REIT : Performance analysis of REITS based Stocks

- 3 December 2020 | 2088 Views | By Abhinav Mishra

Owning real estate is a dream of every Indian. Not only it comes with a social status but also has many other advantages. The only problem with real estate investment is that it comes with a very high ticket size. What if, there was a product where you can invest a small amount and enjoy the financial benefits of owning the real estate – rental income and capital appreciation.

In this article, we are going to talk about REIT – Real Estate Investment Trust.

What is REIT?

Real Estate Investment Trusts are securities linked to real estate. REITs offer you an opportunity to possess high-priced real estate and earn dividend income to boost your capital eventually. Properties included in REITs comprise data centers, infrastructure, apartment complexes, healthcare units, etc.

They can be traded on a stock exchange once they are listed. REIT is similar to mutual funds in many ways. It collects money from a number of investors (unit holders) and invests in some securities. Just like mutual funds, REITs also have their fund managers, sponsors, etc. The major difference between the two is underlying securities. The underlying assets in mutual funds are stocks, golds, bonds while in REIT it is physical real estate.

REIT’s history

To the world, REIT is not a new investment option but to Indians it certainly is. The first REIT product was launched in the US in 1961. In India, REITs regulations came into effect only in 2017 and the first REIT was launched in 2019. Currently, in India, REITs are only working with commercial investments. Given the residential sector is highly fragmented and unorganized in India, REITs invest in residential properties will take time.

What are the different types of REITs?

REITs can be classified based on the type of business it is investing in. Below are different types of REIT –

Equity – This category of REIT is concerned with managing and operating income-generating commercial properties. This is the most popular type in which the common source of income is monthly rent.

Mortgage – It is known as mREITs. This type lends money to proprietors and extends mortgage facilities to them. The REIT may also acquire mortgage-backed securities. The income is generated in the form of interest accrued on the money the company lends to proprietors.

Hybrid – This is the combination of the above two REITs type and it allows investors to diversify their portfolio.

REITs can also be Private REITs meaning they are not registered with SEBI and not traded on the stock exchange. Then there are public traded REITs that are registered with SEBI and traded on the stock exchange. The last category is Public non-traded REITs which are registered with SEBI but not traded on the stock exchange.

Before you pick a REIT to invest in, it is always better to know the category of REIT and its features.

How can a company be qualified as REIT?

REIT was introduced by SEBI in 2017, since then SEBI has put a number of criteria for a company to satisfy to be classified as REIT. They are as below:

- Of the total income generated by the company, 90% must be distributed to the investors in the form of dividends.

- 80% of the total investment must be properties that are capable of generating revenues.

- The trust can invest only 10% of total income in under-construction projects.

- The company must have minimum assets base of Rs 500 crores.

- The company must update NAV twice in a financial year.

Is REIT a good investment in India?

There are certainly many benefits when it comes to investing in REITs. Below are some of the benefits:

- Investing in real estate becomes a lot easy.

- Since REITs are regulated by SEBI, the chances of fraud a very less.

- The dividend offered is relatively higher since approximately 90% of income is paid as a dividend.

- REITs provide investors with an opportunity to diversify their real estate investment.

- Unlike traditional real estate, REIT comes with high liquidity since they are traded on public stock exchanges.

At the same time, there are some disadvantages which investors should be aware of:

- No Tax benefits – You will have no tax benefits on the capital invested.

- Risk – Since this is a listed investment, it will always to susceptible to market-linked fluctuations.

How can I invest in REIT in India?

You can think of REIT as nothing but a listed company. So all the ways through which you can invest in listed companies are also available with REIT. There are 3 ways, through which you can invest in REITs:

Stocks – There are limited numbers of listed REIT stocks in India. If you are looking for a direct way to invest then you can buy shares of the REIT companies.

Mutual funds – Investors who don’t like managing their portfolio on regular basis but still want to invest in REITs can put the money in mutual funds. You will be able to diversify your investment portfolio significantly with this option.

Exchange-Traded Funds – These are similar to mutual funds only but not actively managed. With this, you can have indirect ownership of properties, and would further benefit from its diversification.

How to choose Real Estate Investment Trusts?

Since REITs are not popular, you won’t see too much news and investment strategies around them. If you are planning to invest in REIT, then follow the below steps to analyze the REITs, it will reduce your risk:

- Look for a company that has a positive record when it comes to offering high dividend yields. Also, check the interest of the company in facilitating capital appreciation in the long run.

- You should always choose REITs that hold diverse properties and tenants as it will reduce your risk.

- If you are new to investing, go through mutual funds, and ETFs that invest in REITs. Since it is a different class of investment, let professionals manage it.

- Choose companies that have been in the business for at least a year and check their financial reports.

What are the best REIT stocks?

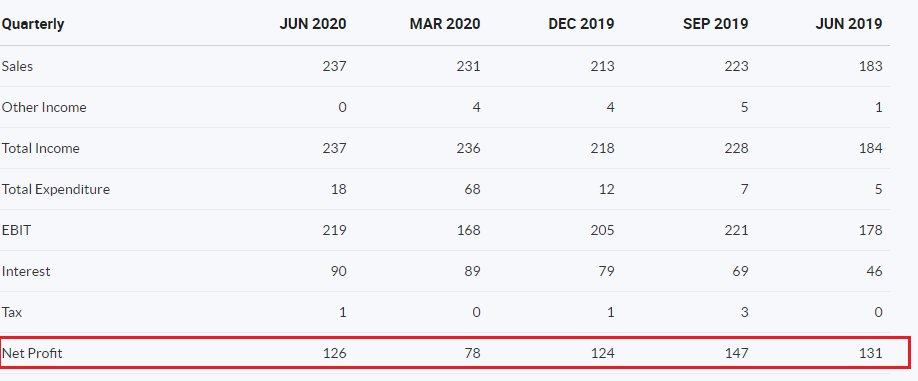

As of now, there are only 3 REIT stocks in India – Embassy REIT, Mindspace, and IndiGrid. Public shareholding of the Embassy is approximately 39 percent. Of these, FPIs hold 26 percent and non-institution individuals 9 percent. Public shareholding of IndiGrid is 85 percent, of which FPIs constitute 55 percent and non-institution individuals 13 percent. If you are looking for REIT stock, check for the quarterly growth of the last 3-4 quarters, if you see a growth in profit, you can look into other parameters. Below is an example of Embassy REIT:

Are REITs better than stocks?

With stocks, there is no minimum investment as such. However, with REITs, you will need to invest a minimum of Rs 50000. When compared to stocks, it is a big amount but if you look at it from a real estate perspective, it is a very less amount.

REITs are less volatile than the stock. The projected return on investment in REIT is between 8% and 12% annually and the risk is also minimum. With stocks, there are no guaranteed returns, no matter how good the stock is.

According to industry reports, Embassy REIT has outperformed the BSE realty index and has given 14 percent returns from its establishment in April 2019 to June 2020.

Can you lose money in REIT?

Since REITs are traded on the stock market they have some of the risk linked with equity investments. They are also adversely affected by weakness in the real estate price. When interest rates are elevated or rising, REITs can produce negative total returns during the times.

For example, you invest in a REIT that invests in commercial retail properties. With time, the number of visitors to malls may decrease as people prefer to shop online. A commercial project like malls loses stores because the stores are losing customers. The REIT in return loses income from less rent. Hence, they reduce their dividend. When the company cuts dividends, the stock price goes down because of negative sentiments in the market. So you as an investor can also lose money – one from the lower dividend and the second from the lower stock price.

Is now a good time to buy REITs?

According to real estate experts, it is the right time to invest in the real estate sector. The real estate industry has been sluggish for the past few years. Everyone is now optimistic about the future of the real estate industry in the country and looking forward to brighter days.