Credit Karma: Free Credit and Financial Management Platform

- 25 August 2020 | 1166 Views | By Abhinav Mishra

A credit score is important for every individual. Though you can survive with a bad credit score, it won’t be easy surviving. With a good credit score, you can save money and make your financial life much easier. Since the credit score is important you need to be updated with your credit score regularly.

In this article, we are going to talk about Credit Karma which solves the purpose.

What is Credit Karma?

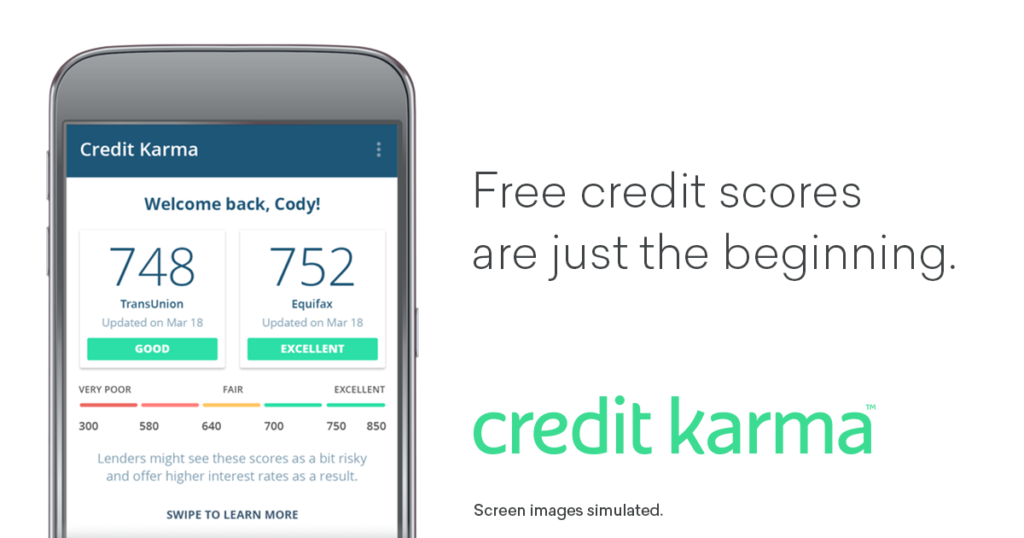

Credit Karma is a free online service that offers you a monthly credit score. The company was started in 2007. They provide credit monitoring, credit card, loan recommendation, and federal and state income tax preparation.

Other than free credit alerts, you get below services when you Signup with Credit Karma:

Dispute errors

The platform lets you dispute an error on your credit report if there are any. If you think you are paying too much in interest, Credit Karma helps you with that even.

Member Reviews

The platform takes reviews from other members on various credit cards and loans so your decision making becomes easier. These reviews are not just for namesake but actually carry weight. These reviews contain information like users’ experience with customer service, how people earn rewards, and redeem rewards. You can also find the odds of approval of your credit card application.

Identity monitoring

They use your email address to search for breached accounts and threats to your identity. If there are any threats detected, they will tell you what actions to take. For example, they may tell you which passwords you should stop using. To not face a similar situation in the future, you will get free alerts and updates so you can spot and stop identity theft.

Unclaimed money

It may happen that a business owes you some money and for some reason, it was not able to send it to you. The amount is returned to the state. The state holds onto that money and keeps a list of who it belongs to. If a part of that money is yours, Credit Karma lets you file a claim for it so it can reach you.

Tools and Education

They have a learning platform which you can use to learn everything about credits. They also have financial calculators and educational articles which will help you better understand various topics around credit.

Free Tax filing

This feature was started in the year 2016 which lets you file federal and state income tax.

Is Credit Karma tax-free?

Credit Karma will file any tax return for you for free. Even if you are looking for a complex Schedule C, D, or E form to file or if you have self-employment income or you have investment income to report, Credit karma helps you in each case. Credit Karma Tax can be a good option to consider if you are tired of having to constantly decline your current tax programs numerous attempts to upsell, or you can file a federal return for free but have to spend a small fortune to complete your state tax return.

If you compare its service with TurboTax or H&R Block that provides expert advice and automatic data imports, you will not find the Credit Karma Tax filing interface user-friendly. However, the key difference is those are paid service and Credit Karma is completely free. You have the choice of using the premium feature but taking a few extra minutes to manually input all your information can be worth the savings. Plus, it’s still much quicker than doing it with pen and paper.

What Credit does Karma deal in?

- Credit Cards – They help you with all services when it comes to credit cards. Based on your credit score, you can choose Shop Credit cards, Balance Transfer cards, Reward cards, Travelcards, Cash Back cards, 0% APR cards, Business cards, Card for Bad credit, cards for fair credit, Secured cards and many more. Find out All You Need To Know About Credit Card Limit

- Auto Loans – You can get a new Auto loan from the suggestion made by Credit Karma, refinance your existing loan, or get auto insurance from the recommendations shown to you.

- Personal Loans – Gives you various options for personal loans, showing the best interest rate you can get based on your credit score. Read about Inconvenient Truth about Personal Loans

- Home Loans – gives you recommendations for best home loans on offer. To receive a quote, you will have to enter more personal information including your age, income, and employment information. Based on recommendations, you can compare interest rates.

How does Credit Karma make money?

Once you register with the Credit Karma, you get your scores and reports, you get access to your credit scores and reports from Equifax and TransUnion with weekly updates. Credit Karma also recommends products to you which can help you save money based on your credit profile. If you make a purchase using the recommendation by them, they get paid by the bank or the lender. The advantage with Credit Karma is that you get credit offers that you really need or are beneficial for you.

If you have an excellent credit score and Credit Karma is aware of the information then it can advertise you a product from a particular bank that is willing to pay big bucks to target you with their best loans and credit cards because it’s ultimately cheaper for the bank over running ads to thousands of people who may never qualify for their products.

What is Credit Karma savings?

Credit Karma also lets you create a savings account. The best part is there is no minimum amount you need to keep. There is also no fee of any kind. They will offer you a saving rate of 2.03% APY. When compared to other saving accounts nation-wide which offer a rate of 0.09%, it is giving you 22 times more interest. You know the interest rate keeps on changing, however, Credit Karma always offers the best APYs to its customers leveraging technology and a network of 800 banks.

Is Credit Karma safe for savings?

It is important to note, Credit Karma is not a bank. But you should not worry, your money will still be insured by the FDIC up to $5 million. They have partnered with the West Virginia based MVB Bank, which will house the funds and offer consumers FDIC insurance on their savings for up to $5 million.

Your money may move to one of Credit Karma’s other network banks so you can earn a better rate, but it will always be FDIC-insured.

Are online savings accounts worth it?

If you are looking for a direct answer then there is none. The answer totally depends on your needs and situation. When you put your money in a savings account, you have access to it all the time which means you have liquidity. Another advantage is safety, if you put your money in a bank with FDIC insurance or a credit union with NCUA insurance, you don’t have to worry about the safety of your money.

If you look at the other side of the picture, you are offered a very low-interest rate in a savings account. When compared to other options, saving account offers the minimum interest rate. Also, there are various types of fees involved when it comes to opening and maintaining a savings account. In most of the cases, you have to keep a minimum balance so you don’t end up paying additional charges.

Is Credit Karma legitimate?

Yes, it is a legitimate and free website. You don’t need to put in your credit card details or remember to cancel the trial version since it does not ask for any such details to let you use their platform. They don’t share your personal information with unaffiliated third parties for marketing purposes. They ensure the highest safety of data by using 128-bit encryption to protect the transmission of your data to their site.

What is a good FICO score?

FICO stands for Fair Isaac Corporation (FICO). It is a data analytics company based in San Jose, California focused on credit scoring services. If you apply for a loan, lenders will use your FICO scores along with other details on your credit report to assess credit risk and determine whether to grant credit or not. FICO scores range from 300 to 850. A FICO score of 670 or above is considered a good credit score, while anything above 800 is considered exceptional.

Is 650 a good credit score?

If you are measuring with FICO standard, you will be 20 points short to fall in a good credit score category.

Why does a credit score drop when you pay off debt?

Yes, your score does drop when you pay off a debt but in most cases, it is only temporary. Here are a few reasons why this may happen:

Only installment account – You have a good credit score when you have a mix of installment accounts (loan) and revolving accounts (credit cards). If the loan you paid off was the only installment account you had, you lose up some points since you no longer have a mix of both types of accounts.

Low balance – The balance in your open account also impacts your credit scores. If the loan you paid off was the only account with a low balance, and now all your active accounts have a high balance it might also lead to a score drop.

What are the limitations of Credit Karma?

- There are three major credit reporting bureaus – TransUnion, Equifax, and Experian. Credit Karma uses only two of the three major credit bureaus as mentioned above, so your score might not be entirely accurate.

- Credit Karma updates its scores once per week. For most people once per week reporting is great, but if you’re planning to apply for credit in the near future, you may need more frequent updates.

Overall, the company is highly transparent in what it does and how it does and millions of people have used it for years.