Morningstar Rating for Mutual Funds: Best ways to use it for your benefits

- 25 February 2020 | 2132 Views | By Mint2Save

Mutual Funds are beneficial when studied thoroughly and deeply. Hence, global vitality of Morningstar is a natural for all , as it comes with a detailed analysis that describes mutual funds in-depth. Being one of the most trustworthy fund ratings, Morningstar ratings give a glimpse of where and when to invest. The analysis by Morningstar also guides the investor about the dos and don’ts in mutual funding. Here is an article explaining what do expect from Morning Mutual Fund Ratings and how to benefit yourself as an investor:

How Morningstar Mutual Fund Ratings are measured?

Morningstar mutual fund ratings are calculated and predicted seeing the past decade’s record. The performance of funds for a long period of time is recorded, tracked and observed. From the long-run behavior of a certain fund, a conclusion is formed and analysis is drawn.

This methodology for studying and dissecting funds gives very practical analysis. And the mutual funds’ ratings give the investor a very well generated report of funds. This report helps any investor, even the amateur and not so knowledgeable investor, to invest with confidence.

The Morningstar rating keeps no secrets with investors. Hence, these ratings are considered highly standard and are referred to, by many investors.

How these ratings are proving a topping layer to the research to investors?

Morningstar researchers and quality analyzers are working together to generate mutual funds report, for years. Since the 1980s researchers have their own principles and protocols. Their protocols of market and fund research make the report set high standards and hold trust.

The whole research team invests a lot of time and energy to come with such detailed reports. The team also carries out the causes and consequences of the investments. Also, the detail prediction with reasoning is mentioned alongside so that you yourself can make the decision wisely.

On what basis the fund ratings are generated?

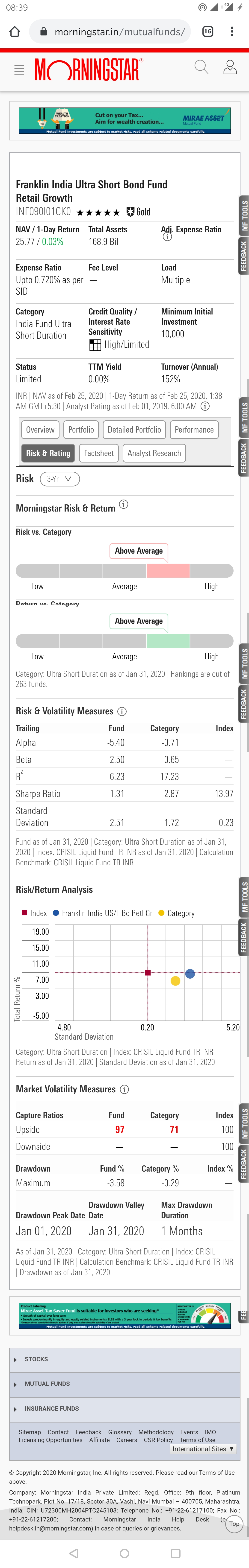

The morningstar fund rating is dependent on various attributes for its analysis. It has its ratings categorized into bronze, silver, and gold. The gold one is the perfect fund to invest in, according to Morningstar experts. Silver and bronze still have room to improve. Usually, bronze and silver-rated funds are either high valued or have poorly performed in the past. The morningstar reviewers have clearly mentioned the reason and what they think of the fund in the future.

The Morningstar rating is transparent that it also has a neutral and negative rating for the funds. The funds which are likely to go down or cause you loss are maintained in the negative ratings. The funds that don’t fall in any profit or loss, go into neutral ratings.

What are the attributes deciding Morningstar ratings?

The ratings of mutual funds are dependent largely on factors like – People, Process, Parent, Performance, and Price.

People

Ratings based on people depending on how many people have together invested in the respective fund and how much have they really gained. This will help any new investor about the market from the number of people’s perspectives. This aspect of the fund encourages people to build their own opinion about the fund, seeing others’.

Process

The process of each fund differs slightly. And the rating is based on the nature of the process. The more hectic procedure gets, the lower ratings become. Here, the ease of the investor is considered. However, if this parameter is nothing that bothers you, you can always skip the rating explaining this.

Parent

This attribute of funds lets the investor about who the actual parent of the respective fund is. The whole history of the fund is presented in a very transparent manner. This parameter of the morningstar rating actually gives real insight into the fund.

Performance

The performance of any fund is calculated based on its previous performance. The earlier graph represents everything. The consequences and the exact of the same and why did the result happen in the way they happened. This dimension of the fund ratings is very helpful for the analysis and has an immense scope of research.

Price

The price is what depends on a personal budget. The ratings of funds do consider pricing, tenure and expected returns in a certain ratio. According to the price and other positivities mentioned, you need to choose your fund to invest in.

Below is a screenshot of a typical rating processed by Morningstar:

Do investors have to invest in only Gold-rated funds?

No. The gold rating indicates that the funds are positive but that doesn’t mean you have to invest in the same. You will have to see your investment budget and decide your timeline. Based on your requirements, it is advised to go for the one amongst – Gold, Silver or Bronze ratings.

How to use the Morningstar ratings for your utmost benefits?

Certainly, the best way to use the Morningstar fund ratings is, to sum up, your own parameters of interest before investing and the Morningstar parameters of positivities. With a column, you can easily mark up the positives of the funds and make your decision.

For example, first, you can decide your investment amount. Secondly, decide your tenure and how much risk can you bare. Write down your most concerned factors in order. And simply compare them with the ratings.

Which mutual fund gives the highest return?

The very common question that mutual fund investors at their initial state tend to ask is which mutual funds are good in terms of returns. The answer to which keeps on varying depends on various factors and most of all, mutual funds are not anticipating.

However, depending on the past decade’s data and returns, the mutual funds forth performance would be depicted. Here’s a list of mutual funds that are making to the profit deal many times:

- ICICI Prudential Equity & Debt Fund

- Mirae Asset Hybrid Equity Fund

- Axis Bluechip Fund

- ICICI Prudential Bluechip Fund

- L&T Midcap Fund

- HDFC Mid-Cap Opportunities Fund

- L&T Emerging Businesses Fund

- HDFC Small Cap Fund

- Motilal Oswal Multicap 35 Fund

- Kotak Standard Multicap Fund

What do you get with the morningstar premium?

The morningstar premium version lets you access over 4,400 ratings of stocks and 19,000 of mutual funds. Also, the detailed rankings and their justification are mentioned. Zacks Rank List and Focus List are included mentioning their equity ranks. Zacks research reports, rankings, and screening tools are most useful for any investor. These listings are included in the Morningstar premium.

How does Morningstar rating work?

The relative funds are examined from the last 5 to 10 years. Based on this examination, a conclusion is derived which is very close to the actual results. The ratings are obtained out of 5 stars. 5 starred ratings are denoted as safer.

How do you analyze mutual fund performance?

Some good funds are seen performing badly under certain circumstances. Analyzing the mutual fund performance is studying its 5 or 10 years performance. Although the future performance won’t be always predictable, you at least get the fund behavior under multiple conditions.

How reliable is the morningstar rating?

The Morningstar ratings and reviews are based on the analysis and thorough study of the fund. Hence we can quite rely on the ratings. However, no one can cent percent predict the forth results of any fund, no matter how good the fund is to date.

Is a morningstar subscription worth it?

As long as you wish to profit from your investment, Morningstar is a good investment. An analysis that is clear and transparent, will surely help you to make a wise decision about your fund investments. Hence, an investment in a guide is always commended.

Is a 3 star Morningstar rating good?

There no such good rating and bad rating, as ratings are based on various categories and parameters. So if your budget other attributes and expectations fit, a 3-star Morningstar rating is good. For instance, 3 rating is for foreign stock eligibility, and if you don’t wish to go for foreign stocks, the rating isn’t good for you.

What is a good rate of return on mutual funds?

Considering stock mutual funds, good is the long-term investment. So if you are gaining a minimum of is 8%-10% returns in tenure of 10 years, stock mutual funds are a good investment. For bond mutual funds, good long-term returns are 4%-5% minimum.

What are the Morningstar categories?

There are several categories on which the Morningstar ratings are based. In the U.S. there are 122 different categories, viz., equity, sector equity, allocation, international equity, alternative, commodities, taxable bond, municipal bond, money market and so on.

Bottom Line

While mutual funds cannot be a sole source for wealth creation, they are useful tools to beat inflation, time market and get relatively better returns over investments.

With clear and real analysis, you become confident enough to invest. Even your studies of funds and markets get a direction with the fund rating programs. The research made by the Morningstar team is genuine and thorough. With all the sources and evidence, reports are generated to make the investors like you feel safe while investing in the funds. The ratings and feedbacks in the report are tending to be right for most of the cases so far. To a lot many investors to date, Morningstar reviews and ratings are proving to be the excellent guide.

If you are a newbie investor, let us know in the comments the doubts regarding using the Morningstar fund ratings. In case you have already used the Morningstar fund ratings, do share your real-time experience with the amateur investors in the comment below.