Investing in Water: ESG and Sustainable Investing

- 29 August 2021 | 1520 Views | By Abhinav Mishra

When we talk of investment, we think of the returns. You invest today when you are confident your investment will give you returns tomorrow. When we discuss equity investment, we expect the company to grow and hence the price to increase in the future. When it comes to commodities, you invest, hoping the demand will increase or it becomes scarce. In either of the two cases, the price will increase, and you make a profit.

Commodity investment is about investing in Gold, Silver, Aluminium, etc. One of the growing trends is now investing in water. Technically, it is not a commodity but consider.

Let us explore why so much noise around investing in water and how you can invest in water.

Why Consider Investing in Water?

We invest in things that are limited, and there is demand for the same. When it comes to water, it seems we have an unlimited supply. After all, 70% of the Earth has water. However, the kind of water we need for drinking, farming, in short, sustaining life, is limited. As per World Wildlife Fund estimates, two-thirds of the world’s population may face water shortages by 2025. A large part of the world population is already experiencing high water stress.

There is no doubt scarcity of water is a major world problem. It most likely will continue to grow. It allows forward-thinking investors to invest in companies that are working towards solving the problem.

How to Invest in Water?

Now that you know why to invest in water, let us talk about how to invest in water? Earlier, most of the water-related companies were managed and run by the state. However, the scenario is changing. Now they are either being run by private players or by public-private partnerships. It allows investors to invest in stocks related to water companies.

If you don’t know any such company, it is normal. Most investors are not aware of stocks around water since it is a relatively new investment theme.

You can invest in companies that produce water-related equipment, such as pumps, meters, and filters. Also, environmental companies that clean, purify or distribute water and invest in water utilities. Water utilities are more stable (less volatile sector), and conservative and moderate investors can consider investing in them. Companies around water utilities also give high dividends to the investors.

Read about Aggressive and Passive Investor

Stocks and ETFs

You will find a lot of companies in advanced nations that are working around water utilities. However, investors should be careful before investing in direct equity around water stocks. You should evaluate the company thoroughly as most of the water companies are subject to financial debt. Unless you know how to evaluate the company, you should not invest directly in them.

Investors can opt for Exchange Traded Funds (ETFs) to invest in water. Advanced countries like the US have a number of ETFs around water. These ETFs hold the shares of companies that invest in water purification, construction, pipeline, and other related equipment.

You can check everything about ETFs here.

Water stocks in India

If you want to Invest in water and you are looking for Indian listed companies, below are the top three companies to explore –

Ion Exchange – It is engaged in the environment and water management business. The company offers water treatment plants, exchanges resins, and chemical additives.

Triveni Engineering and Industries Ltd – Water is only a part of the company’s business. It deals mainly with engineering businesses, gearboxes, and water and wastewater treatment solutions. The company generates decent size revenue from the water segment (Rs 175 crore).

VA Tech Wabag – It is one of the leading companies in the water sector. Its principal activities include design, installation, supply, operational, and construction management of drinking water.

Water ETFs

There are no water ETFs in India as of now. However, it is possible to invest in US ETFs from India. Below are the top three ETFs you can explore –

Invesco Water Resource Portfolio ETF – It is the largest water ETF in the US. It consists of 38 US companies. Most companies are small and mid-cap companies.

First Trust ISE Water Index Fund – It includes companies that derive a substantial percentage of their revenues from the potable and wastewater industry. The fund selects the top 36 stocks from the sector by market capitalization.

Invesco Global Water Portfolio ETF – The Fund invests at least 90% of its total assets in companies listed on a global exchange that create products designed to purify and conserve water for homes, industries, and businesses.

When you invest in water, ensure you only have limited exposure to this sector. Diversification is essential, and when you decide to invest in water, ensure you are diversifying within the sector.

Michael Burry and Investing in Water

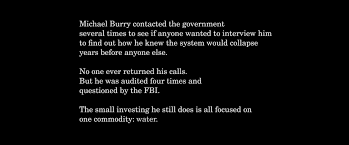

If you have followed the various textual and cinematic adaptations of the 2007 subprime mortgage crisis, it is difficult to ignore Michael Lewis’s The Big Short.

Detailing extensively about the causes of the crisis, the book also details Scion Capital and its fund manager, Michael Burry. The book, when turned into a star-studded movie, had this image as a part of its end captions:

ESG Investing, specifically water, has come a long way since then. Stocks, ETF’s and AIFs focusing on the water are here to stay. Considering the increasing global concern towards the conservation of water, this sector bats heavily to be called bullish.

Have you started investing in water? Read about: