Sezzle to Buy Now Pay Easy

- 16 November 2021 | 2679 Views | By Abhinav Mishra

With the growing global popularity of Sezzle, the idea of the buy now, pay later option has become really popular in recent times. It means that you can purchase an item and pay for the amount later over a stipulated period of time. Apart from credit cards, credit was earlier accessible towards buying assets of higher value such as electronics or real estate, or cars. Now, with buy now pay later, one can buy anything. Easier credit appraisal, aided by highly adaptive algorithms and evolving marketing gimmicks, this idea is here to stay for long.

Based on the same model, Sezzle has been gaining popularity in recent times. It is a payment solution that empowers you with “Buy Now, Pay Later” with interest-free installment plans. The USP of the company is that it breaks your total cost into smaller payment options spread over at least six weeks.

At the time of purchase, you have to pay only 25% of the total amount. The balance is paid as equal installments with a two weeks gap.

On the Sezzle platform, you can find a number of sub-stores (subsites) across various categories. The categories on the website are Women, Beauty, Home, Kids, Men, and Jewelry & Accessories.

How does Sezzle work?

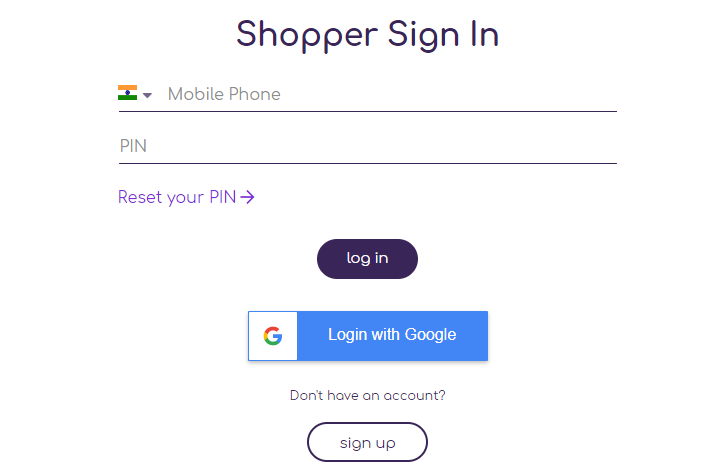

If you have an existing Sezzle account, you can log in using your number and PIN as below.

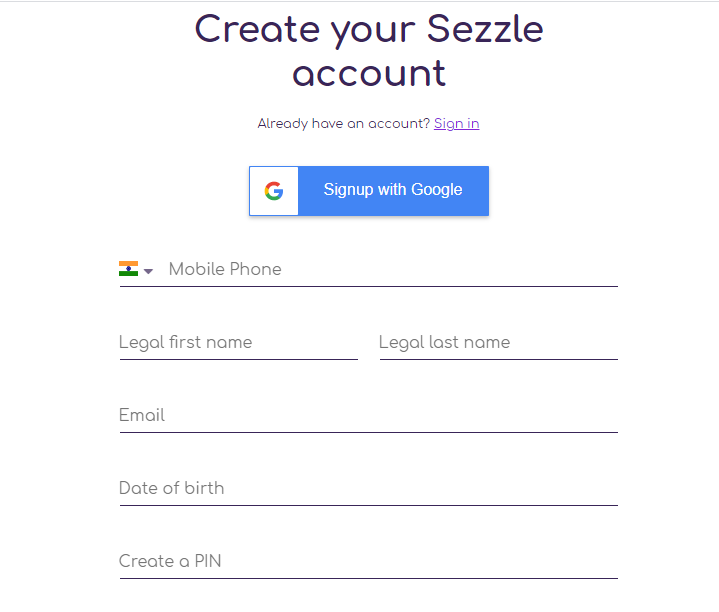

If you are new to the site, you can signup on the page by giving your mobile number, full name, email address, and date of birth. You will have to set a PIN that acts as your password for login later.

There are multiple products on Sezzle under various categories. You can select the products and add them to your cart. You can then select the payment method as Sezzle at checkout and complete the payment (25% of the total amount).

Read about Klarna: Pioneer of Buy Now and Pay Later

Sezzle will automate the remaining payments through whichever payment method you have selected initially. The platform before processing the payment sends you an email and text reminder. Sezzle will automatically process payments as per the due dates stated on the Payment Schedule. You irrevocably authorize Sezzle to process payments using the Payment Method details provided by you.

You can log into your account and change your payment method if required.

What do you need to purchase on Sezzle?

The Sezzle is available as www.sezzle.com and www.sezzle.in If you are browsing from India, you must be 18 years or older and have a valid phone number. Sezzle accepts all major debit and credit cards. You can also link your UPI account with the Sezzle account. The banks supported are ICICI bank, CitiBank, Canara Bank, and Kotak Mahindra Bank.

Are payments really interest-free on Sezzle?

Yes, the purchase is interest-free on Sezzle if you pay your payments on time. However, if you reschedule your payment or miss a payment, fees may apply along with the installment payment. For example, if your installment amount is Rs 5000 and the fee charged is Rs 100, you will be charged Rs 5100 in total.

There are two types of fees Sezzle may charge you –

Reschedule fee – You can reschedule your payment twice. The first instance when you reschedule will attract no cost. But if you reschedule again, you will be charged Rs 100.

Failed payment fee – If your payment fails on the due date, your account is suspended, and Rs 200 will be applied as failed payment fee. However, if you can resolve the payment within 48 hours, the failed payment fee will be waived off from your account. Else, on the next due date, you will have to make an installment amount along with Rs 200. Once the payment issue gets resolved, your account is restored, and you can make new purchases on Sezzle.

Can I make payment in full?

Yes, you can make full payment and clear off all the dues in one go. Early payments increase the chances of getting approved for new orders but not necessarily. There is no penalty or additional benefits if you make payment before the due date.

Sezzle for Merchants

If you are a merchant, you can register your store on the Sezzle platform. Sezzle can simply and quickly integrate a variety of e-commerce platforms, like Magento, Shopify, WooCommerce, and more. The company takes care of all fraud and repayment risks, so merchants can process the order without any worry.

What other Top European Fintech Startups You Must Know?

What is Sezzle Score?

Sezzle score is a user-exclusive score to reward and encourage consistent and healthy payment behavior from you. Consistent payment increases your Sezzle score that leads to numerous benefits. With a high score, you receive exclusive offers, increased credit limit and early access to new features, and much more. You earn more as you stick by your repayment schedule, getting access to even more quality perks to help you shop more.

Credit Limit on Sezzle

You cannot buy products of any amount of Sezzle. You have a credit limit on your credit cards. Similarly, you have a limit on your Sezzle account. The platform decides your credit depending on the amount of time you have been shopping on Sezzle, how many orders you have repaid on time, the total amount of your open orders, and the outstanding amount on open orders. Based on all these factors and the amount of your new order, Sezzle will determine if you can make a new purchase.