How to apply for IPO?

- 5 November 2021 | 2000 Views | By Abhinav Mishra

Over 30 IPOs have come so far in 2021. Some of those have given exceptional listing gains to investors. The IPO euphoria is likely to continue in the coming months. The success of some of the recent IPOs has drawn the interest of many. The question is – how to apply for IPO?

What is an IPO?

Initial Public Offering (IPO) is the offer a company makes to the public to subscribe to its shares. Different companies have different reasons for raising funds through IPO. For example, some companies may launch an IPO as part of an expansion plan. Some IPOs come as existing shareholders want to sell their shares to the public (and book their profits).

What is ASBA?

Before we get what you need to apply for an IPO, let us understand ASBA. You can apply for an IPO through a bank that provides you ASBA facility. Application Supported by Blocked Amount (ASBA) allows you to invest in an IPO with ease.

When you invest through ASBA, the amount does not get deducted from your bank account. The amount is blocked against your IPO application and it only gets deducted once you are allotted shares of the company.

The amount is unblocked if no shares are allotted to you. However, you will continue to earn interest on the amount for the period it was blocked.

Essential for applying IPO

If you plan to invest in IPO, you will need to have below with you:

PAN card – issued by the Income Tax department that is required to open a Demat account.

Demat account – You open a bank account to keep your money there and do different transactions. Similarly, you need a Demat (dematerialized) account to hold shares and securities in digital format. The Demat account is maintained by Depository Participants (DPs) and there are only two DPs in India – NSDL, and CDSL.

Read about NSDL in detail here.

Trading account – Just having a Demat account won’t be enough. As mentioned, it is just a platform to hold shares. You need a trading account with any brokers to sell your shares. If you are allotted shares for an IPO, the shares will be stored in your Demat account and visible in your trading account. You can sell shares from your trading account.

Read about the top two brokers here

An account with a bank with ASBA or UPI ID – You will need an account with a bank having an ASBA facility or UPI id.

How to apply for IPO through a broker?

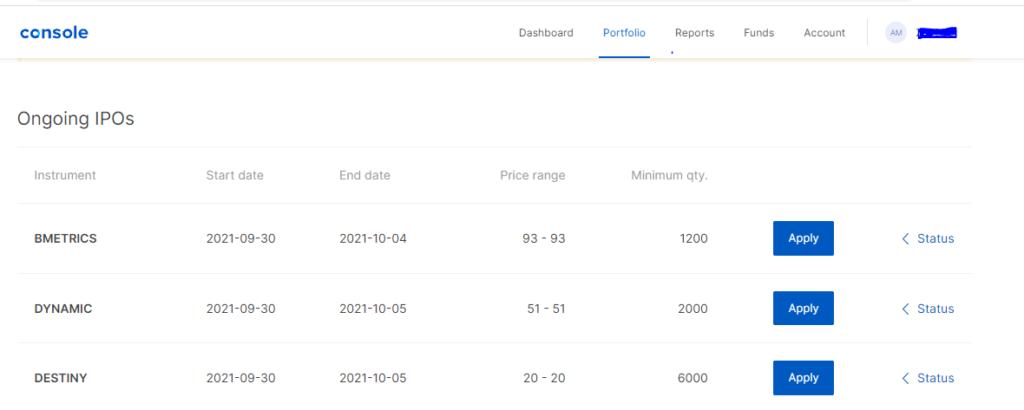

Applying for an IPO through a broker is a lot easier. You can go to your broker’s website and find the IPO section. For example, in Zerodha, you will see the list of open IPOs under Portfolio in Console (a feature of Zerodha), as shown below.

You will see start and end dates, the price range, and the minimum quantity you need to apply for all the IPOs. In most cases, the price range and minimum quality are kept such that the investment amount is between Rs 14000 and Rs 15000.

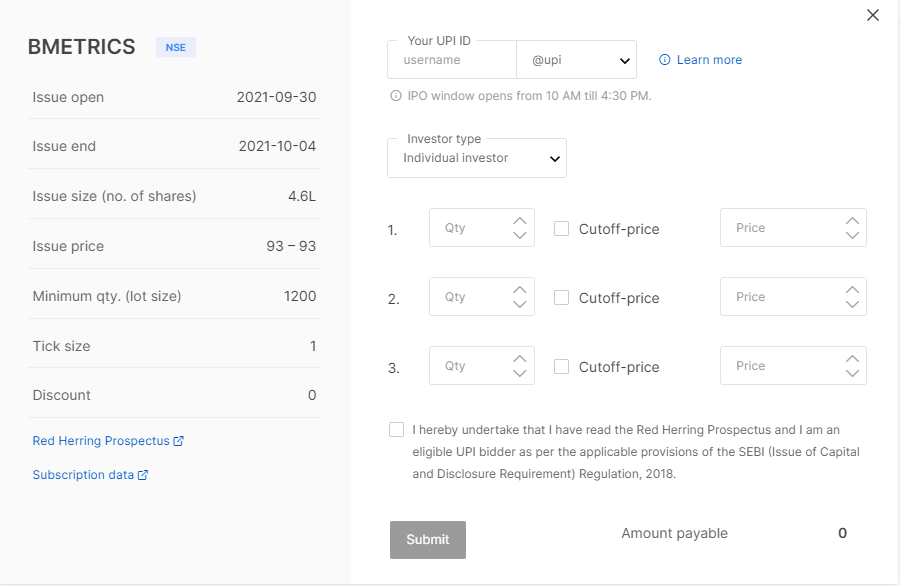

Once you click on apply, the form will open up. The advantage of applying through a broker is that your Demat-related details are already with them. You only have to give your UPI id, the quantity, and the price. You should always apply for an IPO at the cut-off as the chances are higher at a cut-off price for an IPO in demand.

Provide your correct UPI id and submit the form. Then, a mandate request is sent to your UPI application for approval. You need to login into your UPI app and accept the mandate.

Applying through Bank

Most banks have an ASBA feature on their website. You can login to your bank and go to the ASBA section. Just like with brokers, you will see a list of open IPOs. To apply using ASBA, you will need to know your Demat account number.

- If your account is with CDSL, it will be a 16 numeric digit

- If your account is with NSDL, it will be two alphanumeric ‘IN’ followed by 14 numeric digits.

The other details will be the same as in the case with brokers.

Few points related to the IPO process

- You can apply for one lot or multiple lots of IPO. Retail investors can invest up to 2 lakh.

- Applying for IPO does not necessarily mean you will get the IPO.

- Whether you will get the shares is a question of demand and supply. If there were only 1000 lots on offer and investors have applied for 10,000 lots, only 1 in 10 gets a lot.

- There are different categories, and each has a reservation. Retail investors quota in most cases is 35%.

On a closing note – there are a lot of IPOs that come in a financial year, and not every IPO will give you returns. You need to understand the business and the reasons the company is coming with IPO. If you are new to investment and IPOs, you should consult a financial advisor before applying for an IPO.