Elizabeth Warren and 50/30/20 Rule for Personal Finance Management

- 11 October 2019 | 1862 Views | By Mint2Save

Money management is a continuously improving dynamic process, where one balances his income with his savings, necessary expenses and luxuries. Vital to one’s present and future, there are ample options to enhance as well as ruin one’s money management practices. Many of us carry on with long jobs, working multiple shifts, distant from homes, travelling frequently, making a sales almost every hour. These trade offs are a common feat in every working class hero like lifestyle.

In this cobwebbed life, personal finance or personal money management doesn’t reap visible results in at least a decade. There have been a few attempts in rationalizing one’s income with the necessary expenses, luxuries and debts, and in this article, we cover one such rule called the 50/30/20 rule.

This rule is accepted as the key to a reasonable modern day living, that can encompass not only major expenses and investments, but also has a fair share for the luxuries that one gets lured into. However, following this rule can help in avoiding the debt spiral.

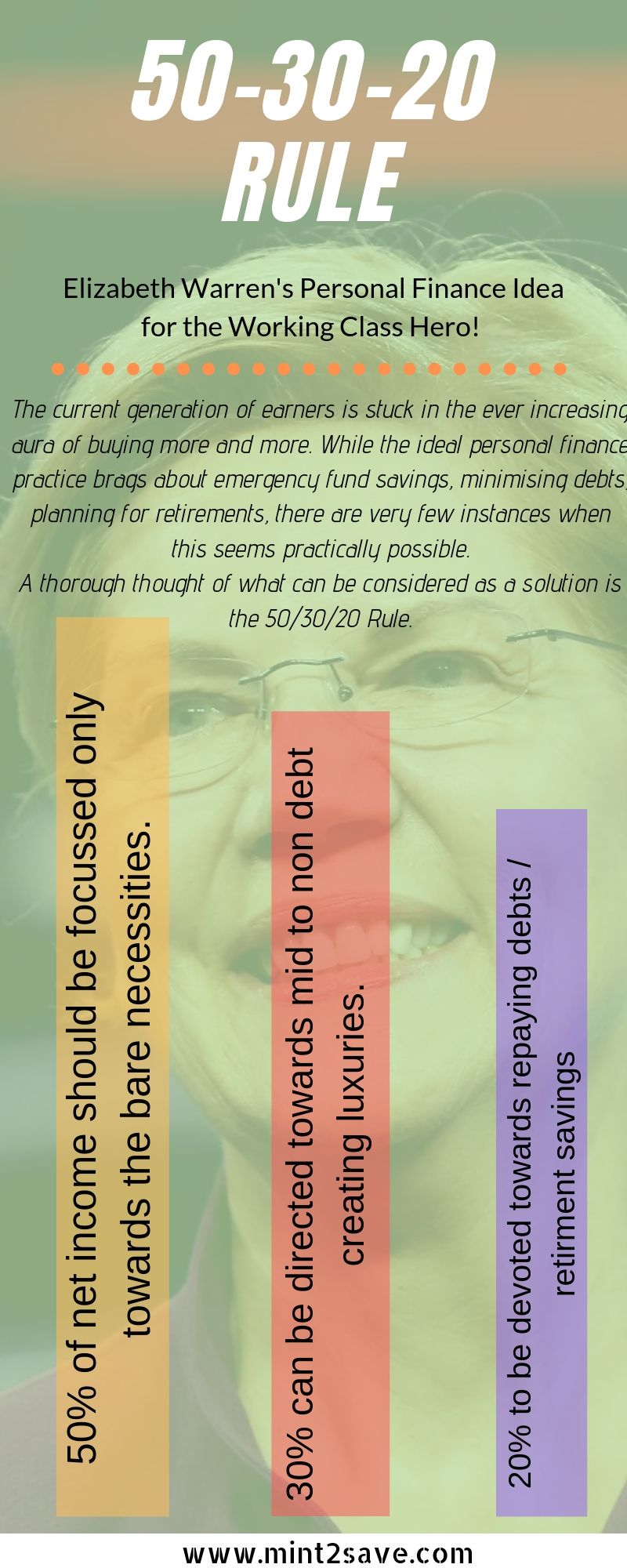

Understanding the 50-30-20 Rule

Globally accepted, yet not openly acknowledged is the 50-30-20 Rule. Ideated by Elizabeth Warren, this rule derives its essence for and from an average salaried man.

Let us understand how it works.

Step 1:

Consider the Net Salary credited into one’s savings / salary account, i.e., after all deductions such as taxes, provident fund contribution, pension fund contributions, etc.

Step 2:

50% of this net income, should be focussed only towards the bare necessities, such as

(a) Payments of mortgage loans,

(b) Essential utility bills such as electricity, water, maid etc.

(c) Groceries and basic food items

(d) Transportation (irrespective of public or personal, expenses should be kept aside)

(e) Childcare

(f) Healthcare, insurance premiums etc.

Step 3:

30% of the net income is then recommended to be kept aside for the following expenses:

(a) Bill Based services such as Cable Television, Hi-speed internet, phones

(b) Eating out / casual snacking or Dining out

(c) Entertainment such as movies, shows etc.

(d) Gadget and service based personal care

(e) Shopping for clothes, furniture, or anything non vital.

(f) Casual, festive or occasional travel

Step 4:

The remaining 20% should be focussed on repaying additional / unnecessary debt or savings for the retirement. This is the surplus amount, which one ideally generate, once he is able to sort out his expenses and catergorize the same as per the 50/30/20 rule.

Step 4, reveals an interesting feature of everyday financial planning: additional / unnecessary debts. This includes the luxuries that one has created, by incurring debt. These includes expensive cars, exotic holidays, credit card spends on jewellery.

Further, when it comes to retirement savings, you can diverse it out with equities, stocks, debt mutual funds.

For the modern day man, while there are several ways popping up for spending money, there are few new income generation sources. Further, unreliable leadership, increasing frequencies of cheating in businesses has tremendously hampered one’s investment appetite.

This six digit, single rule takes all sorts of loans, irrespective of them being secured (mortgage) or unsecured (credit cards), expenses (luxuries or necessities) into consideration. When abiding by this rule, personal loans also come into consideration and one can tap his repayment capacity, without needing any assistance from the lender. One mantra to rule them all:

The sheet of as much as the sheet of the feet