Greater Fool Theory : Understanding the Important Aspects of it

- 21 August 2020 | 1861 Views | By Abhinav Mishra

As an investor, you must be aware of the term – market bubble. A market bubble is an economic event in which prices of any asset (gold, real estate, or stock) rise dramatically and the price is much higher than their fundamental value. In the past two decades, investors have seen two market bubble, the tech-stock bubble that occurred in the late 1990s and the real estate market bubble that occurred in the mid-2000s. You can view a bubble as self-generating and self-sustaining waves of optimism that drive up asset prices and cause investments to be misallocated. There is no data that can explain why an asset bubble is formed and when does it burst.

However, there is a theory that explains the continuation of a bubble to a certain extend – The Greater Fool Theory. In this article, we are going to learn everything about the theory.

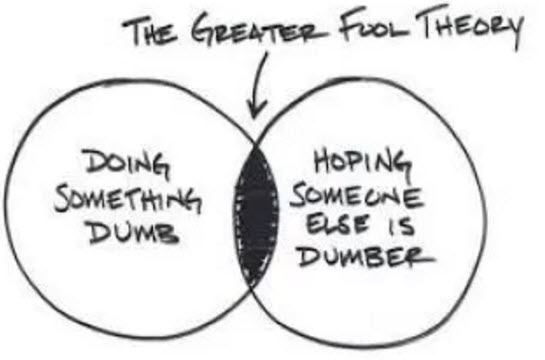

What is the Greater Fool Theory?

The Greater Fool Theory is the idea that one can make money by buying overvalued assets and selling them for a profit later because it will always be possible to find someone who is willing to pay a higher price. If you buy the theory, you will buy potentially overvalued assets without any regard for their fundamental value.

With this theory, you believe that you can make money by gambling on future asset prices and that you will always be able to find a “greater fool” who will be willing to pay more than what you did. Unfortunately, every bubble has a life and it eventually bursts, which leads to a large sell-off in the market and a rapid decline in the asset values. During the sell-off, you can lose a great deal of money if you are the one left holding the asset.

Taking the example of the stock market, the Greater Fool Theory (GTF) becomes relevant when the price of a stock goes up so much that it is being driven by the expectation that you can sell it to someone for a higher price, not by the intrinsic value (cash flows) of the company. Under this assumption, any price (no matter how high) is justified since another irrational buyer presumably exists who is willing to pay an even higher price.

Greater Fools keep entering the market at higher and higher costs and the market is on the rise. With the entry of more and more fools, who are expecting still bigger fools to enter the market following them at still higher costs, the market gradually reaches a point of saturation. It is a point beyond which there are no greater fools willing to enter the market. In other words, there are no investors left who are willing to purchase at that level. This is the point where the market bust and reversal happen and the last of the fools who had entered the market at the highest costs, expecting that there would be still greater fools willing to purchase at higher costs lose the most.

Is Reliance making us Greater Fools?

A perfect example of this is Reliance Industries’ present scenario. The stock price has more than doubled in the last 5 months and the price is still on the rise. Even though the company has got cash inflow by selling a stake in its Jio platform but the intrinsic value of the company has not seen a significant change in this time period whereas the stock price has doubled. What an investor is thinking when he buys a Reliance industry share at the current level? If you are one of them, you may not be aware of it, but what you are doing is playing with The GFT.

Should you buy an overpriced stock based on the premise that you can make money because of the greater fool theory?

You cannot deny GFT exist since there is ample evidence to support it. But can you count on them? The first answer that comes to mind is – No. Here are a few reasons for it:

- The greater fools are attracted to the stocks that are hot, they have nothing to do with steady performers or value stocks. The major problem with them is their impatience, at the first sign of trouble (stock price go down or a hiccup), the greater fools will exist the stock and move to the next hot stock. You will be left behind with overvalued stock?

- The stock market follows the law of gravity, what goes up has to come down after a certain point of time. You cannot predict when the reversal will happen and if you enter the market just before the reversal, you may not find a greater fool.

- The reversal can happen in a split second and you may never know when it did. To be successful in this game you have to pay attention. You may have to check the stock prices at least twice a day, if not multiple times in a day. Do you have the patience, time, and discipline to do that? Unless you’re a full-time day trader, it won’t be a good idea to play the greater fool game.

Other examples of Greater Fool Theory

Bitcoin

If you have been following the cryptocurrency market for the last 5 to 8 years, you will notice Bitcoins occasionally making headlines – a lot of people having discussions and debates on their value and profitability. What are they valued so high?

If you look at Bitcoin as an asset, its value is zero. Another way to look at Bitcoin is to look at it as a commodity, whose value is based on its inherent value. The inherent value of gold would depend on its utility as a metal and its usefulness in different areas. By this logic, Bitcoin does not have any such inherent value, its value should be equal to zero.

The reason the Bitcoin is trading so high is because most of the investors holding Bitcoin are playing the greater fool theory. Investors believe that the value of Bitcoin will go up in the future, due to which they will be able to sell it for a higher price.

Gold

Gold this year has seen an amazing rally, what do you think has been the driving factor? Yes, the equity market is risky at this moment given the pandemic situation but the rally of gold is not just because investors are looking for safe investment. It is an example of GFT.

Startups Offering Digital Gold in India

How to Avoid Being a “Greater Fool”

Since you now know, you can lose big if you become ‘greater fool’, so here are ways you can avoid being a greater fool:

- Don’t blindly follow the herd, and fall in the trap of paying higher and higher prices for something without any good reason.

- Follow a plan and do your research.

- Always opt for a long-term strategy for investments to avoid bubbles.

- Diversify your portfolio with different assets.

- Resist the temptation to try to make big money in a short time.

- Understand that there is no sure thing in the market, not even continual price inflation.