What is Bullet UPI | Bullet UPI Now Pay Later

- 25 May 2021 | 2408 Views | By Mint2Save

Ever since its invention, credit has always, upgraded, evolved itself to suit the needs of the masses and the elites. With Bullet UPI, we evolve into a new genre of credit. A smartphone application that is available on Android and iOS, Bullet turns the highly convenient UPI into a credit card, which has a billing cycle every -15- days.

A very simple idea that must have been lingering in the back since the advent of UPI. With several compliances, looming frauds, it required nothing less than a genius to actualize this concept.

In this article, we shall explore the basics of the app, the brains behind it, working, and various other interesting topics.

Let’s Mint 2 Save it!

What is Bullet App

Bullet is:

- Credit Card that dwells on the UPI: UPI has now become a household name for daily expenses. Essentializing from a smartphone, UPI is available at ease. From paying the milkman to buying coffee at Starbucks, UPI is a convenient method. With most transactions based on a QR Code, the chances to err are the least, when using UPI. Unified Payments Interface (UPI)- What Is It? | How it works?

- Totally Digital: Bullet works as an application on an Android or iOS-based smartphone. It helps in two things:

(a) Avoiding an additional smart card (like a credit card) to be kept and taken care of,

(b) Approval to use credit service is almost instant.

The ultimate motive of going digital is reducing time consumption, and Bullet is taking care of the same.

- Costless: Since this application imbibes a credit card, use is effectively costless. The billing cycle of this app is -15- days, meaning one has to repay the debt in -15- days. You pay on time and there is no interest to be borne. It is free credit until it is paid on time. Further, unlike the majority of the credit cards out there, there are no annual charges (as of now).

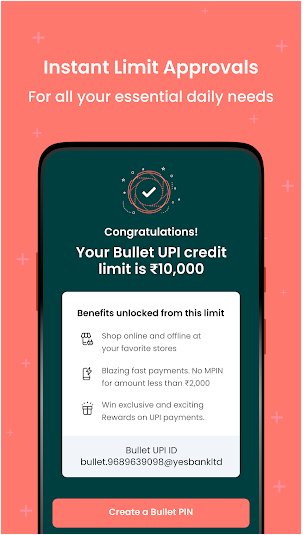

- Limit Capping: Since this application is made to cater to daily expenses, the limit is capped to Rs. 10,000/-, which seems satisfactory considering the expenses one can make in a span of -15- days.

Who Made Bullet UPI App?

While introducing the article, the innovation pertaining to the app was also mentioned. The app is owned by Amica Financial Technologies Private Limited. Incorporated in 2019, this Company is lead by Jitendra Gupta, Vishnu Jerome, and Vikram Vaidyanathan. The trio is well known in the tech and startup industry and have lead by example in multiple next-gen companies (startups), such as:

(a) Citrus Biz Payments

(b) BharatPe (Resilient Innovations Private Limited)

(c) PayU

(d) Jerome Merchant and Partners

(e) Ziploan

(f) Ola Financial Services Private Limited

(g) Ofbusiness Tech,

and many more.

How Does the Bullet App Works?

Let’s get to the basics of working via these simple images:

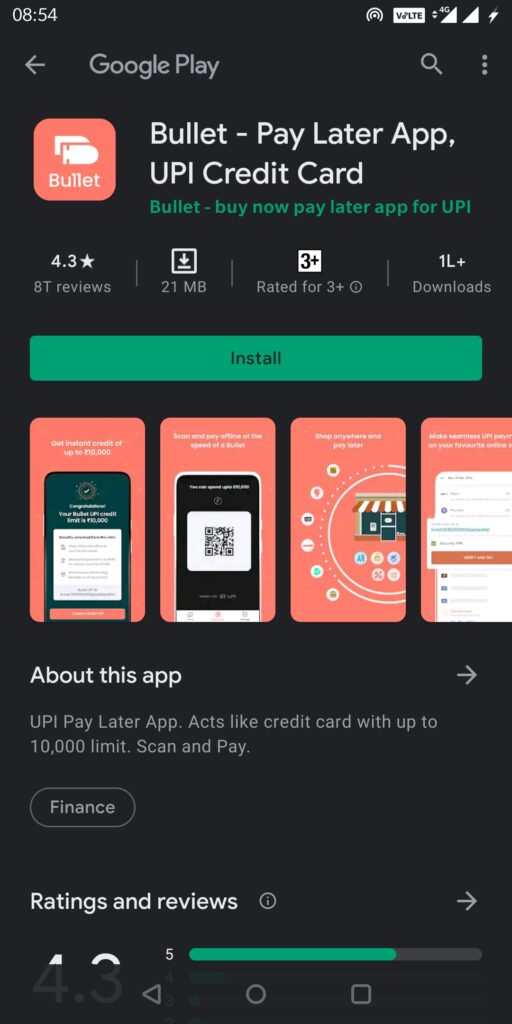

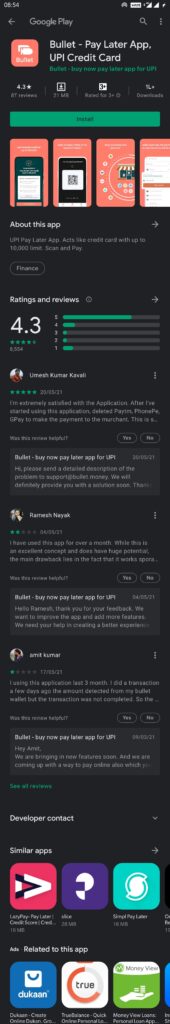

The application can be easily found on the Android store.

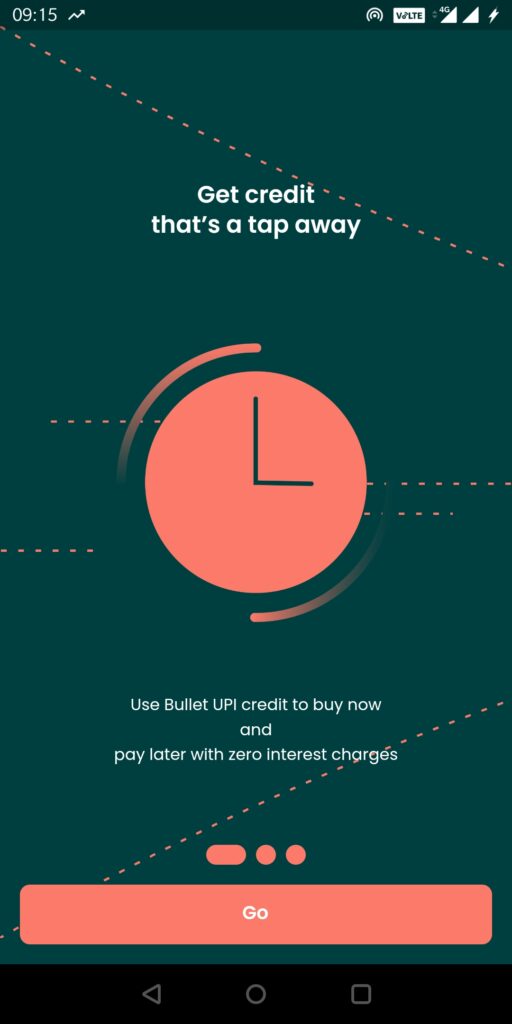

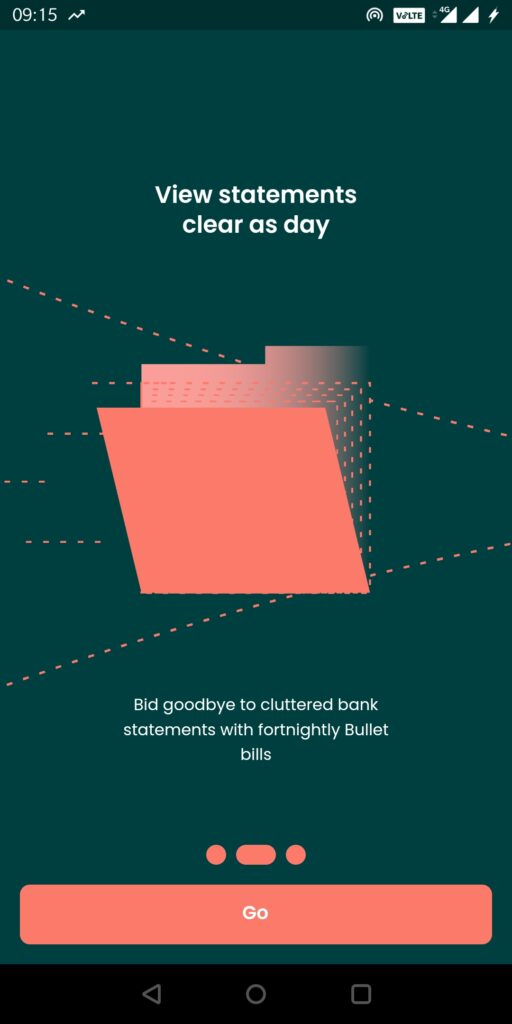

Upon installing the application, the user will be greeted by -3- welcome images, that shall are basically marketing and usability content for the application.

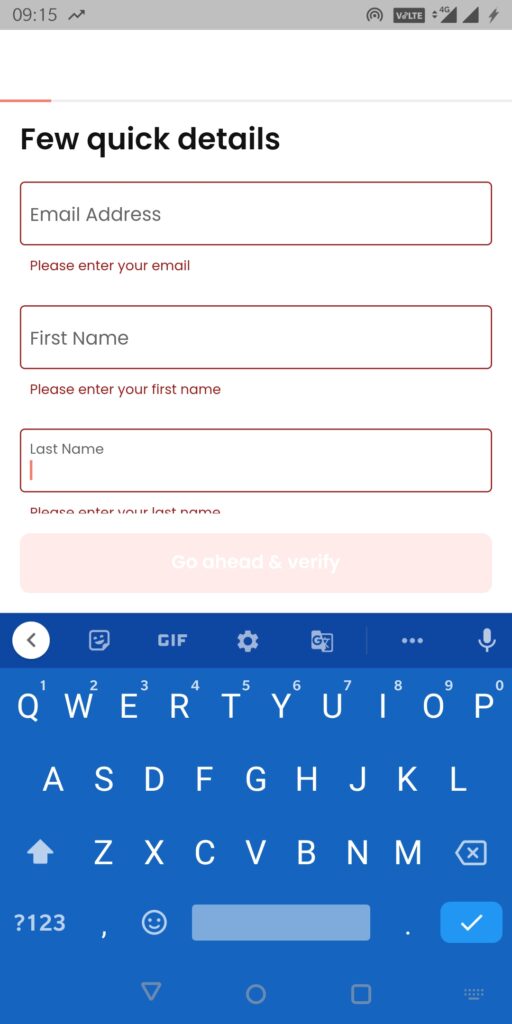

The application shall then prompt for some quick details of the borrower, such as email ID, contact number.

Additionally, it shall also ask for PAN Card details in order to generate a credit report.

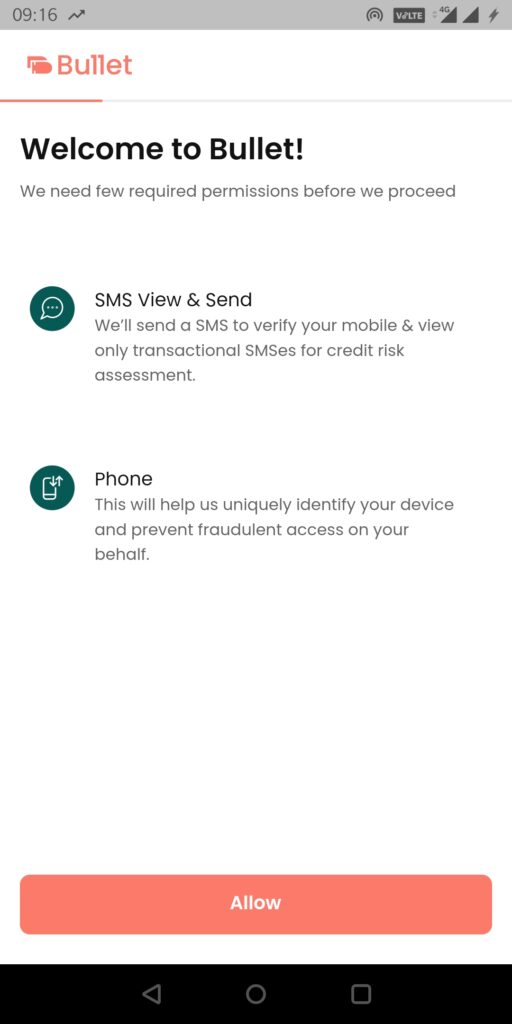

Prior to usage, a few permissions for SME, phone, location shall be requested by the application.

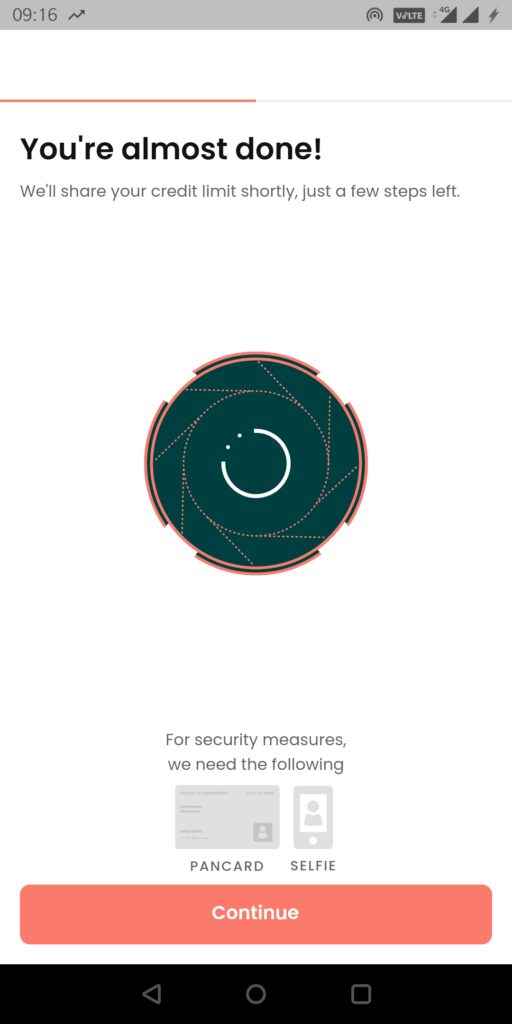

As a part of Know Your Customer norms, PAN Card and selfie are required.

An Experian credit report will be generated, after which the app shall decide whether you are eligible to avail the loan or not.

If not, you shall be informed right away, but if yes, you shall be greeted by the image below, and then you can start using the application.

Future of Bullet UPI App

When it comes to operational and consumer finance, UPI has seen unprecedented growth. Space now hosts unicorns like PhonePe and mammoths like Google and Amazon.

Bullet UPI is a recent innovation in this area, that brings easy credit. The startup not only aims to provide credit but also targets to be the fastest UPI agent.

With tens of millions as users, NPCI and RBI watching its back, Bullet has just been fired.

We hope that the credit limits shall be enhanced, and the application shall provide credit to sellers, and not just buyers.

The competition shall also ramp up, and existing players will also crave an extra feature to their products.