Mutual Fund: Basics you must know- Part 1

- 1 November 2015 | 1550 Views | By Mint2Save

The Indian economy has taken the highway route to development. In the recent years, we have witnessed many a number of companies from plethora of industries. The corporates and large investors are obviously growing a lot out of this, but it has also opened chances for the common to attain some financial gains when company opts for public stock option or mutual funds.

Can I buy all the stocks I like?

“To earn money, you should have money”, same goes for stocks and equity. So, if 100 stocks attract you, buying them all may require a lot of money. One of the better ways by which you can choose to invest in all those stocks without affecting your saving strategy is Mutual Fund.

Mutual funds are age old tried and tested investment instruments, which invest in variety of stocks, bonds, money market instruments. Managed by qualified personnel, mutual funds have recently grabbed a lot of limelight for reaping phenomenal returns for the common investors in the recent years.

Realising the big opportunity in the mutual fund market, several investment companies and government agencies have started to encourage people in this investment scheme. Further, with a wide variety of instrument and abundance of options, have attracted young as well as age old investors.

One can invest into mutual funds as per his investment capacity, risk appetite, tenure, tax saving and even goal setting. Small amounts pooled together constitute a good corpus. This corpus can be used to invest in several instruments, and thus reduce the concentration risk and optimising return with the market trend.

However, being popular does not ease on the understanding part of mutual funds. Hence, basic understanding of the mutual funds is absolutely necessary, before approaching any mutual fund for investment. In this article, we shall explore the basics of the mutual fund.

1. There is no Entry Load: There has been an age old theory that to enter the market of shares and stocks, there is a certain amount of fee to be paid. In case of mutual funds, it is certainly NOT so. You don’t need to give any extra money as a fee to enter the scheme. There is, however, an exit load, which is usually waived when you stay in the investment for at least a year. If someone tells you to do so, be smart and aware of the reasons he puts.

2. There are NO Fixed Returns: Any random mutual advisor can come to you and tell you the past performance where some mutual fund gave like 14% or even 20% returns. Well, before you get inclined to that fact, let us tell you that there are no fixed returns on mutual funds. Adding more to that, there are no guarantees that a past performance would be repeated (marketed as magnified).

3. Diversification: One of the most common phrases in the financial world is “Not putting all your eggs in the same basket”. Most mutual funds do believe in this idea. There are usually over a dozen different instruments in which mutual funds put their money. Cutting down on concentration risk, the chances of returns being optimised with the market trend and investment horizon are often matched with the expectation of the investor.

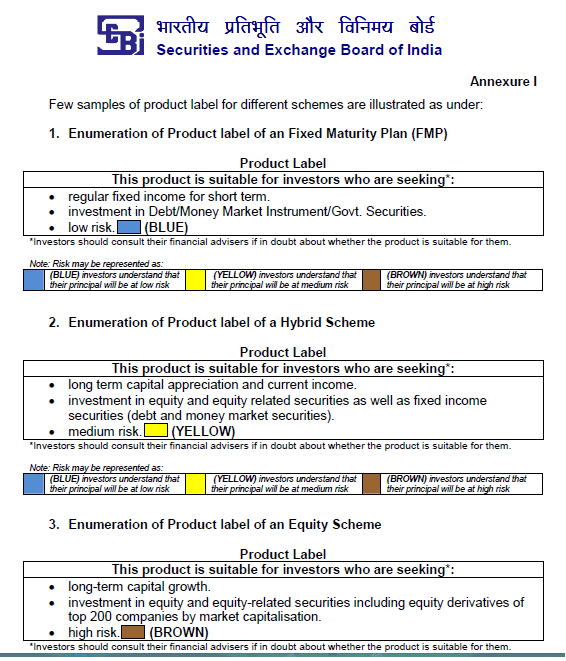

4. Want to the Risk? Search for the color : Colors do define almost everything these days. From defining whether food is for vegetarians or not, to controlling the traffic, a color clears it all. In terms of Mutual funds too, the case is same. Check out how SEBI has regulated the mutual fund investment in terms of risk involved. This would certainly mean that you now know how risky your investment is. Interesting, isn’t it?

In fact, the much popular quote “Mutual fund investments are subjected to market risk. Please read the offer document carefully before investing”, gets quite easier to understand once someone gets habitual with the color.

Has the simple 4 made it easier for you? Feeling confident or taking it just a random piece of financial literacy? Give yourself a day or two, go swiftly through any financial newspaper or website your trust and read the same again.

If you have already, then catch the other crucial 6 basics here.