OctaFX: Best Online Forex, CFD Trading Application

- 1 September 2020 | 2061 Views | By Abhinav Mishra

Have you heard about Forex trading? Just like stocks and commodities are traded, you can trade currencies. Forex is the marketplace where you can trade various national currencies. The Forex market is one of the largest and most liquid markets in the world. Trillions of dollars change hands every day. It is an electronic network of banks, brokers, individual traders, and institutions.

Unlike the stock market, the Forex market is open 24 hours a day, five days a week, except for holidays. Currencies trade even on a holiday if at least the country/global market is open for business.

So how you trade with currencies? There are a number of applications and platforms which allow Forex trading. In this article, we are going to talk about – OctaFX.

What is OctaFX?

OctaFX is a Forex trading platform build to provide an economical trading experience so that both experienced and new traders can make the most profit by investing equally. OctaFX provides access to commodity trading, CFD (Contract for Difference) trading, and trading of indices through rewarding Forex trading conditions. It started in the year 2011 and currently operates in more than 100 countries. They have 15 million Forex trading accounts and have executed over 288M trades.

What is CFD Trading?

Thousands of companies issue traded shares on the stock market. You can divide these companies into several categories based on their sector, exchange on the industry, or trade. Many financial agencies calculate indices based on stock prices to evaluate market performance. CFD is a contract for difference: a contract for the exchange of open price and close price difference.

How do I start OctaFX?

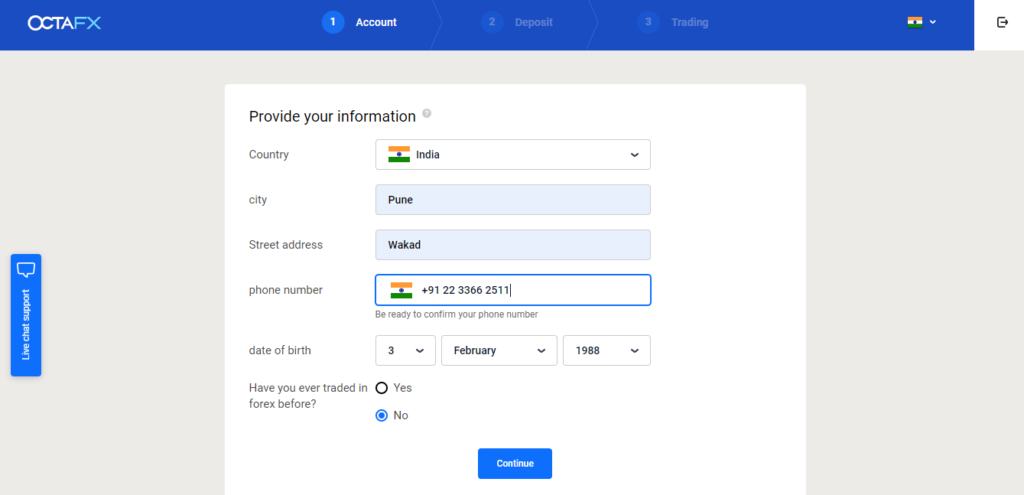

OctaFX provides a user-friendly and distinctive approach to trading the financial markets. You can open an account with them using your email address.

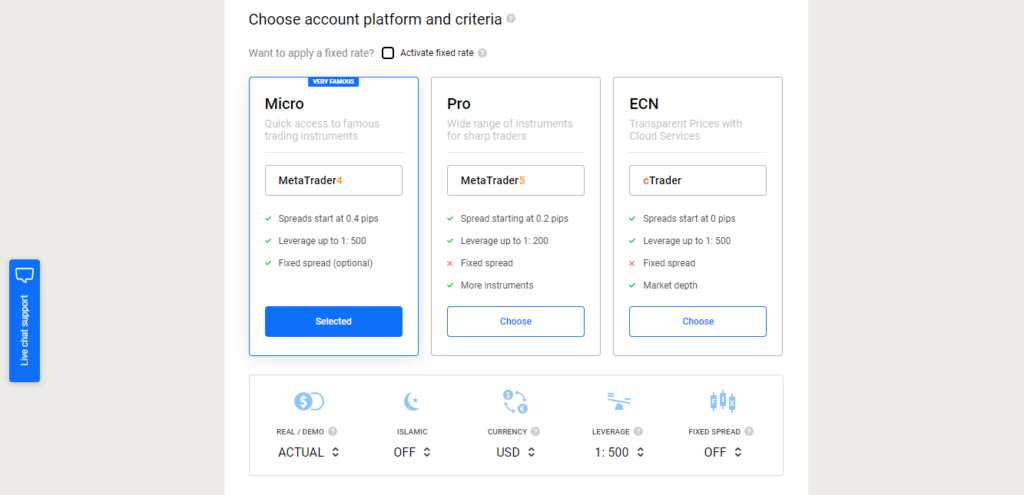

Post email verification, you have to verify your phone number and then choose the type of account you want to have. There are 3 options:

Micro

Quick access to famous trading instruments. It uses the MetaTrader 4 software platform. The META Trader 4 (MT4) provides satisfactory technology and high security so that you can choose Forex or CFD without worrying about the stability of the platform. It provides instruments for identifying the shape of trends through price charts, fluctuations, and graphs. It also deploys automated trading techniques for trade management. Its features are:

- Spreads start at 0.4 pips

- Leverage up to 1: 500

- Fixed spread (optional)

Pro

It provides a wide range of instruments for sharp traders. Pro mode comes with next-generation MetaTrader 5. Further, it also lets you start trading Forex and CFD with amazing capabilities, basic and technical market analytics, and copy trading, and automated trading features are included in this platform. In this version, you get different order types and methods of execution. MT5 offering the widest range of tradable instruments, which is: 28 currency pairs, 10 indices, 3 cryptocurrencies, 4 metals, and 2 energy markets. The features are:

- Spread starting at 0.2 pips

- Leverage up to 1: 200

- No Fixed spread

- More instruments

ECN

Transparent prices with cloud services. This uses the cTrader software platform which is a robust and comprehensive trading platform designed specifically for Forex and CFD trading. With this, you get more Forex trading transparency and visual support, including 26 prefabricated cTrader chart views, fully customizable interfaces, and up to 50 saveable chart templates for all possible technical trading analysis strategies.

- Spreads start at 0 pips

- Leverage up to 1: 500

- No Fixed spread

- Market depth

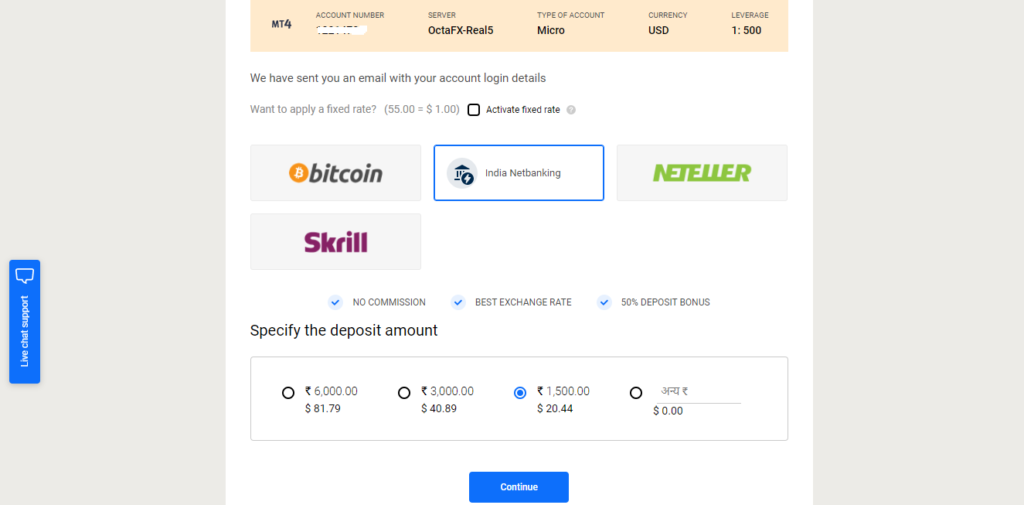

Once you select, type of account, your account will be opened immediately and to start trading you will have to deposit the initial amount in your account. Once you confirm the account and payment amount, you will be directed to the payment gateway to complete the payment.

You can also trade using the OctaFX app which is one of OctaFX’s strong suits. All the apps are available for Apple and Android devices and through each provider’s app store.

What is the minimum deposit for OctaFX?

You can choose the amount you want to deposit in the account. The minimum amount you can deposit and starting trading is $5. You can use net-banking or other digital wallets to deposit money in your trading account.

Can I start trading with $5?

Yes, you can start trading with $5 using the OctaFX account. However, according to Risk Management strategy, the more funds you have, the fewer risks you are exposing yourself to on a particular trade.

Analysis and Education section

Like other trading platforms, OctaFX provides you with trading tools and education material. They have a number of trading tools that you can use while trading – trading calculator, profit calculator, live quotes, monitoring, and Autocharist. The different analytics are :

- Market information

- Economic calendar

- Market Insight

- Forex news

- Interest rate

If you are completely new to Forex trading then you can go through the study material which covers Forex foundation, video tutorials, instructions, etc.

What is Copy Trading?

OctaFX also offers a Copy Trading feature. Copy trading is popularly known as social trading. It automates your trading by copying the trades of other experienced traders. It is useful for new traders who are not sure where to start Forex trading. They can learn trading from scratch from the more experienced traders.

Learn about options trading: Olymp Trade: Is it Profitable For You??

For Copy trading on the OctaFX platform, you will have to load funds in your wallet. You can directly deposit it from your bank or if you already have the money in your trading account, you can use the internal transfer feature to transfer it to your wallet. You can then find the master you want to follow. After confirmation, their position will be automatically copied in your account. Ideally, you should have multiple masters to copy, it allows you to create a diversified and balanced portfolio and earn a steady income. You also have complete control over the process and can modify/stop copying trades at a given time.

Fees and commissions

You will see the fees and commissions are structured differently according to account type. As mentioned earlier, Micro, Pro, and ECN accounts use the MT4, MT5, and ECN software platforms, respectively, and support different trading approaches, hence they have different charges.

What is Spread in Forex?

The Forex spread is the difference between the rate at which the broker buys the currency and the exchange rate that a Forex broker sells a currency.

What is Pip?

Pip stands for Point in Percentage. It represents a tiny measure of the change in a currency pair in the Forex market. You can define it as the smallest amount by which a currency quote can change. For example, let us say you have a USD/EUR direct quote of 0.7738. This quote means is that for US$1, you can buy about 0.7738 Euros. If there was a one-pip increase in this quote (to 0.7739) and as US$1 would allow you to buy slightly more Euros, the value of the U.S. dollar would rise relative to the euro.

You will have the widest spreads on the MT4 Micro account and find fewer instruments to trade through this account. Typically, the spread on a EUR/USD trade might be 1.1 pips, but if you make the same trade through the MT5 Pro account, this might drop to 0.9 pips. When considering both ranges of instruments and price structure to trade, the MT5 Pro account is generally the best of the three options.

Is OctaFX a market maker?

A market maker is a type of brokerage that acts as a counterparty to a customer’s order. It is the other side of the customer’s deal and makes money or profits from the loss of the customer. It is also called a dealing desk broker. Yes, OctaFX is a market maker.

Is OctaFX legal in India?

Many new traders wonder if Forex trading is legal in India or not. Of course, you can trade Forex in India. It is completely legal to trade Forex in India given you are trading with Indian Exchanges which offers Forex Instruments. At present, Indian Exchanges only offer USDINR, JPYINR, GBPINR, and EURINR pairs for trading purposes. Under the FEMA Act, trading non-INR Forex pairs is illegal in India.

It is illegal to trade on platforms that are not approved by SEBI or RBI. Since OctaFX is not approved by either of these, it is not 100% legal in India.

Is OctaFX trusted?

Given the company is 9 years old and is operating in all major countries, you can trust the platform if you want to start Forex trading. However, if any dispute occurs, no Indian body will take the complaint.

Is forex gambling?

Like any other form of trading, Forex too can become gambling if you have no clue what you are doing. As a newbie, if you register and start trading, all you are doing is gambling, the chances of your success in each trade will be 50%.

You will have to learn a trading strategy and keep yourself updated with the news around the forex pair you are planning to trade.

Is it worth becoming a Forex trader?

If you are ready to learn the basics and gain the advanced knowledge of Forex trading then yes becoming a Forex trader is worth. It is not everyone’s cup of tea. You will have to decide for yourself if you are ready to invest time (and money) learning the Forex trading.

Benefits of OctaFX

- No commissions

- 50% deposit bonus

- Fast deposits and withdrawals

- Reward winning loyalty program

While OctaFX offers MetaTrader and cTrader, there is a limited offering of tradable instruments. The pricing is also not competitive. OctaFX needs to improve its product, pricing, and tools offering if it wants to compete with the best MetaTrader brokers.