Debt trapped? Explore Loan Settlement

- 23 March 2023 | 1097 Views | By Abhinav Mishra

With the credit process getting easier, people are often falling into the debt trap. With climbing interest rates, along with the need for instant gratification, getting a debt trap has become one of the latest trends with this generation.

Have you ever taken a personal loan? Are you using a credit card and spending heavily on it? As long as everything is going smoothly in life, we don’t care much if the answer to the above questions is YES or NO. Sometimes life takes a U-turn, and one goes through the life low, then such questions start haunting.

The bank and the credit card company do everything in their capability to get their money back. Sadly, even if the borrower is going through a tough time. There could be life situations like the loss of a job or medical emergencies where one cannot pay the due bills. During such time, the person is going through mental stress, and the banks make it even harder for the borrowers. Is there a way out of such a situation? Until recently, there was none, but now there is – Loan Settlement.

What is a Loan Settlement?

It is a fintech company that aims to help people in India who are in financial distress. They make you come out of debt traps. If you or anyone in your network has ever defaulted on loan repayment, you would know, recovery agents, make the life miserable of such people. It is despite Supreme Court judgments not to use strong-arm tactics in recovery.

The debt settlement process is common in advanced nations like the US and the UK. In India, no one is on the side of consumers who are not in a position to repay the loan due to circumstances that are beyond their control. Loan Settlement helps such consumers to pursue debt settlement options wherever possible.

They help you with the below loans:

- Credit card loans

- Credit card payments

- Personal loans

- Other Unsecured loans

In what areas does the company work?

The company can help you in one of three situations –

You cannot pay your personal loan EMIs – If you are frequently missing on your EMIs, you can get in touch with the company and enroll in their debt settlement program.

Credit card bills are increasing – If you have failed to pay your credit card bills and you see no way of making the payments in the near future, you can reduce your liability with the debt settlement program.

High-interest rate – You should never take a loan to pay another loan. If you are thinking of doing it, you are getting into a debt trap. The better solution is to go with Loan Settlement.

How does the Loan settlement process work?

There are five phases in the loan settlement process:

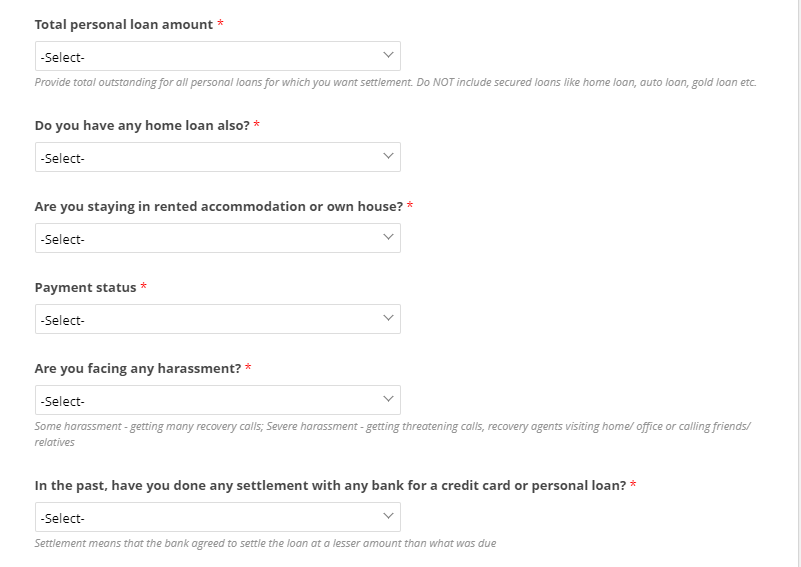

Check Eligibility – You have to share details of your unsecured debts (credit card or personal loan) with the counselors to figure out if you are eligible for debt settlement.

Enroll – Once your eligibility is confirmed, you can sign up for a suitable plan and sign a legal agreement that protects your interest and enables debt settlement.

Save – You can save monthly into an escrow account, and the Loan Settlement company will handle all the communication with the creditors to protect you from any harassment during the settlement process.

Negotiate – Once you have saved sufficient funds in the escrow account, they will negotiate with creditors to settle your loans for significantly less amount compared with the outstanding amount.

Settle – They will work to get you the best saving possible. The loan settlement will only happen after your approval. Once the amount gets settled, you receive a settlement letter and become debt-free.

How do I get assistance from them?

If you or anyone in your network needs help to settle loans, they can contact the company to settle the loans at less than 50% of total outstanding dues. You can contact them with your problem by filling the form.

You will have to provide personal details, financial details like employment status, monthly income, area you need help with, and other relevant details. Once you submit all the details, the counselor gets in touch with you for further discussion.

It is an excellent service for people who cannot make EMI or credit card bill payments. You need to understand – you will still have to arrange the money to start the settlement process. It is definitely a relief if the settlement happens at half the amount. The company claims they can for those who cannot make the complete payment.