Simplifying the Concepts of CAGR and XIRR

- 8 February 2020 | 1400 Views | By Mint2Save

Not merely a measure of exchange now, money carries immense value for everyone and almost everyone wants to reap maximum returns while investing it. How do you measure investment returns over a certain period of time. Computed Annual Growth Returns and Extended Internal Rate of Return are two prime return measures that can be used by retail as well as institutional investors.

In this article, we shall explore the essential differences between these two return benchmarks, along with general ways of money management.

There are four categories of money management:

- Income,

- Expenditure,

- Saving, and

- Investment.

Wealthy are those who have managed to make their investment as a new source of income. Turning these quadrants into a cycle is where investors come in.

Usually, it takes a study, skill, and knowledge to escape the income and expenditure recurring process. Savings have so many options and so does the investment. Nonetheless, losses are inevitable without proper knowledge.

Before hopping directly to the topic, it is necessary to dive into the subject of savings and investment. The father of all the investors, Warren Buffett, spent his large amount of hours sharpening his axe. He studied, read, researched, tried, failed, succeeded and learned before being the most accurate predictable man in stocks and shares.

When to Invest and When to Save?

The investment comes out of saving. The terms in saving and investment should be well known before opting for either one.

When the difference between income and expenditures is quite low, it is advisable to save. When the difference increases and saving is stable, investment is encouraged.

Here is a brief description of investment terms CAGR and XIRR.

What investors should know before investing?

Investors should be very much aware of their money after investing. For the same purpose, awareness of all the terms and literacy in the same is a must.

The very common terms that investors will have to deal with are – CAGR and XIRR.

To calculate Returns over the investment, there are two methods of calculation – CAGR and XIRR.

CAGR aims upon new yearly calculations, whilst the XIRR calculation is the rate of return on total investment.

What calculations should Investors be aware of?

Before investing, every investor calculates the risk factor. Though the invested money are uncertain, many investors are planning for certainty. For the same certainty, calculations are necessary. And these calculations are based upon CAGR and XIRR.

Both CAGR and XIRR are the Annual Returns and reports for investors.

What is CAGR and How it is Calculated?

If you are making the investment at once. Like, the Lump-sum investments and want to strike over returns gained, after say 5 years or forth. You need to go for the CAGR calculations for your investments. The CAGR is the compound annual growth rate

For instance – If you make an investment of INR 12,000 for only 1 year, the value of the same will be INR 23,358

Here is how CAGR gets calculated:

12,000 × (1 + CAGR )

= 23,358

23,358 ÷ 12,000 – 1

CAGR = 95 %

In the present case, CAGR is 95%. The percentage of CAGR varies with the tenure you select.

CAGR gives the returns in compounded form, unlike FDs. In FDs, you know the rate of interest and hence you can easily calculate your returns the moment you make one. In CAGR, you get annual return once, and henceforth you get compounded annual returns for the selected tenure.

What is XIRR and How it is calculated?

If you want to know the average revenue of your investment every year, before it matures, the quantity that yields the rate is XIRR.

For instance, if you are investing for 5 years. You will know your gains on average, every year, with XIRR.

Difference between CAGR and XIRR

CAGR is a Compounded Annual Growth Rate, which accesses over current calculation for every year. It aims at a single investment calculation. XIRR is the gives you the average of every single year, or of the time period that you wish to calculate.

To calculate the returns gained on the current year investment, you will need to apply CAGR.

CAGR= (Current or Maturity Value/Investment Value) ^ (1/investment tenure in years) – 1

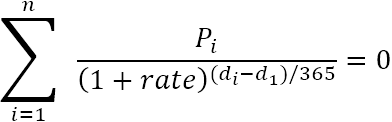

To calculate the gain on total investment, you will have to go with XIRR formula:

XIRR =

Total calculations of CAGR over the different tenure can also recognized as XIRR.

XIRR calculations can be easily performed in Excel sheets.

Does the XIRR compound annually?

As the CAGR compounds annually, so does the XIRR. XIRR simply calculates the rate. Even if you wish to calculate it daily you can. It does not mean you will get your investment compounded daily.

XIRR is simply the calculation of your investment and returns at the given point of time.

Who to rely on Calculations?

There are many software and tools available that do your job confusion-free. You simply have to fill up the required fields and you get your calculations ready. Even the excel sheets have these functions working in them. All you have to do is enter the investment amount, rate of interest, rate of compounding, and tenure.

Bottom Line

Before investing your savings, do calculate your returns and risks. The formula and examples mentioned above will help you better understand the concepts. However, the tools and software have given so much of ease and liberty to calculate the returns on investment readily.