deposits and debt funds, but the interest rate has significantly dropped for them.

Is there an option in between these two options? Yes.

What is Wint Wealth?

Wint Wealth is a debt asset platform backed by Zerodha and some other big investors. When it comes to debt investment, retail investors cannot invest in it because of the high ticket size. Wint Wealth is an investment platform democratizing debt investment options for retail investors. The platform is suitable for investors who are looking for high returns with low risk. As a retail investor, you can expect returns between 9 percent and 11 percent with an investment as low as Rs 10,000.

Wint Wealth not only allows you to invest in a debt portfolio but also educates you to understand the risk-return profile and why to diversify your portfolio. They want investors to invest 10 to 15 percent of their portfolio with Wint Wealth assets.

Debt instruments are high ticket size investments and range between Rs 50 lakh and Rs 1 crore. Hence only HNIs and ultra HNIs invest in them. Now with Wint Wealth, retail investors can invest in debt funds.

How can I invest in Wint Wealth?

If you want to invest in debt instruments, you can register on https://www.wintwealth.com/. There are no fees to use or join the platform.

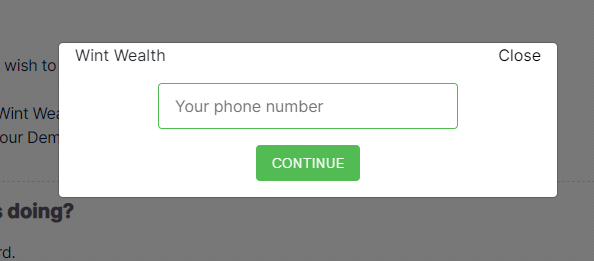

To signup, you can give your mobile number and proceed by entering the four-digit PIN.

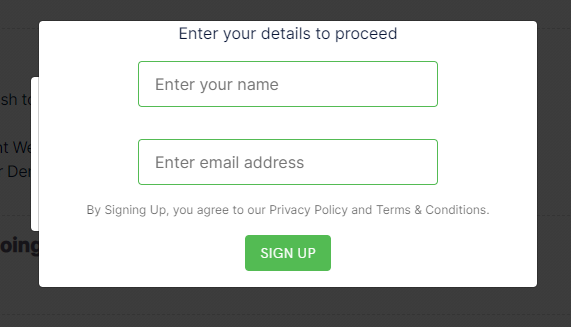

In the next step, you will have to enter your name and Email address.

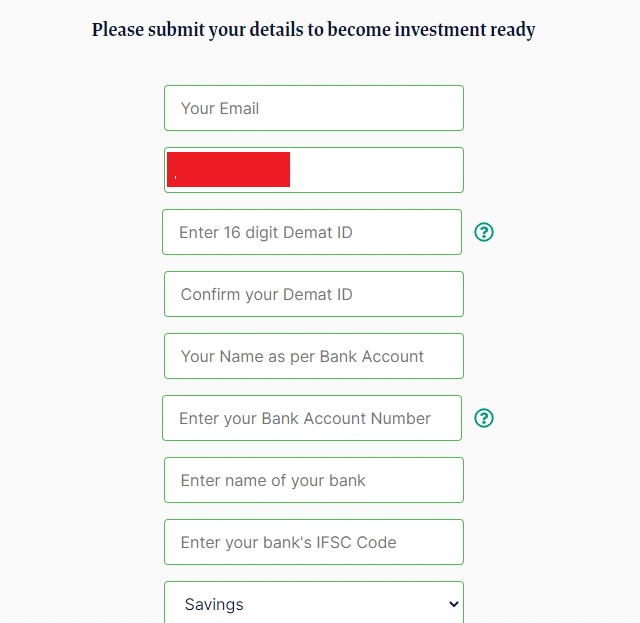

Once you log in, you can submit your KYC details – it includes your DEMAT and bank account details.

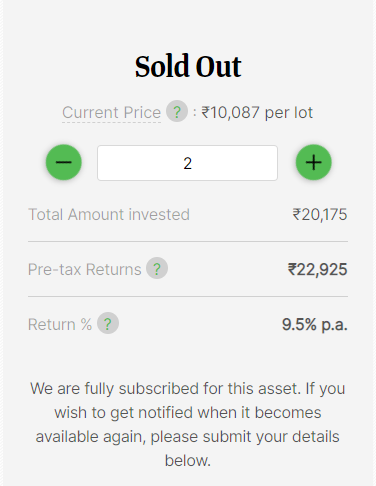

You can choose the asset in which you want to invest once your account is approved. As of now, there are six assets available on the website. Out of these, five are fully subscribed, and one is upcoming. For each asset, you will see the return percent and where your money will be invested. For example, Wint Gold Jun21 gives you 11 percent returns (pre-tax) and invest in Covered Market Linked Debentures (MLDs). You also get to see when the interest will be paid, asset size, asset maturity date, and collateral type.

To invest, you can transfer money to the Wint Wealth account. You can transfer up to Rs 1 lakh using the UPI option. For a higher amount, you can use RTGS/NEFT/IMPS or Net Banking.

Once the amount is transferred, you invest in assets open for investment. You can invest in multiples of Rs 10,000 in a particular asset.

How does Wint Wealth work?

As mentioned above, high-yield debt instruments and MLD give much higher returns than fixed deposits. The only problem is the ticket size.

To help retail investors also invest in such instruments, Wint Wealth partners with different RBI registered Non-Banking Finance Companies (NBFCs). NBFCs issue bonds and you invest in bonds of those NBFCs, which come with two layers of security. The first layer of security is the NBFCs. They pay you back your money with interest at maturity.

The NBFCs issues different types of bonds. At the second level of security, Wint Wealth picks out the best loans from all the loans that NBFC has already given. If the NBFC is not able to pay you back, your money is recovered from the loans that Wint Wealth has picked.

Is Wint wealth safe?

Debt investments haven’t been as safe as they were thought to be. From Franklin Templeton’s debt fund fiasco to DHFL’s bonds, investors have been made to face heat and liquidity issues, even when the instruments were not rated as junk. Wint Wealth, well aware of the fact, is quite open to share its views and advise investors.

There is a certain amount of risk involved with each asset and it has been clearly mentioned by the company, you should not invest more than 10 percent of your portfolio in Wint Wealth assets.

The first point investors need to understand is that the money is not with the Wint Wealth and is managed by SEBI impaneled firms known as Trustees. Wint Wealth has not to control over your investment. Just like Zerodha has no control over the stocks you own. All investment options available on the platform are regulated by both RBI and SEBI.

Also, the investment options available on the website are covered bonds. Covered bonds are bankruptcy protected, unlike regular bonds. If the NBFC closes, the money will be recovered from the cover pool.

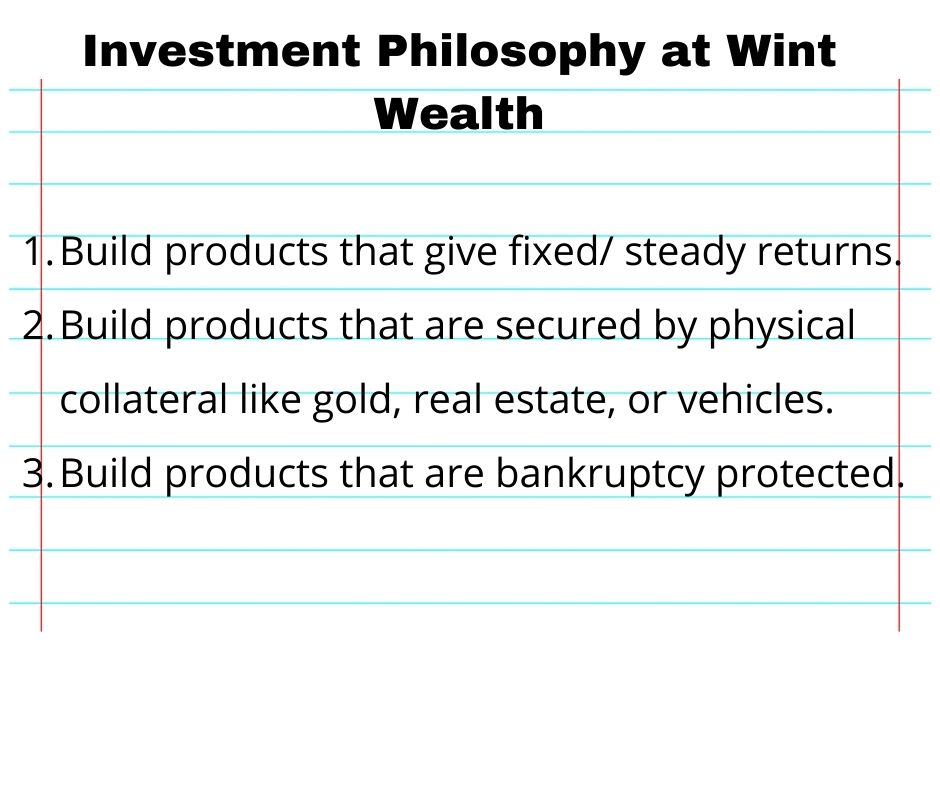

Wint Wealth’s Stance on Product Offering

Wint wealth has also maintained a clear stance about detailing its investment products and is actively addressing investor concerns via its Twitter channel. A few mentionable tweets include:

We sound too good to be true with the 9-11% fixed returns part?

While we do mitigate the risks involved via exhaustive due diligence, auditing, cash reserve, etc.

But, there are still some risks involved; read them below:

— Wint Wealth (@WintWealth) June 8, 2021

Before investing in our assets + brownie point:

➡️ Don’t think of our assets as an alternative to FD.

➡️ Understand the risks associated and how we mitigate them.

➡️ Look at our assets to diversify your portfolio; start by allocating 2-3% of your funds.

Brownie Point👇🏻

— Wint Wealth (@WintWealth) July 2, 2021

To sum up

The new generation of smart finance startups and entrepreneurs has been evolving as ever. Wint Wealth reveals another chapter of it. An IITian startup, Wint Wealth does get its backing from already known finance entrepreneurs such as Kunal Shah of Cred, Nitin Kamath of Zerodha, Nishchal Shetty of WazirX, and many more.

If you plan to invest your money through Wint Wealth, you should check the lockin period of the asset in which you want to invest. Some of the assets are illiquid. It means you will only get the amount at maturity.

Before investment, also check the different types of risk associated with the asset. The asset page clearly highlights all the risks associated with the investment.