CRIF: High Mark Credit Information Services

- 27 March 2020 | 2985 Views | By Mint2Save

Your credit score will be the scale on which lenders will measure your creditworthiness or your financial health. If your credit score i.e., effectively your credit history is not where it needs to be, you need to react quickly. Changing the credit score takes time, but the sooner you start the better. But everything starts with understanding what your credit score exactly is and how it comes with your credit information report.

Let us first understand what a credit information report is completely, then discuss CRIF High Mark credit information services then understanding that report and then some general tips on improving the credit score.

What is a Credit Information Report (CIR)

Credit information report called In short CIR, contains the information of your credit history and your track record of taking and repaying loans from banks and other Non-Banking Financial companies effectively serving as a report on past repayment performance. It is a detailed breakdown of individual credit history and it is prepared by a credit bureau.

To create credit reports, the credit bureau collects the financial information about the individual and consolidates all the individual’s borrowings and history of their credit by taking different banks and NBFCs as sources. In addition to the history, the CIR may also have the list of enquiries made onto your account by various member institutions like banks or NBFC for the purpose of approving a credit.

Why is it Important to have Credit Information

When you apply for credit, a CIR plays an important role in assessing whether to give you a loan or not. Effectively saying, your Credit score and CIR is a measure of your financial health and worthiness of credit. CIR is used by the lenders to determine the loan applications, creditworthiness. Understanding your credit information helps you to take control of the financial situation and to take steps of improving your credit score.

By taking a copy of your CIR before going to apply for credit, it helps you know in advance where you stand and understand if credit could be approved. If your CIR is up to date and correct, it makes it easier for institutions to approve your loans. In any case, you find a discrepancy, you need to file a dispute immediately and make sure that it is corrected. It is thus important to keep monitoring it regularly and to see that the CIR is up to date and is free from inaccuracies.

Before going on to explore the credit information services of CRIF, let us have a general overview of it and its other services.

About CRIF High Mark

CRIF is a global credit bureau which has a strong presence in Europe and the Asia-Pacific region. The high mark was founded in India in 2007 and in 2010, The reserve bank of India gave certification of registration to operate as a credit bureau. Then in 2014, CRIF had acquired a majority stake in High mark and after that, high mark’s name was changed to CRIF High mark.

CRIF High Mark provides credit Information, Business information along with analytics, scoring, credit management and decisions solutions. It is an RBI licensed credit bureau with which its extensive database provides so much of the information and analytical solutions.

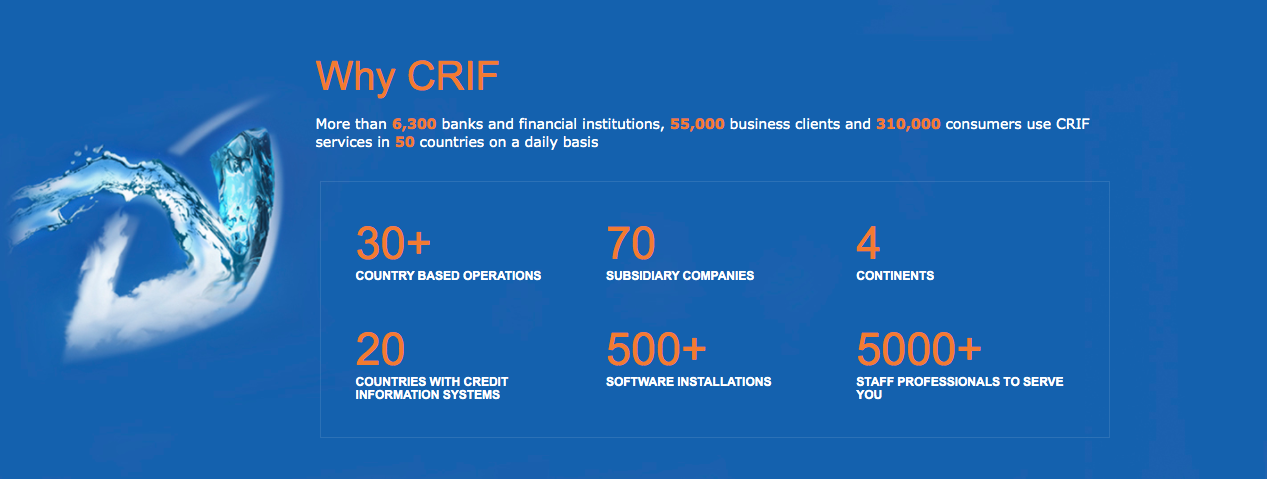

CRIF operates in more than 30 countries serving more than 6300 banks and financial institutions, 55000 business and clients and 310000 customers.

Services of CRIF High mark:

CRIF will be a partner for your entire credit life cycle. Overarchingly, it gives three services: Information, Analytics and Solutions. Under Information, it gives credit information, Business information and anti-fraud services.

Under analytics, it provides the services of an expert and statistical approaches in risk management, taking decisions and marketing, predictive analysis and advanced analytics, RIsk consulting. Under solutions, they provide software platforms to support business rules and decision management, organization of loans, management of collections, external data connections and removing duplication.

Let us now explore their credit information services:

Credit Information Services of CRIF:

They provide comprehensive credit information solutions to many ones including banks, lenders, insurance companies, telecom operators across many sectors like agriculture, retail, MSME, commercial and microfinance lending. The credit information report and scores they provide contain precise and extensive information assessing loan applications of its customers.

They provide two types of credit scores: one for individuals called the Personal Credit Score which includes the individuals payment history, Owned amounts, Length of credit history, credit mix and new credit. And the other is for Businesses called the Commercial Credit Score which contains information about your business, Credit score, history of Loans and past searches.

They also provide monitoring tools will let you keep an eye on the portfolio performance and

based on that, identify pools of customers for specific actions like recovery, cross-selling etc. Market reports are also available and are helpful in identifying trends and insights on industry across geographies.

Getting Credit information

As mandated by the Reserve Bank Of India, every customer should get a credit score for free for one time every year. So, you can get your free report of credit score from CRIF High mark. To get your report go to the go to CRIF high mark website and after going to your credit score menu, click the read more button on either personal or business credit information. Alternatively, you can just follow this link to directly access the page: https://cir.crifhighmark.com/Inquiry/B2C/B2CFFCRPortal.action

Next step is to provide the required details. Click Get your Score Now button and proceed to provide the details . Then, you need to review the report type.as you need a credit information report, select it. After that you need to authenticate your enquiry.

After submitting, your request will be forwarded to CRIF High mark which will complete the process and send you the report generally within 7 working days.

Understanding Credit information report

Now you have the Credit Information report and you know in general what it contains, it is important for you to analyze and understand them so that you can take necessary steps to keep your credit score in good range. Here the ranges of score and their indication:

300 to 500: This means that the customer is in a very risky position and lenders probably will not lend to such customers.

500 to 700: This indicates that the customer has some payment delays and defaulted on some payments. These customers are also considered risky by lenders and thus some of the lenders may not extend their loans to them.

700 to 850: Having the credit score in this range indicated that customers have good repayment behaviour. By seeing this score, one may also expect that they have not single but multiple loan types and have shown good repayment behaviour across all the loan accounts. Lenders consider them safe customers and will be willing to give loans to them.

850 and more: Customers whose scores fall in this range are considered to be excellent and they need to have a flawless record to get such a score. All banks will give all types of loans to these customers.

Improving your credit score

A low credit score is not the end of the road. You can increase your credit score by taking several steps. The most obvious step would be setting up a proper history of paying bills on time, clearing debts etc. But there are also other tools that help you out. But as each company calculates credit scores by applying their own mathematical algorithms, there are no universally applicable steps of improving on it. So, understanding how your credit report is generated is key to understanding how to improve it.

But generally, we can say that scoring models take primarily your payment history on loans and credit cards into account, how regularly you use revolving credits, the time you had your accounts open, what types of accounts you have and how often are you applying for new credit.

So, other than paying your bills on time and clearing the debts, keeping low balances on credit cards and other revolving credit so that your credit utilization ratio would be low, Applying and opening new credit only when needed but not to add generally to the mix. If you apply for too much new credit, it may result in multiple inquiries which are hard enquiries. Too many hard enquiries will negatively impact the credit score.

Not closing unused credit cards would also be a good strategy because it increases your credit utilization ratio.

Conclusion

Knowing your credit score is very important as it gives you information as where you stand and thus let you improve it. CRIF High Mark’s credit information report is a comprehensive and easy to read report that provides you the necessary information.

After obtaining the report, checking where your score fall in the standard ranges will help you determine your financial health. A Score less than 350 would mean that you are in risy position, but a score greater than 850 would mean that you have an excellent record.

By taking appropriate steps, you can get your score to be within good range and thus can confidently apply for new credit.