Marcellus Investment : An Overview

- 9 December 2020 | 2111 Views | By Abhinav Mishra

If you are just starting with your investment journey, you may find yourself confused. There is nothing to worry about, you are not alone in the boat. You are in the digital age and with so much information and different investment options, getting confused initially is something you can’t avoid. However, you need to ensure you end the confusion as soon as possible in your investment journey.

What are the 4 types of investments?

One way to end confusion is to understand the topic better. Let us talk about the different investment options you have at a very level. An ideal portfolio is one where you have an allocation in all the below categories.

Cash – This is the safest form of investment. Technically, there is no risk involved with cash investment and so the returns are also minimal. You can do cash investment in saving accounts and term deposits. Even though the returns are low, you need to have a sufficient amount of cash on hand for an emergency.

Fixed Interest – These include government bonds. The government takes a loan from you with the promise of repayment with a fixed interest. These are also low-risk investments and hence the returns are low. The returns are usually higher compared to saving and fixed deposit options.

Real Estate – This is a high growth investment. You can invest in real estate by buying land or residential property. You can also invest in real estate through Real Estate Investment Trust (REIT).

Shares – The last type of investment is shares. These include mutual funds and ETFs also as the underlying asset in both types is mostly equity. This is a high-growth, high-risk investment.

What is an investment service?

You have your 9 to 5 job which has nothing to do with investment. Since the schools and colleges don’t provide financial literacy, the chances are investment decisions will be a headache for you. At the same time, making a smart investment is very important to have financial security. So what do you do? You can take help from investment service companies. Investment Services is a service that involves the management of your investment account or it can be just about taking advice with respect to the investment and/or reinvestment of assets or funds.

What are some common investment services?

You know there are different types of investments and also what is an investment service. There are a number of investment services that are available. Which one are you going to take? You can figure that out after understanding the different services:

Money Management – This about managing your overall money to ascertain you always have cash at disposal for an emergency, for fresh investment, etc. It is managing your money such that your taxes are minimized.

Portfolio Management Services – At the start of the article, we mentioned that an ideal portfolio is one that has a mix of all types of investments – stocks, bonds, cash, etc. Under this service, you get to know what percentage to invest in which asset class based on your risk appetite. You also get to know the best time to enter the market and when to make an exit.

Retirement Planning Services – Once you are clear with your retirement goals, you need to invest in a certain way to achieve your goal. This service helps you with the right kind of investment for a better after retirement life.

We are going to talk about an investment service company in detail further – Marcellus Investment Managers.

What is Marcellus?

Marcellus is an investment service company founded in 2018 with the sole purpose of influencing efficient capital allocation in the Indian economy. The company provides a portfolio management service (PMS) that not only focuses on delivering healthy returns to you but also aims to do so by taking relatively low risks. They are licensed by SEBI to offer Portfolio Management Services and Investment Advisory (IA) services.

Marcellus’ Investing Philosophy

Every Investment service company has a philosophy on which it operates or invests. Marcellus wants to channelize Indian household savings towards high-quality companies that have a long track record of efficient capital allocation and deliver a higher return to investors. The 3 pillars of their investing approach are:

Clean accounts – They follow a quantitative framework that uses a combination of capital allocation assessment and forensic accounting to create investment options.

Capital Allocation – Most of the companies which they chose for investment are the ones that generate free cash flows and they reinvest the cash in the business to fuel further growth.

Competitive advantage – They also do in-depth primary research to create a pool of companies that has deep competitive moats.

Read more investing: Hedge Funds : How to start your investment in Hedge Funds

INDmoney: Helps you to Simplify your Investments, Finances and Wealth Management

Investment Strategies offered by Marcellus

The company offers 3 different types of portfolio management strategies. They are:

Marcellus’ Consistent Compounders PMS

This is their flagship product which invests in companies that have a superior record of capital allocation, clean accounts, and high barriers to entry. They follow a filter-based approach to shortlist 25 to 30 companies. Once they have the list, they do bottom-up research of such companies to assess sustainability in the next 5 to 10 years. Once the stocks are selected they sit on these stocks for the long term. Since they have chosen the companies which have DNA to grow over the subsequent 10 years, you can expect good returns with this product.

Fee Structure

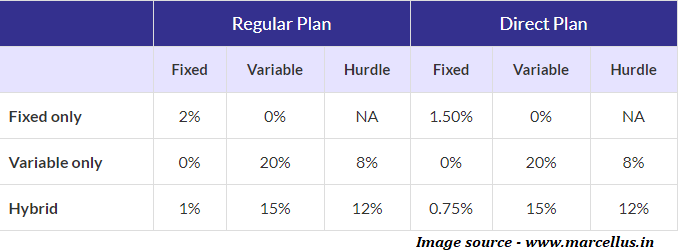

The minimum investment required to enter this product is INR 50 lacs. It comes with a ZERO entry load/exit load and there is no lock-in. There are 3 different types of fee structures. In the fixed structure, you will have to pay a fixed percentage on your investment at the start of the tenure. Variable only, it is a kind of profit-sharing where you share a percentage of the profits with them. Hurdle denotes the minimum return after which you need to share your profits. Hybrid is a mix of both the above two. You need to pay a fixed percentage on your investment and also share profits with them. In this case, the hurdle is usually higher.

Little Champs PMS

If you are looking to invest only in small caps then Little Champs does exactly that. They maintain a portfolio of around 15 small-cap companies which has excellent capital allocation and corporate governance and strong sustainable competitive advantages built around brands, business processes, and strategic assets.

Fee Structure

You need to invest a minimum of Rs 50 lacs to enter this product. There are two types of fees charged: Fixed fees of 1.5% per annum which is charged every quarter and Performance fees. The performance fee is 20% of the profit above the 10% hurdle. There is an exit load of 3%, 2%, and 1% if redeemed in the first, second, and third-year respectively.

Kings of Capital

This product invests in 10 to 15 high-quality financial companies of India which include banks, life insurance companies, general insurance companies, NBFCs, and asset management companies. They pick companies that have good corporate governance, a big barrier to entry, and prudent capital allocation. The thought process behind this product – As per RBI’s household survey, 95% of Indian wealth is in physical assets while only 5% is in financial assets. The non-lenders in the Kings of Capital portfolio therefore have a large structural opportunity to benefit from the financialization of Indian household savings.

Fee Structure

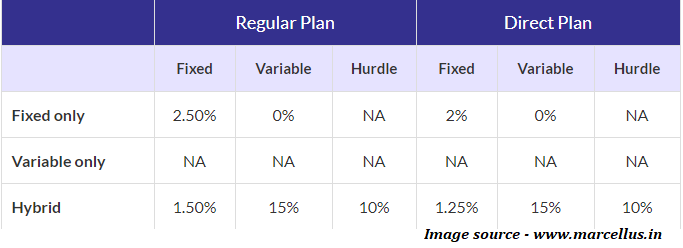

There is a Fixed and Hybrid fee structure under this product. Under fixed you have to pay 2.5% and 2% in regular and direct plan respectively. In the case of hybrid, the hurdle is 10% and the fixed percentage is 1.5% and 1.25% for the regular and direct plan. The profit you need to share is 15% in both cases. This product comes with zero entry and exit load and there is also no lock-in.

Benefits of taking Investment Services

When your investment is managed by an Investment Service company, there are a number of benefits you get:

You get to know hidden investment risks – Investing is also about risk management. Your portfolio will always be at risk since you are not trained to identify and manage risk. If you have an investment manager, he not only knows the risk associated with each asset class but knows how to work with it.

The benefit of Automation – As mentioned above, these companies work on a certain philosophy and defined rules. There is no scope for emotions. Their strategies are time tested so once you invest with them your money is going into a profit-generating machine (under normal scenarios).

You are protected during downtime – A portfolio manager not only ensures you are making money in good times but also ensures the downside is minimum during bad times. The managers do this by keeping a diversified portfolio, maintaining liquidity, etc.

Performance

Marcellus is a relatively new company but if you check its performance in the last one year it has outperformed the corresponding index in all its three products. They have highly flexible commission models, as well as investment plans. As per reviews available online they provide good convenience and satisfaction to all of their clients.