Understanding Asset Allocation: Insight into Strategies, Importance and More

- 5 August 2020 | 1304 Views | By Mint2Save

Let us break the term into two. An asset is a resource having economic and financial importance that an individual, corporation, or country owns or controls with the expectation that it will provide a future benefit to them. An asset could mean anything to anyone; it can be anything from your home to your right to collect royalties on a book that you wrote. The term “allocation” means the action or process of distributing something. So combining the two meanings, asset allocation refers to the strategy of dividing your investments among different asset categories, such as stocks, bonds, real estate, cash, and cash alternatives, etc., to best suit your goals. It aims at balancing risk versus reward but with more than thousands of stocks, bonds, and mutual funds to choose from, picking the right investments can confuse even the most seasoned investor.

Asset allocation – Overview, Examples, Strategies

What should Asset Allocation be?

An ideal asset allocation is a mix of various kinds of investments; from most aggressive to safest, that will earn the total return over time that the investor desires. Although there are no guarantees that any specific mixture of investments will be more profitable or less risky than any other, a concrete diversification strategy assists in optimizing a portfolio of investments. An investor can diversify their portfolio in 3 broad categories:

How to choose an Asset Allocation?

Investors want to diversify their portfolio to maximize reward and minimize return by holding a portion in stocks and a portion in bonds, which helps to maintain the balance. During a situation of market downturns, stocks suffer but on the contrary, the bonds thrive; in a bull market, the stocks appreciate and the bonds lose value. Moreover, it is important always to keep a portion of the portfolio in cash or other liquid assets.

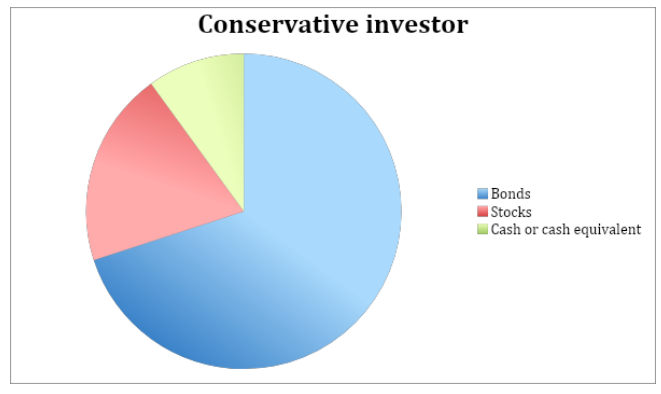

A conservative asset allocator would put 70 percent to 80 percent of available capital in bonds as they provide fixed returns without much of risk involved, 15 percent to 20 percent in stocks, and the balance in cash or other cash equivalents.

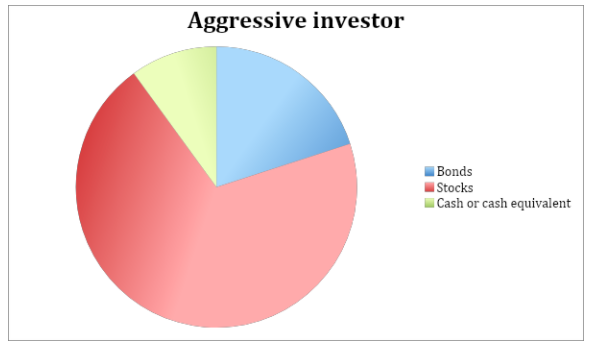

Alternatively, an aggressive asset allocator would place up to 70 percent of available capital in equity, as they provide higher returns with higher risk involved, 20 percent to 25 percent in fixed income sourced like bonds, and the balance in cash.

How does asset allocation work?

Asset allocation is an investment policy to spread investor’s portfolio across a varied range of different asset classes. As a general rule, assets with higher levels of risk are also likely to provide higher anticipated returns, so dividing the portfolio amongst asset classes gives the investor the potential to balance both. Investors sometimes also like to spread their investments over several geographical regions. This is done to minimize the risk of all the investments falling simultaneously. There is no set formula that can find the right asset allocation for every individual. The goal of allocating assets is to minimize risk while meeting the level of expected return.

What is the safest asset to own?

Safe assets are those assets that do not carry a high risk of loss across all types of market cycles. Some of the popular types of safe assets historically include real estate property, cash, Treasury bills, money market funds, and gold, etc. The safest asset class is also known as risk-free assets such as sovereign debt instruments issued by governments of developed countries.

What are the important elements of asset allocation?

Asset allocation is one of the most important decisions that investors must make when building a portfolio. The important or key aspects to keep in mind while deciding about asset allocation includes:

- Risk vs. Return: Asset allocation strategy offers implementation of a plan that tries to balance the risk versus the reward by fine-tuning the percentage of each asset in an investment portfolio with the investor’s risk tolerance capacity, their goals and investment time frame. It’s a well-established fact that every year investor’s returns are going to be beaten by another investor, mutual fund, pension plan, etc. What separates a greedy and return-hungry investor from successful ones is the aptitude to contemplate the relationship between risk and return. Investors with a higher risk tolerance capacity should allocate more funds into stocks or equity. But if they can’t remain invested through the short-term fluctuations of a bear market, they should balance their exposure to equities by investing in safer options like the bonds.

- Evaluating the time horizon: In general, if the investor’s horizon for investing in the long-term, they may consider taking on more risk with their investments, as they have a longer time in hand to ride out the inevitable ups and downs of the market. On the contrary, if the investment horizon is short term, they may consider investing in classes of assets offering lesser risk.

- Rebalancing the portfolio: Rebalancing means altering the proportion of different asset classes in a portfolio. Asset allocations can fall out of orientation as investors change their position and the economy changes. Rebalancing tunes the allocation of assets in a portfolio to a more appropriate level of risk. Professional investors are frequently looking to rebalance their portfolios, while the individuals rebalance less frequently.

- Tax effect: The investor even needs to consider the tax implication on the investment they are proposing to make. One way to attain better tax efficiency is by increasing the investment in tax-advantaged vehicles. The investor needs to analyze the tax implications on the returns on different asset classes and then decide as to the proportion of investment in different asset classes.

Which asset class has the highest return?

Stocks or we can say equities have been considered the source of the greatest historical returns for investors, outperforming all other types of financial securities. But whether stocks are the best investment also depends on the time frame investor chooses to remain invested in and the investor’s investment horizon.

What is the best asset allocation strategy?

There is no fixed rule for the best allocation strategy. The asset allocation that works best for any investor at any given point will depend largely on their time horizon and their ability to tolerate risk. The most important thing to remember is to maintain a diversified portfolio with a risk to reward ratio that matches the investor’s requirements. Following are the types of asset allocation strategy:

- Age-based asset allocation: Under this, the investment decision is based on the age of the investors. The figure of proportional investment depends on the life expectancy of the investor. The higher the life expectancy, the higher the portion of investments committed to riskier areas, such as the stock market and low exposure to bonds to get higher returns.

- Tactical Asset Allocation: Tactical asset allocation aims at maximizing short-term investment strategies. An investor takes a more active approach under this strategy and tries to position a portfolio into those assets, sectors, or individual stocks that show the most potential for perceived gains.

- Strategic asset allocation: The objective of strategic asset allocation is to create an asset mix that seeks to provide the optimal balance between expected risk and return from a long-term investment horizon.

- Dynamic asset allocation: The dynamic asset allocation strategy is one of the most popular strategies of asset allocation. It allows investors to alter their investment proportion based on the highs and lows of the market and the gains and losses in the economy.

Why asset allocation is so important?

Asset allocation not only helps investors reduce risk through diversification but also ensures that the investor reaches their financial goals. Factually, the returns of stocks, bonds, and cash haven’t moved in harmony. Thus, if the value of one asset class declines significantly, the impact on the portfolio overall is minimal. The outcome being less volatile for investors on a portfolio level as these movements in the prices offset each other. An investor that isn’t taking on plenty of risk might not create higher enough returns to reach their goal, on the contrary, while an investor that’s taking on excessive risk may not have enough money when they need to access it. Picking the right asset allocation assists to avoid these issues by ensuring that a portfolio is well-positioned to reach the financial goals of the investor. More so, it isn’t a one-time decision. Rebalancing the portfolio is a must from time to time to see if it is still meeting your needs and goals.

Conclusion

While there are many ways to invest, there is no one-size-fits-all approach to investing. While deciding an investment strategy based on the above concepts doesn’t guarantee the outcome that the investor seeks but one can know that the resulting portfolios rooted in a research-driven approach that, over time, has tended to provide the outcomes investors need. By selecting the right mixes of stocks, bonds, cash, and other asset classes, investors can ensure that you reach their financial goals.