15 Lessons you can learn from the Book: “Rich Dad Poor Dad”

- 11 July 2020 | 5413 Views | By Abhinav Mishra

If you have anything to do with wealth and financial freedom (sure you do) then you should read the book – Rich Dad Poor Dad by Robert Kiyosaki. If you have not, this article will list down all the learning from the book.

In the book, Robert tells his story of growing up with two dads – his real dad and the other dad of his best friend, who is a rich man. He compared the two father’s mindsets on money and how that shaped his thoughts on money. The basic difference between the two fathers teaching was –

The poor dad taught him – ‘Love of money is the root of all evil.’

The rich dad taught him – ‘Lack of money is the root of all evil.’

What are the Rich Dad Poor Dad lessons?

Below are all the lessons from the book:

1. Work with your thoughts

The negative thought process is something you need to get rid of. If you have a habit of saying ‘I can’t afford it’, then you restrain yourself from thinking the various possibilities to grow. The positive and right statement would be – ‘How can I afford it?’ With this statement, you open up to explore possibilities.

2. You get experience and you become smarter taking risk

Unless you take a risk, you cannot grow, grow as in grow really big. You should take a risk because some opportunities in life have the potential to change the course of your life. In the book, Robert took a risk with his first investment. He bought a small $18000 condominium in Hawaii and rented it for $25 a month. Although, he did not earn a lot from the investment but it made him smarter about investment. His future investments made fortunes for him.

3. Everyone needs to be a financially literate

‘Intelligence solves problems and produces money. Money without financial intelligence is money soon gone.‘ The sad part about the education system around the world is that it teaches to work for money. The system never teaches how to make, manage, and keep the money. You should learn how to create wealth and make a plan to achieve financial freedom. To achieve financial freedom, one has to keep in mind the inflation factor and have the right mix of investment.

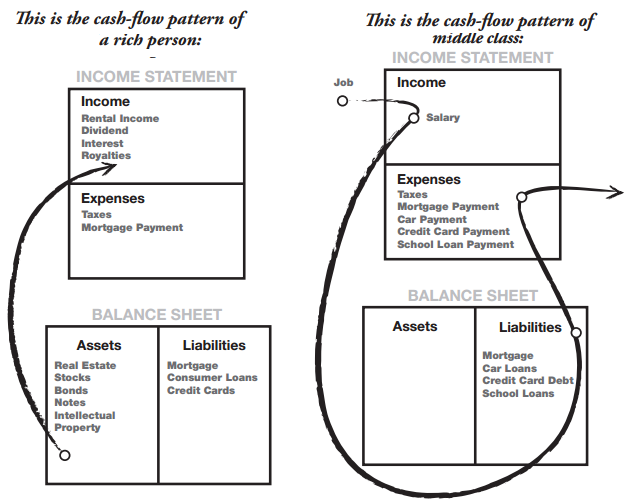

4. It’s not how much money you make, it’s how much money you keep

If you want to build a 100-floor building you need to have a strong foundation. The problem with most people is they try to build a skyscraper on a foundation of a single storied house. There is only one outcome to it. It will collapse. You may make multiple attempts, but the final outcome will be the same. You need to first build your financial intelligence, your foundation and only then the money will follow. Measure your net worth or your liquid net worth to know whether or not you are keeping enough money.

5. Mind Your Own Business

Look around, most of the people are using their life to grow someone else’s business. An individual should remain focused on his end goal and work for it. If you want to start a new business, get over your fear and just do it. Don’t think about others. You need to figure out a different way to build wealth, look for opportunities or invest in businesses to build more assets, and generate a strong flow of income for yourself. You will have financial freedom only when you learn to generate returns from your returns. A fun activity you should try – make managing your money your part-time job.

6. The taxes

If you are rich and lack financial literacy, you will end up paying a lot of taxes. The rich have their investments often in cooperation, so they have to pay fewer taxes. You need to have financial IQ in different areas like accounting, investing, market forces, and the law. This will help engage you in meaningful tax planning, and savings on the outgo taxes, which can be invested wisely to augment your wealth further.

7. Reduce expenses and liabilities

One must learn the difference between an asset and a liability. Once you have learned the difference, it is very important to stay away from liabilities. If you are looking to buy something, you need to figure out, are you buying an asset or a liability. If it is a liability, and not very important, avoid buying it. Budgeting money is also very important. It lets you check everything that you spend your money on. This then allows you to eliminate any unnecessary expenses.

8. Good and bad debts

Just like you need to learn about assets and liability, you need to learn about good and bad debts. Once you have done that, learn how to make good debts in your favor.

Borrowing money to start a new business comes under a category of good debt whereas spending over your credit card limit for personal expenses is classified as bad debt. If you want to be successful, you need to discover new ways to get good debts.

9. Pay Yourself First

Most people earn and spend their salary paying bills. A rich person always pays himself. In the book, Robert tells that each month the rich dad used to pay himself and he would save this money to eventually purchase assets for himself.

10. Saving and investing are different

Saving is considered a must and a good habit. However, saving won’t be able to cope up with the fluctuations in the value of the currency. You need to invest your money instead where it grows at a higher rate than inflation. Saving weaken the purchasing power while investment will increase the value of your money. The best approach is to hedge your money and make a better financial investment.

11. Do not rely on a single source of income

Sadly, most people rely on a single source of income. You can never become rich and financially secure if you are one of those. You should have 2 to 3 streams from where you earn money. In the book, Robert’s rich dad realized that real assets will serve him throughout his life and are shares, property, value- bonds, real estate, etc.

12. Surround yourself with people smarter than you

There is a very popular saying ‘If you are the smartest person in the room, then you are in the wrong room.’ If you want to be smart, surround yourself with smarter people.

13. You become what you study

There is a study saying if you read a book, you will become at least 5% of the book. How many life-changing books have you read so far? The brain is hardwired to adapt to any information you feed into it, so make sure you are feeding the right information. The more you read about something, the more your brain becomes accustomed to it.

15. Control emotions

The situation only gets worse for you when you are not able to control your emotions. The statement holds good for both personal and professional life situations. Robert says, that human beings always give in to five traits: fear, cynicism, laziness, bad habits, and arrogance. How you handle these traits makes a whole lot of difference. You should learn to channelize your emotional balance and be focussed on accomplishing your financial goals.

Is it worth reading Rich Dad Poor Dad?

Yes, it is. Even after 20 years, the book and its idea hold true. If you have anything to do with money, this is a must-read book. It will give you the push and make you understand that you need to start thinking seriously about your financial future and to start taking action. The book will not give you tips to be rich but will motivate you to be rich.

However, there are a lot of people who don’t agree with a lot of things Robert wrote in the book. You don’t have to follow and agree with everything said in the book but the book opens a different perspective about money and therefore you should read it.

Is Rich Dad Poor Dad good advice?

Overall, yes, the advice is good. However, not everything said in the book could be labeled as good advice. It is up to an individual to cherry-pick the advice and apply it in their life.

Is Rich Dad Poor Dad a fiction? / What kind of book is Rich Dad Poor Dad?

A lot of people have doubts about two dads story of Robert. Is it fiction or nonfiction? Robert himself has made it complicated for his readers. He has said a lot of different things about the rich dad. In one interview, he said that Rich Dad has passed on. In another book, he claims that the family of Rich Dad asked not to be identified. And in yet another instance he reportedly admitted that Rich Dad is not a single real person, but a composite character based on several of his advisors.

The book is published under non-fiction and it can be put in the self-help category.

What does Dave Ramsey say about Rich Dad Poor Dad?

Both Dave and Robert have completely different views on money and finance. When Dave was asked about Robert’s book Rich Dad Poor Dad, he Twitted – ‘Robert and I are friends. Highly recommend Rich Dad Poor Dad book. We disagree on debt.’

Is Rich Dad Poor Dad a best seller?

You are still interested in knowing about the book and its lessons even after 20 years, the book has to be a best seller!! It has sold over 32 million copies in more than 51 languages across more than 109 countries, been on the New York Times bestsellers list for over six years.